Released on April 30, Apple’s second quarter report revealed that Apple’s wearables business has seen its best quarter yet. In recent years, Apple was able to develop an extremely fast-growing business segment - the Wearables, Home and Accessories sector - that was previously considered an inconsequential contributor to total revenues. With its approximate quarterly turnover of $5 billion, this segment alone can now be considered a Fortune 200 company, according to Apple’s CEO Tim Cook. Two products in particular lead to this increase in revenues: the Apple Watch and the AirPods wireless headphones. In this way, Apple is progressively moving its focus away from being solely a technology company, and moving towards an industry that is more focused on services and wearables.

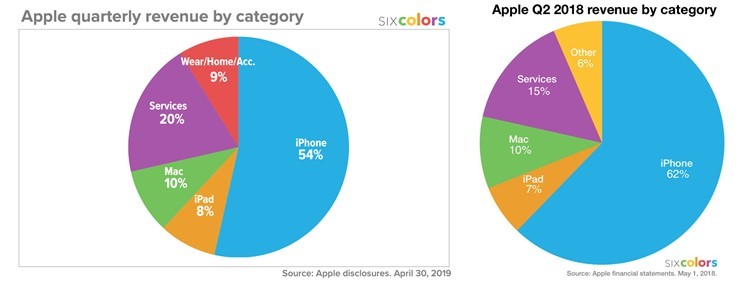

In the past, there was some scepticism as to whether Apple could maintain its market share in the technology industry given previous declines in iPhone sales. However, after Apple’s Q2 earnings call, it became evident that Apple has had ‘the biggest quarter in [its] history, with broad-based growth that included the highest revenues ever from a new Phone lineup’. Apple has always relied on iPhone sales for its revenues, and with such an upturn, revenues and profits are expected to increase. Yet – previously unthinkable by all experts - the Wearables, Home and Accessories business segment actually contributed a larger-than-expected amount to the overall revenue compared to the previous year, as seen in the Figure above. In fact, the multinational corporation announced that this ‘Other’ sector accounted for $5.1 billion of total revenues in the second quarter; this is a $1.2 billion increase compared to the year-ago quarter (revenues equalled $3.9 in the same period of 2018). The CFO then also mentioned that the wearables, i.e. the Apple Watch and the AirPods, were the second-largest contributor to revenue growth, after the iPhone, during this quarter. In addition, this year’s second quarter was actually one week shorter than that of last year. Thus, in terms of average weekly sales, the stark increase in revenues for this sector becomes even more significant.

In this quarter, the Apple Watch has proven itself to be a stable, and reliable source of growth for Apple. According to Tim Cook, this quarter ‘was [the] best quarter ever for the Apple Watch, with over 50% growth in revenue and units for the fourth quarter in a row and strong double-digit growth in every geographic segment’. Furthermore, the publication of the financial results revealed that about three-quarters of all Apple Watch sales were made to new customers. This result has several important implications. First of all, it demonstrates the products continued dominance in the smartwatch market. Yet, it also suggests that Apple has been successful in expanding its client reach. In this way, the market can expect Apple’s revenue growth to further accelerate in the future, which will consequently broaden the customer base even further.

Evidently, Apple is attempting to spawn significant volumes of revenue from sources other than its iPhone sales, making product groups like the wearables and services progressively more central for Apple’s operations. Given these quarterly results, one can conclude that this initiative has thus far been successful. Yet, on a macro-level, the quarterly revenue, $58 billion, is actually 5% less than the year-ago quarter. Thus, how successful will this initiative be in the longer run?

Apple is no longer just a producer of the iPhone, the iMac and a provider of the iCloud service, it is now also a strong competitor in product categories such as services and wearables. The surprise in the sale of the Apple Watch will completely change the structure of the company. In fact, it generates immense future potential for the company, especially in financial services and health services. Within the financial service sector, Apple can maximise the use of the Apple Watch by providing payment services, and in the health services sector it can provide tools that, for instance, control blood pressure or are capable of preventing life-threatening illnesses by giving out warning signs. And lastly it opens up a huge leeway for Apple’s stock price to rise significantly above the current $205 per share.

Lilian Cohaus

In this quarter, the Apple Watch has proven itself to be a stable, and reliable source of growth for Apple. According to Tim Cook, this quarter ‘was [the] best quarter ever for the Apple Watch, with over 50% growth in revenue and units for the fourth quarter in a row and strong double-digit growth in every geographic segment’. Furthermore, the publication of the financial results revealed that about three-quarters of all Apple Watch sales were made to new customers. This result has several important implications. First of all, it demonstrates the products continued dominance in the smartwatch market. Yet, it also suggests that Apple has been successful in expanding its client reach. In this way, the market can expect Apple’s revenue growth to further accelerate in the future, which will consequently broaden the customer base even further.

Evidently, Apple is attempting to spawn significant volumes of revenue from sources other than its iPhone sales, making product groups like the wearables and services progressively more central for Apple’s operations. Given these quarterly results, one can conclude that this initiative has thus far been successful. Yet, on a macro-level, the quarterly revenue, $58 billion, is actually 5% less than the year-ago quarter. Thus, how successful will this initiative be in the longer run?

Apple is no longer just a producer of the iPhone, the iMac and a provider of the iCloud service, it is now also a strong competitor in product categories such as services and wearables. The surprise in the sale of the Apple Watch will completely change the structure of the company. In fact, it generates immense future potential for the company, especially in financial services and health services. Within the financial service sector, Apple can maximise the use of the Apple Watch by providing payment services, and in the health services sector it can provide tools that, for instance, control blood pressure or are capable of preventing life-threatening illnesses by giving out warning signs. And lastly it opens up a huge leeway for Apple’s stock price to rise significantly above the current $205 per share.

Lilian Cohaus