KKR's joint venture with GIP for Vantage Towers is a continuation of their successful partnership in the European telecom market. Previously, KKR and GIP teamed up to acquire a majority stake in the Spanish telecom operator, Euskaltel, which has proven to be a profitable investment. This joint venture for Vantage Towers allows them to build upon their previous success and expand their presence in the European telecom market.

The focus on providing high-quality, sustainable solutions for mobile network operators is a smart strategy for long-term success in the highly competitive European telecom market. Vantage Towers aims to establish itself as a leading provider of passive telecom infrastructure, and the partnership between KKR and GIP brings together a wealth of experience and expertise in the industry.

In addition to the potential for growth and success, this joint venture is also a smart move from a sustainability standpoint. The focus on providing sustainable solutions for mobile network operators aligns with the growing emphasis on environmental responsibility in the telecom industry. This strategic focus sets Vantage Towers apart from competitors and positions the company for long-term success.

Overall, the joint venture between KKR and GIP for Vantage Towers is a promising move for both companies and for investors looking to be a part of the growth and development of the European telecom market. Can Vantage Towers establish itself as a leading provider of passive telecom infrastructure in Europe? Only time will tell, but the partnership between KKR and GIP is a strong foundation for success.

The focus on providing high-quality, sustainable solutions for mobile network operators is a smart strategy for long-term success in the highly competitive European telecom market. Vantage Towers aims to establish itself as a leading provider of passive telecom infrastructure, and the partnership between KKR and GIP brings together a wealth of experience and expertise in the industry.

In addition to the potential for growth and success, this joint venture is also a smart move from a sustainability standpoint. The focus on providing sustainable solutions for mobile network operators aligns with the growing emphasis on environmental responsibility in the telecom industry. This strategic focus sets Vantage Towers apart from competitors and positions the company for long-term success.

Overall, the joint venture between KKR and GIP for Vantage Towers is a promising move for both companies and for investors looking to be a part of the growth and development of the European telecom market. Can Vantage Towers establish itself as a leading provider of passive telecom infrastructure in Europe? Only time will tell, but the partnership between KKR and GIP is a strong foundation for success.

Industry Overview

Market Overview

The global telecom tower infrastructure market is experiencing significant growth and is expected to continue in the short to medium-term. Telecom towers are a form of infrastructure that facilitate wireless communication, radio broadcasting and mobile networking via a network of antenna. The market is segmented based on type, installation, region and ownership, with the latter being divided between telecom operator owned (MNO), TowerCo, and Joint Ventures (ESCO). Some key players in the global market include Verizon, AT&T and the Vodafone Group.

Industry Growth Trends

The global market is experiencing some industry tailwinds that experts define as key growth drivers over the next 5 years. The main key factors include the rising number of internet service providers and mobile phone users, looking for increased connectivity in rural and remote contexts. Additionally, strengthened investment across smart city projects, availability of affordable mobile devices and rising usage of IoT devices is pushing key players, such as Vodafone and Airtel, to deploy capital towards growing their Long-Term Evolution-Advanced (LTE-A) Network.

Future Value Drivers

The key areas of value-creation for telecom tower infrastructure companies relate to networks, coverage area, and service. Significant deployment of capital into the industry by investment firms, pension funds, and other current backers has led to propped-up valuations. However, against the backdrop of elevated interest rates, experts recommend infrastructure companies to extract further value by:

1. Identifying valuable investment opportunities

It has become harder for infrastructure owners to identify towers to add to their portfolios as the field has become more competitive. There are still appealing prospects available, but in order to succeed, businesses must position themselves wisely and bid diligently. Companies should weigh the advantages of increasing their holdings to include associated assets like fiber, data centers, and undersea cables when looking for growth prospects.

2. Digitizing value chains to improve service and streamline costs

Upgrades to digital for those operations can unlock significant value through lower costs, better service, and enhanced customer experiences if tower companies manage assets or other aspects of their mobile clients' businesses. A switch to digital could allow tower infrastructure companies to open up new possibilities for expansion in the future.

The global telecom tower infrastructure market is experiencing significant growth and is expected to continue in the short to medium-term. Telecom towers are a form of infrastructure that facilitate wireless communication, radio broadcasting and mobile networking via a network of antenna. The market is segmented based on type, installation, region and ownership, with the latter being divided between telecom operator owned (MNO), TowerCo, and Joint Ventures (ESCO). Some key players in the global market include Verizon, AT&T and the Vodafone Group.

Industry Growth Trends

The global market is experiencing some industry tailwinds that experts define as key growth drivers over the next 5 years. The main key factors include the rising number of internet service providers and mobile phone users, looking for increased connectivity in rural and remote contexts. Additionally, strengthened investment across smart city projects, availability of affordable mobile devices and rising usage of IoT devices is pushing key players, such as Vodafone and Airtel, to deploy capital towards growing their Long-Term Evolution-Advanced (LTE-A) Network.

Future Value Drivers

The key areas of value-creation for telecom tower infrastructure companies relate to networks, coverage area, and service. Significant deployment of capital into the industry by investment firms, pension funds, and other current backers has led to propped-up valuations. However, against the backdrop of elevated interest rates, experts recommend infrastructure companies to extract further value by:

1. Identifying valuable investment opportunities

It has become harder for infrastructure owners to identify towers to add to their portfolios as the field has become more competitive. There are still appealing prospects available, but in order to succeed, businesses must position themselves wisely and bid diligently. Companies should weigh the advantages of increasing their holdings to include associated assets like fiber, data centers, and undersea cables when looking for growth prospects.

2. Digitizing value chains to improve service and streamline costs

Upgrades to digital for those operations can unlock significant value through lower costs, better service, and enhanced customer experiences if tower companies manage assets or other aspects of their mobile clients' businesses. A switch to digital could allow tower infrastructure companies to open up new possibilities for expansion in the future.

About Vantage Towers

Founded in 2019 as a Vodafone subsidiary, Vantage Towers AG is one of the largest European tower companies, pushing toward a digital transformation. Vantage Towers provide various services, from site operations to upkeeping power supply management to federal authorities, mobile network carriers, and clients in the technology and utility industries. Vantage Towers’ product line comprises small cells, distributed antenna systems, rooftop sites, and towers and masts.

The company has a network of more than 83,000 towers spread across 10 nations and is the number one tower company in Germany, Italy, and England.

Vantage Towers trades on the XETR since March 18, 2021: its IPO valued the company at approximately €12.1bn. After only one year, Vantage Towers’ market capitalization reached €16.56bn.

The company has a network of more than 83,000 towers spread across 10 nations and is the number one tower company in Germany, Italy, and England.

Vantage Towers trades on the XETR since March 18, 2021: its IPO valued the company at approximately €12.1bn. After only one year, Vantage Towers’ market capitalization reached €16.56bn.

About KKR

KKR & Co. Inc. is a global investment firm founded in 1976 by J. Kohlberg, H. Kravis, and G.R. Roberts. The firm started growing immediately and raised its first $1bn institutional fund in 1984. Today US-headquartered KKR provides innovative financial solutions, capital markets, and insurance solutions, managing assets for the value of $471bn. The firm has over 650 private equity investments in portfolio companies (as of 31/12/2021) and has performed some of the market’s largest LBO transactions, becoming an industry-recognized name.

KKR has relevant expertise in the digital infrastructure sector since its portfolio comprises other telecom tower operators and infrastructure service providers – such as Indus Towers Limited and Telxius Telecom S.A., respectively.

KKR has relevant expertise in the digital infrastructure sector since its portfolio comprises other telecom tower operators and infrastructure service providers – such as Indus Towers Limited and Telxius Telecom S.A., respectively.

About Global Infrastructure Partners (GIP)

Founded in 2006, Global Infrastructure Partners (GIP) is an American independent infrastructure fund manager. The firm achieves its successes through vast expertise and in-depth knowledge of the areas in which it invests – mainly infrastructure businesses and assets in the energy, transportation, digital, and water and waste sectors. The firm currently manages $84bn in assets and is keen to invest in companies that deliver high-quality service to the communities in which they operate.

Due to its sector knowledge and strong track record alongside large industrial partners, GIP is a vital component of the joint venture. The firm already has experience in this field, having in its portfolio Ascend Telecom Infrastructure Private Limited, an India-based tower company similar to Vantage Towers.

Due to its sector knowledge and strong track record alongside large industrial partners, GIP is a vital component of the joint venture. The firm already has experience in this field, having in its portfolio Ascend Telecom Infrastructure Private Limited, an India-based tower company similar to Vantage Towers.

Deal structure

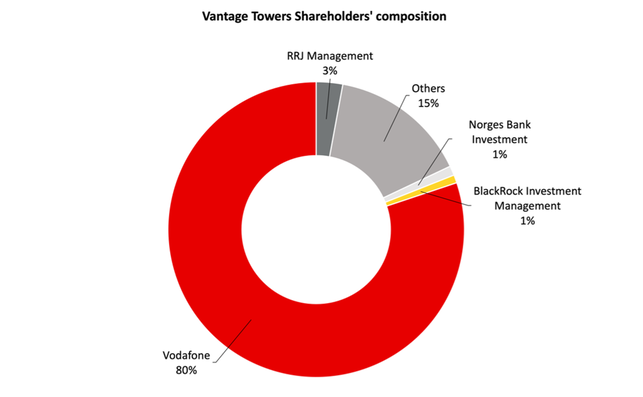

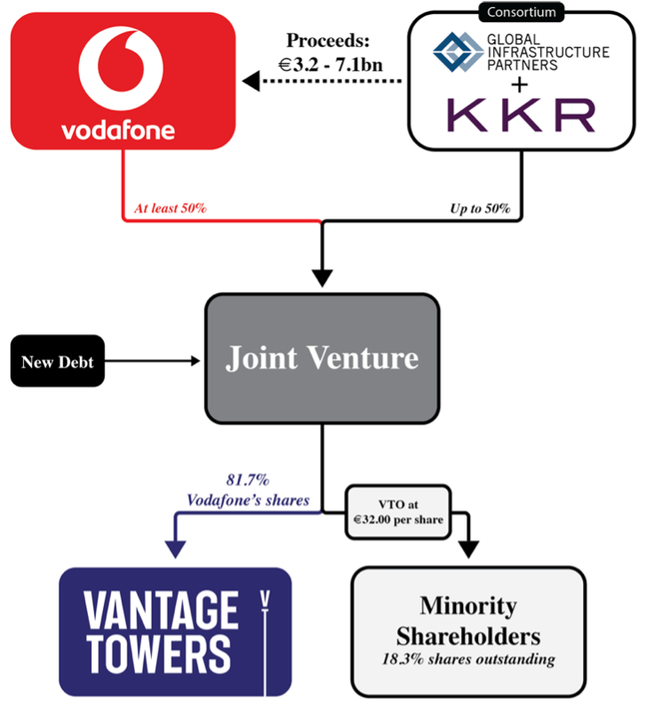

On November 9th, Vodafone announced it would create a joint venture with a Consortium made up of GIP (Global Infrastructure Partners) and KKR. Vodafone will transfer its 81.7% stake in Vantage Towers to the joint venture.

The Consortium will obtain up to 50% shares of the joint venture by acquiring them from Vodafone with cash. The new entity will launch a voluntary takeover offer for the remaining shares currently not owned by Vodafone at €32 per share, valuing Vantage Towers at €16.3 billion. This way, minority holders will be offered a 19% premium to the average price over the last three months and 8 euros more than it listed at in March 2021. The second largest minority shareholder of Vantage Towers, RRJ Capital, has already supported the joint venture via an irrevocable undertaking to accept the VTO.

The Consortium will obtain up to 50% shares of the joint venture by acquiring them from Vodafone with cash. The new entity will launch a voluntary takeover offer for the remaining shares currently not owned by Vodafone at €32 per share, valuing Vantage Towers at €16.3 billion. This way, minority holders will be offered a 19% premium to the average price over the last three months and 8 euros more than it listed at in March 2021. The second largest minority shareholder of Vantage Towers, RRJ Capital, has already supported the joint venture via an irrevocable undertaking to accept the VTO.

The Consortium has fully committed equity to buy between 32% and 40% of the joint venture – depending on the outcome of the VTO. Additionally, the Consortium intends to raise additional equity to buy 50% of the joint venture. This way, Vodafone could gain a minimum of €3.2bn and up to €7.1bn. If the Consortium owns less than 50% shares of the joint venture by 30 June 2023, Vodafone will have the right to sell its shares to third parties to reduce its own stake to 50%. If the VTO is successful, Vodafone and the Consortium may decide to remove Vantage Towers’ listing from the Frankfurt Stock Exchange.

Strategic rationale

Just one year after Vantage Towers IPO, the British telecommunications company is trying to deconsolidate the company from its balance sheet by creating a joint venture with KKR and GIP.

Some investors and analysts were concerned about Vodafone's large debt (more than €40bn) and its implied leverage, also due to the increasing interest rates. For this reason, Vodafone is currently trying to restructure its balance sheet by selling poor-performing divisions and simplifying its international portfolio. The British company has already started this process, agreeing to sell its Hungarian business for $1.8 earlier in August, and is currently looking to sell its Spain division.

Vodafone's Chief Executive Officer also declared that deconsolidating Vantage Towers from Vodafone's balance sheet will allow it to optimize its capital structure. In addition, the joint venture will enable Vodafone to generate enough cash to allow the company to advance in its deleveraging project.

For what concerns the Consortium, it's essential to notice the expertise of KKR and GIP in this sector. KKR has a long history of investments in the digital infrastructure sector in Europe and is trying to increase its presence in the European market. According to Vincent Policard, Partner and Co-Head of European Infrastructure, this investment will enable them to "capitalize on the growth in this sector and to help drive consolidation in a fragmented market." Similarly, GIP has a broad portfolio of investments in the European infrastructure market and believes in the value-creation purpose of Vantage Towers.

In addition, GIP and KKR have a long track of collaboration in the infrastructure sector and share experience and expertise in the digital infrastructure sector. Those elements will provide Vantage Towers with valuable resources to pursue its value-creation objective and to enter in more European markets.

Some investors and analysts were concerned about Vodafone's large debt (more than €40bn) and its implied leverage, also due to the increasing interest rates. For this reason, Vodafone is currently trying to restructure its balance sheet by selling poor-performing divisions and simplifying its international portfolio. The British company has already started this process, agreeing to sell its Hungarian business for $1.8 earlier in August, and is currently looking to sell its Spain division.

Vodafone's Chief Executive Officer also declared that deconsolidating Vantage Towers from Vodafone's balance sheet will allow it to optimize its capital structure. In addition, the joint venture will enable Vodafone to generate enough cash to allow the company to advance in its deleveraging project.

For what concerns the Consortium, it's essential to notice the expertise of KKR and GIP in this sector. KKR has a long history of investments in the digital infrastructure sector in Europe and is trying to increase its presence in the European market. According to Vincent Policard, Partner and Co-Head of European Infrastructure, this investment will enable them to "capitalize on the growth in this sector and to help drive consolidation in a fragmented market." Similarly, GIP has a broad portfolio of investments in the European infrastructure market and believes in the value-creation purpose of Vantage Towers.

In addition, GIP and KKR have a long track of collaboration in the infrastructure sector and share experience and expertise in the digital infrastructure sector. Those elements will provide Vantage Towers with valuable resources to pursue its value-creation objective and to enter in more European markets.

Short-term and Long-term impact

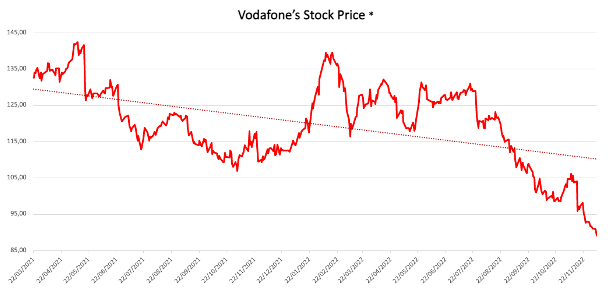

Looking at the short-term consequences, the market reacted negatively to the terms of the deal, with Vodafone's shares falling more than 2% to trade not far off two-year lows. Also, Vodafone shares recorded a -18.8% YTD, performing much worse than the -11,5% of the industry and the +2% of the UK FTSE 100.

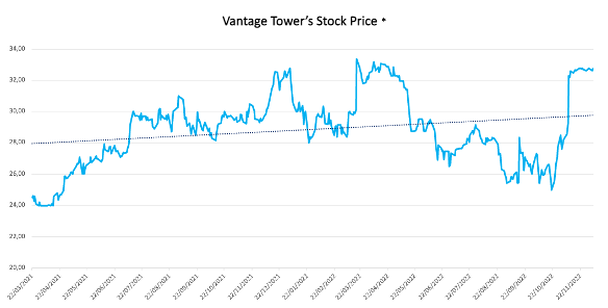

On the other hand, Vantage Towers' stock price jumped from €29.28 to €32.30 upon the deal announcement and kept trading above €32.50 in the following days.

On the other hand, Vantage Towers' stock price jumped from €29.28 to €32.30 upon the deal announcement and kept trading above €32.50 in the following days.

Source: Yahoo! Finance

Source: Yahoo! Finance

*all stock data are considered starting from Vantage Tower’s IPO dated March 13th, 202

The mix of poor stock performance and failed M&A plans, creating discontent in the eyes of some investors that would have preferred a swifter action, caused Nick Read to step down from his role as Vodafone’s CEO, temporarily leaving the role to Margherita Della Valle, currently CFO of the Group.

As mentioned, in recent years Vodafone experienced many difficulties in its battles to gain scale through mergers and acquisitions.

In Spain, Vodafone lost out to Orange, striking a merger deal with Spanish telecom MásMóvil; and in Italy, Vodafone spurned a takeover offer from Iliad and Apax Partners.

In the United Kingdom, an agreement of sorts was announced in October for a possible merger between Vodafone and Three (3), the country’s fourth mobile operator. Still, there’s a long way to go, especially in terms of regulatory approvals, before the operation can be definitely carried out.

In Portugal, Vodafone is acquiring cable operator and mobile virtual network operator Nowo, to strengthen its presence in the area. Furthermore, in August the operator announced a deal to sell its Hungarian operations.

The few conclusive outcomes, clearly haven’t been enough to satisfy investors, leading them to push for a new cost-cutting program to face the shrinking margins reported in Vodafone’s fiscal half-year results and the Group’s sliding market valuation.

In this scenario, the announced Joint Venture with KKR and GIP for Vantage Towers is expected to bring the Group cash proceeds between 3.2 billion euros and 7.1 billion euros. The minimum net cash proceeds to Vodafone will start from a base of €3.2 billion, based on equity from GIP and KKR, fully committed at signing and maximum minority take up in the voluntary takeover offer. This would help reduce Vodafone’s leverage by 0.2x. A maximum of cash proceeds of €5.8-7.1 billion would be reachable, depending on the take up in the voluntary takeover offer and subject to GIP and KKR raising further equity before closing, to increase their stake in the JV to 50%, contributing to a leverage reduction of 0.4x-0.5x.

Apart from further supporting the Group’s deleveraging, these proceeds will be used for the optimization of Vodafone’s capital structure.

However, even though, after months of pressure from Shareholders, the reduction in debt should help Vodafone’s executives take some breathing space for focusing on pursuing deals in mobile and even if, as ex-CEO Nick Read used to say, "This move significantly increases Vantage Tower's financial flexibility to capture future growth opportunities ", it has to be noticed that while Vantage has added around €4 billion to its market value from the announcement of the Joint Venture, Vodafone’s valuation has continued to shrink.

The incoming CEO will have to focus on accelerating the execution of the company's strategy, improving operational performance, and committing to delivering Shareholder Value.

As mentioned, in recent years Vodafone experienced many difficulties in its battles to gain scale through mergers and acquisitions.

In Spain, Vodafone lost out to Orange, striking a merger deal with Spanish telecom MásMóvil; and in Italy, Vodafone spurned a takeover offer from Iliad and Apax Partners.

In the United Kingdom, an agreement of sorts was announced in October for a possible merger between Vodafone and Three (3), the country’s fourth mobile operator. Still, there’s a long way to go, especially in terms of regulatory approvals, before the operation can be definitely carried out.

In Portugal, Vodafone is acquiring cable operator and mobile virtual network operator Nowo, to strengthen its presence in the area. Furthermore, in August the operator announced a deal to sell its Hungarian operations.

The few conclusive outcomes, clearly haven’t been enough to satisfy investors, leading them to push for a new cost-cutting program to face the shrinking margins reported in Vodafone’s fiscal half-year results and the Group’s sliding market valuation.

In this scenario, the announced Joint Venture with KKR and GIP for Vantage Towers is expected to bring the Group cash proceeds between 3.2 billion euros and 7.1 billion euros. The minimum net cash proceeds to Vodafone will start from a base of €3.2 billion, based on equity from GIP and KKR, fully committed at signing and maximum minority take up in the voluntary takeover offer. This would help reduce Vodafone’s leverage by 0.2x. A maximum of cash proceeds of €5.8-7.1 billion would be reachable, depending on the take up in the voluntary takeover offer and subject to GIP and KKR raising further equity before closing, to increase their stake in the JV to 50%, contributing to a leverage reduction of 0.4x-0.5x.

Apart from further supporting the Group’s deleveraging, these proceeds will be used for the optimization of Vodafone’s capital structure.

However, even though, after months of pressure from Shareholders, the reduction in debt should help Vodafone’s executives take some breathing space for focusing on pursuing deals in mobile and even if, as ex-CEO Nick Read used to say, "This move significantly increases Vantage Tower's financial flexibility to capture future growth opportunities ", it has to be noticed that while Vantage has added around €4 billion to its market value from the announcement of the Joint Venture, Vodafone’s valuation has continued to shrink.

The incoming CEO will have to focus on accelerating the execution of the company's strategy, improving operational performance, and committing to delivering Shareholder Value.

Deal Advisors

Due to the deal dimension, several major financial and legal advisors were involved in this transaction. Specifically, Robey Warshaw and UBS acted as financial advisers to Vodafone, with Linklaters acting as legal advisor. Morgan Stanley assisted GIP and KKR assisted as exclusive financial advisor, Latham & Watkins acted as legal advisor. Vantage Towers was supported by Rothschild & Co worked as exclusive financial, with Orrick Herrington & Sutcliffe serving as legal advisor.

By Edoardo Barion, Filippo Reina, Ruben Van Der Lubbe

Sources:

- Vodafone’s official website

- ANSA

- Vantage Towers’ official website

- Linklaters’ official website

- Reuters

- Il Sole 24 Ore

- Financial Times