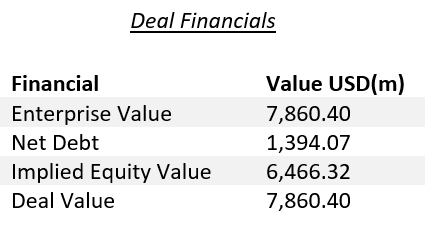

At the end of October 2015 Walgreens Boots Alliance announced its intention to buy Rite Aid for a tie-up worth $9.4 billion. The deal was supposed to be closed by the end of 2016 but it looks like they are fighting a losing battle so far. In fact, the Federal Trade Commission put under scrutiny the merger since it is considered an operation that might reduce the competition in the retail pharmacy market. The Walgreens-Rite Aid merger involves respectively the second and third biggest players in the US’s drugstore market; after the deal, Walgreens Boots Alliance would run more than 13,000 shops in the US, Puerto Rico and Virgin Islands overpassing the market leader CVS Health. Walgreens has been expanding during the last years, acquiring Duane Reade, USA Drugs, Kerr Drug and lastly the deal with Alliance Boots completed in 2014, a two-step merger which created the world’s first global pharmacy-led, health and wellbeing enterprise: Walgreens Boots Alliance.

Regarding the deal, Rite Aid would continue to operate under its own name becoming a wholly owned subsidiary of the group. At the time the merger was proposed, Rite Aid had an enterprise valuation of $17.2 billion and shareholders were supposed to receive between $6.50 - $9 dollars a share. From the beginning the FTC showed resistance to the deal, requesting extra information and taking time to authorize the acquisition. Lastly, Walgreens Boots Alliance has agreed to divest 865 stores, selling them to Fred’s Pharmacy for $950 million in order to preserve competition in the market and make the deal more likely to be closed. The reasons underlying a negative response might be that the FTC does not agree either on the number of stores to be sold or does not think Fred is a suitable buyer.

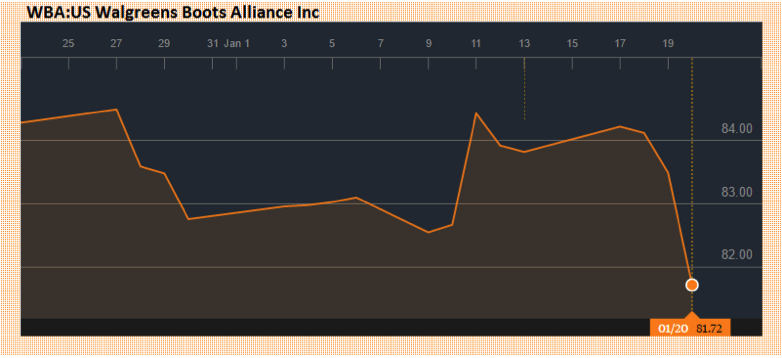

The situation may change once the FTC Chairwoman, Edith Ramirez, leaves the office on January 10th as President Trump will appoint somebody who will be more prone to authorize the transaction. Investors and Walgreens Boots Alliance CEO, Stefano Pessina, are optimistic the deal can still be done though on Friday 20th the stock lost 2.64% dropping to $81.29 same as for Rite Aid which slipped to $7.65 with a 11.10% loss.

Regarding the deal, Rite Aid would continue to operate under its own name becoming a wholly owned subsidiary of the group. At the time the merger was proposed, Rite Aid had an enterprise valuation of $17.2 billion and shareholders were supposed to receive between $6.50 - $9 dollars a share. From the beginning the FTC showed resistance to the deal, requesting extra information and taking time to authorize the acquisition. Lastly, Walgreens Boots Alliance has agreed to divest 865 stores, selling them to Fred’s Pharmacy for $950 million in order to preserve competition in the market and make the deal more likely to be closed. The reasons underlying a negative response might be that the FTC does not agree either on the number of stores to be sold or does not think Fred is a suitable buyer.

The situation may change once the FTC Chairwoman, Edith Ramirez, leaves the office on January 10th as President Trump will appoint somebody who will be more prone to authorize the transaction. Investors and Walgreens Boots Alliance CEO, Stefano Pessina, are optimistic the deal can still be done though on Friday 20th the stock lost 2.64% dropping to $81.29 same as for Rite Aid which slipped to $7.65 with a 11.10% loss.

The upcoming deadline of the transaction, postponed to January 27th from the original one which was set three months ago, might be once again delayed if the FTC does not express itself yet. In addition, the merger agreement contained a termination fee of $325 million or $650 million which Walgreens Boots Alliance is supposed to pay to Rite Aid under “certain circumstances”. The unfolding of the deal is not a plain sailing, eventually Mr. Pessina will be able to expand and consolidate its sprawling pharmaceutical group.

Vittoria Roà

Vittoria Roà