US retail giant Walmart Inc. is in the final stage of negotiations to become the largest investor in India’s leading e-commerce company, Flipkart Online Services Private Ltd.

Founded, in 1962, Walmart Inc. is an American multinational retail corporation headquartered in Bentonville, Arkansas that operates as a chain of hypermarkets, discount department stores and grocery stores. It has more than 11,000 stores and clubs in 28 countries and is the world’s largest company by revenue as well as the largest private employer in the world. It is a publicly traded family owned business and debuted on the NYSE in 1972.

On the other hand, Flipkart is an Indian company active in the e-commerce sector. It was founded in 2007 and is headquartered in Bengaluru, which is known as the center of India's high-tech industry.

It earned a revenue of $3 billion in 2017 and has more than 33,000 employees. The company offers a wide variety of products such as mobile phones, computers, books, home appliances, etc. Flipkart has a 100 million registered users and more than a 100 thousand sellers on its e-commerce platform and around 8 million shipments are processed every month.

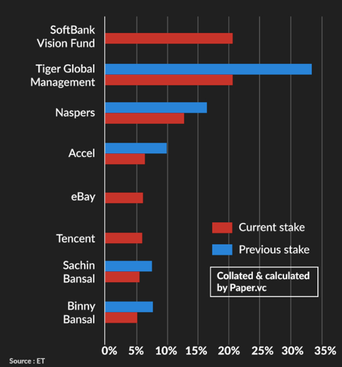

After a $2.6 billion investment in August 2017, SoftBank is now the largest shareholder in Flipkart, followed by Tiger Global Management and Naspers.

Amid heavy losses and ongoing litigation with the taxation department, Flipkart registered a 29% YoY increase in its revenues. But it continued to record significant losses, which as per the financial reports of Flipkart are the result of a five-fold increase in finance costs.

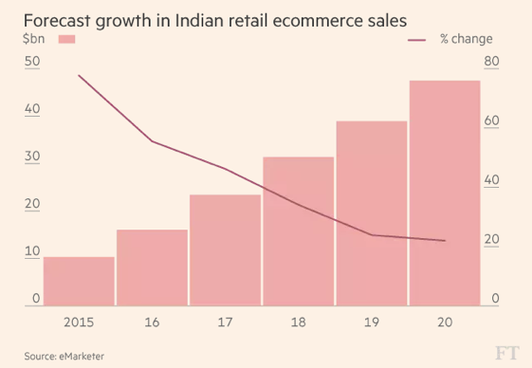

According to the Indian Brand Equity Foundation, the Indian retail industry – both offline and online - will reach $1.3 trillion by 2020, while eMarketer expects Indian e-commerce sales to increase more than fourfold by that time.

Founded, in 1962, Walmart Inc. is an American multinational retail corporation headquartered in Bentonville, Arkansas that operates as a chain of hypermarkets, discount department stores and grocery stores. It has more than 11,000 stores and clubs in 28 countries and is the world’s largest company by revenue as well as the largest private employer in the world. It is a publicly traded family owned business and debuted on the NYSE in 1972.

On the other hand, Flipkart is an Indian company active in the e-commerce sector. It was founded in 2007 and is headquartered in Bengaluru, which is known as the center of India's high-tech industry.

It earned a revenue of $3 billion in 2017 and has more than 33,000 employees. The company offers a wide variety of products such as mobile phones, computers, books, home appliances, etc. Flipkart has a 100 million registered users and more than a 100 thousand sellers on its e-commerce platform and around 8 million shipments are processed every month.

After a $2.6 billion investment in August 2017, SoftBank is now the largest shareholder in Flipkart, followed by Tiger Global Management and Naspers.

Amid heavy losses and ongoing litigation with the taxation department, Flipkart registered a 29% YoY increase in its revenues. But it continued to record significant losses, which as per the financial reports of Flipkart are the result of a five-fold increase in finance costs.

According to the Indian Brand Equity Foundation, the Indian retail industry – both offline and online - will reach $1.3 trillion by 2020, while eMarketer expects Indian e-commerce sales to increase more than fourfold by that time.

Walmart, despite being the world’s largest retailer, has struggled against Amazon as consumers increasingly migrate to online commerce. The investment represents a strategic move that will allow the two companies to compete in one of the most dynamic markets and will also open the doors to India’s underexploited offline retail market, whose huge growth potential Walmart aims at capturing. For Flipkart, this deal might represent a decisive turning point, requiring strong restructuring efforts in order to capture the benefits of the pursued diversification in terms of selling channels.

In particular, the Walmart-Flipkart combine aims to compete aggressively in the food sector with a significant portion of Walmart’s investment earmarked to build back-end food and grocery infrastructure. These planned investments are in line with Walmart’s greater push globally in food retailing for future growth.

To begin with, Walmart is expected to buy about 20-26% stake and increase its shareholding to 51% in tranches. It is expected to spend about $10-12 million to acquire this majority stake. This transaction will involve the purchase of shares from existing investors such as Japanese telecom and internet giant SoftBank, South African media giant Naspers and New York based Tiger Global.

The primary investment will value the Bengaluru-based company at about $20-22 billion, nearly a 100% rise from the $11.6 billion valuation it got in April 2017. Walmart’s share purchase from existing investors is expected to happen at a discount to the valuation of primary infusion.

Walmart may face various legal hurdles before carrying the transaction to an end. The Indian government is likely to seek a clarification on whether the stake in Flipkart will be used to open offline stores since this is possible only in some specific cases and under specific conditions.

Shivani Tara

In particular, the Walmart-Flipkart combine aims to compete aggressively in the food sector with a significant portion of Walmart’s investment earmarked to build back-end food and grocery infrastructure. These planned investments are in line with Walmart’s greater push globally in food retailing for future growth.

To begin with, Walmart is expected to buy about 20-26% stake and increase its shareholding to 51% in tranches. It is expected to spend about $10-12 million to acquire this majority stake. This transaction will involve the purchase of shares from existing investors such as Japanese telecom and internet giant SoftBank, South African media giant Naspers and New York based Tiger Global.

The primary investment will value the Bengaluru-based company at about $20-22 billion, nearly a 100% rise from the $11.6 billion valuation it got in April 2017. Walmart’s share purchase from existing investors is expected to happen at a discount to the valuation of primary infusion.

Walmart may face various legal hurdles before carrying the transaction to an end. The Indian government is likely to seek a clarification on whether the stake in Flipkart will be used to open offline stores since this is possible only in some specific cases and under specific conditions.

Shivani Tara