In the thirty years since the end of communism, Romania has learned to play the capitalist game by the book. And banks have gone a step further to master it, with return on equity (ROE) in Romanian banks being the highest in the European Union, at an average of over 19%. But in the words of prof. Groysberg, “mean is mean, variance is meaner” and in the case of Romanian banks, variance is the meanest: while some large lenders are barely hitting a hurdle rate of 6 to 8%, some of the largest banks of the country achieve a ROE of over 25%. So, what are the next steps for this young but dynamic industry and how do we explain recent M&A activity in a less than ideal macroeconomic environment for deal making?

Specifications of the banking industry in Romania

Despite challenging economic conditions in the Central, Eastern, and South-Eastern Europe (CESEE) region, there are several reasons why it remains an attractive market for international banking groups to invest in. First, the CESEE financial sector is characterized by the prominent dominance of traditional commercial banking. In Romania, as our example, commercial banks account for the largest part of the financial sector with a 77% share in the total assets, as of the end of 2020. According to the National Bank of Romania, the rest accrues to pension funds (8%), non-bank financial institutions (6%), investment funds (5%) and insurance companies (4%).

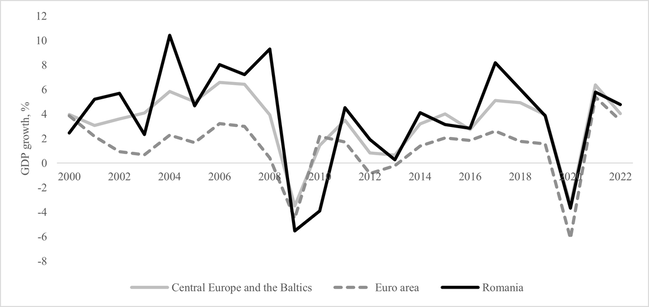

Another attractive feature that characterizes the region is the rather high rates of economic growth. The region experienced relatively high GDP growth rates during the past decades, and despite being struck by the recent geopolitical events, the forecasts for its recovery are more optimistic than those for the Eurozone countries. Case in point, UniCredit Research department shares a forecast that anticipates CEE economies to grow by 0.8% in 2023, re-accelerating to 2.7% in 2024 if domestic demand rebounds due to real wage growth and the beginning of postponed capex projects. The same UniCredit’s outlook for the Eurozone's economic growth is projected to be 0.5% in 2023 and 0.6% in 2024, respectively.

Economic growth is one of the key points to consider for international banks when it comes to making decisions regarding expansion into new regions. The recent article by Zeqiraj et al. (2020), that focuses on the banking sector of South-Eastern Europe, highlights the classical link between growth and financial sector expansion trends. Namely, economic development creates a need for financial services, as more new and existing ventures seek financing, which in turn creates a fruitful environment for financial sector growth.

Annual GDP growth in Central and Eastern Europe (CEE) from 2000 to 2022

Source: World Bank

Source: World Bank

Trends driving M&A in the Romanian banking sector

Going back just 10 years ago, Romania’s banking sector seemed to be connected mostly to regional banks: 2 out of the 5 largest lenders operating there were Austrian, while the 6th one was Greek. This trend continued down the line, which left Romania’s economy in a vulnerable position in case of a crisis due to the exposure on less than rock-solid economies. Fast-forward to present day, and after a series of some “losers” leaving the market and some M&A deals, the banking sector seems much more diversified: France’s Société Générale, Italy’s UniCredit (now merged with AlphaBank), Holland’s ING complete the top 5 players, along with Banca Transilvania (the largest Romanian Bank) and Austria’s ERSTE. And while returns are attractive, the sector has not yet developed to its fullest extent: according to McKinsey, as just 6 out of 10 Romanians have a bank account.

Apart from the obvious reasons such as its large population (for EU standards at least), why did Romania start to attract the wanted attention of international players? A big factor was the introduction to the EU in 2007. Another factor commonly overlooked, but just as important, is Romania’s brain drain. More than 1.2 million young Romanians left the country in the past 10 years, with most of them going to the countries mentioned above (with one notable addition: German banks have virtually no exposure to Romania, while the country is a popular destination for youngsters seeking a better future). Romanians who work outside the country oftentimes come back for long visits or at the very least send money to their relatives still in the country, so the prospect of having these transactions execute more efficiently through international banks is attractive for both sides.

Lastly, the expansion in banking M&A activities in Eastern Europe, notably in Romania, can be linked to major changes in the regulatory environment. The recent revision of the merger control law, which introduced stronger fine mechanisms, has significantly contributed to the legal clarity for market players. This adjustment promotes a business-friendly environment and encourages financial institutions to be more confident in their merger and acquisition activity. Furthermore, the new Memorandum of Understanding between the European Central Bank (ECB) and Romania plays an important role in making the Romanian market more appealing to foreign financial institutions to invest in. The ECB's collaboration with Romania strengthens governance and control structures, aligning them with European norms. As a result of enhanced transparency and regulatory harmonization, investors and financial institutions are more eager to join in the Romanian market.

M&A activity overview

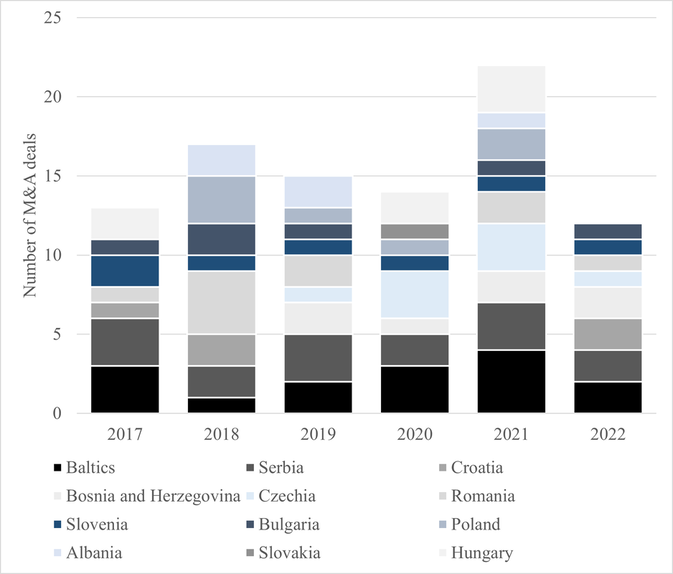

According to CMS M&A Report, overall transactions value in the Emerging Europe market reached a peak of 41 billion euros in 2021 (1,164 deals in total), decreasing to 33 billion euros (1,229 deals in total, with 234 deals in Romania) due to the challenging economic environment in 2022. Despite a decline in M&A deal volume in 2022, there are reasons to believe that the CESEE market will continue to be an attractive market, especially for international banks.

According to Deloitte, the region’s M&A activity in banking sector in 2022 slowed down compared to 2021 but remained at a high level, as 12 deals were reported. The main driver of deal activity in 2022 was exit or rationalization of non-core large international players (e.g., Société Générale, Sberbank), and incumbent international or local players (OTP, Raiffeisen Bank International, KBC, MK Group, local states) acquiring these targets. Another trait that makes this market quite attractive is the fact that the CESEE banking sector is still highly fragmented and smaller banks with less efficient operations represent attractive acquisition targets for larger, more diversified banking groups that seek to benefit from synergies.

Country-wise, the Baltics and Serbia were the busiest M&A markets in the CEE region, both with 15 transactions between 2017 and 2022, followed by Romania and the Czech Republic with 10 and 8 deals respectively. The top buyers in the region by the number of transactions in the last five years were: OTP (Hungarian group, 8 transactions), NLB (Slovenian Nova Ljubljanska Banka), Austrian-based RBI, and Blackstone Group. Accordingly, the top sellers were: Société Générale that decided to divest of its non-core business in the CEE banking market (6 transactions), Sberbank Europe due to insolvency announcement triggered by imposed sanctions, RBI, and EBRD with 5 transactions each.

Number of bank mergers and acquisitions (M&A) deals in Central and Eastern Europe (CEE) from 2017 to 2022, by country

Source: Deloitte CEE Banking M&A Study 2022

Source: Deloitte CEE Banking M&A Study 2022

The CESEE Bank Lending Survey, conducted by the European Investment Bank (EIB) in March 2023, revealed some important findings regarding the banking groups’ strategies when it comes to CESEE. An impressive 73% of parent banks maintained their exposure to the market, while every fifth banking group (18%) increased its presence in CESEE in the last six months. Despite the war in Ukraine, banks remain optimistic about the region, with 45% planning to selectively expand their operations and a further 45% aiming to maintain the same level of operations in the long term. The primary reason behind the banks’ expansionary strategies in CESEE lies in their confidence in the market’s potential. Despite the challenging economic environment, credit demand from bank clients has remained resilient and is expected to improve slightly. The primary driver of credit demand in CESEE are firms’ liquidity needs, particularly working capital, as identified by the EIB’s survey. In addition, according to EIBs economists, banks’ long-term strategies reveal a focus on expansion, driven by anticipated high or medium market potential and higher profitability within the region compared to international overall bank group levels.

Case in point: recent M&A deals

Several recent transactions have drawn attention to the increasing activity of the FIG sector within Eastern European economies. Looking at Romania, for instance, there have been two such announcements made in the last month. On October 23rd, 2023, it was announced that UniCredit Bank, the Romanian subsidiary of the international banking group, fulfilled all economic requirements to proceed with the acquisition of Alpha Bank. Shortly after, Intesa Sanpaolo signed a purchase agreement for First Bank S.A.

As a result of its merger with Alpha Bank, UniCredit Bank is now set to become the third-largest bank in Romania, with a 12% market share (calculated in terms of total assets). Last year, UniCredit was the seventh-largest bank, with 8.6% market share, and Alpha Bank the ninth, with under 3%. Together, the banks serve 14 markets, offering competitive financial products and a wide array of consumer and corporate services. It is expected that Alpha Bank will own 9.9% of the social capital of the newly founded joint entity and will receive € 300 million, full due diligence outstanding. This transaction marks the end of the Target’s 30-year-long presence on the Romanian market. Alpha Bank was backed by Alpha Services and Holdings, a Greek company, and has been experiencing ample difficulties after the financial crisis, progressively losing market share.

According to Andrea Orcel, the CEO of UniCredit Group, this is the first transaction made by UniCredit in the last 15 years, and it signals “the inherent potential that UniCredit sees in Romania and in Central and Eastern Europe”. In fact, it is expected that a large part of the more than 100 million in additional mid-term net profit forecast by UniCredit will come from the group’s operations in Romania. This transaction is part of an extended collaboration between the two head groups, during which UniCredit will acquire AlphaLife Insurance Company as well as authorize the distribution of its mutual funds through Alpha Bank’s Greek Branch, which serves over 3.5 million clients. This is in line with Orcel’s overall strategy to grow fee-yielding businesses for UniCredit.

An equally interesting event is the consolidation of Intesa Sanpaolo’s position in the Romanian banking market, mirroring the moves of its longtime (co-national) competitor, UniCredit. Intesa has only recently displayed interest in the Romanian market (despite being present since 1996), and this acquisition will more than double its position: as of now, Intesa operates 34 branches in the country, while First Bank has 40. The combined entity would have a market share of around 2%, placing Intesa Sanpaolo among the Top 10 largest actors in the Romanian market. Although the details of the deal have not yet been made public, Bloomberg estimates place the value at around 200 million, which will cover the purchase of 99.98% of shares from J.C. Flowers & Co., an American investment fund. Marco Elio Rottigni, head of Intesa’s International Subsidiary Banks division, affirms that this is one of the first manifestations of the bank’s new strategy of engaging in more small acquisitions internationally, in rapidly growing markets. According to declarations made by Intesa Sanpaolo, Romania represents a particularly attractive investment destination, being characterized by a consistently high GDP growth rate and strong cultural and demographic links to Italy.

Outlook

No one can predict the future, but we will do our very best: The way we see banking in Romania is as a sector in need of consolidation. In 2021, there were 30 companies with banking licenses in the country, the same number as Poland, a country with twice the population and more than twice the GDP. Alpha Bank’s merger with UniCredit shows large banks stand to gain from entering the market (according to Andrea Orcel, UniCredit’s CEO), seconded also by Intesa’s acquisition of First Bank. In addition, Romanian banks are also interest in profiting from current developments: Banca Transilvania is close to acquiring the Romanian branch of Hungary’s largest bank OTP Bank as they are going head-to-head with Austria’s Raiffeisen.

So, while commercial banks have felt the need to expand, when will we see financial advisors present in the country? They have assisted more and more transactions here, with Rothschild and Citi winning mandates for Hidroelectrica’s IPO (the largest in Europe’s energy sector this year) and the previously mentioned Italian-Greek merger. Consequently, it cannot be long until investment banks start setting their eye on the Eastern European and especially Romanian advisory market.

No one can predict the future, but we will do our very best: The way we see banking in Romania is as a sector in need of consolidation. In 2021, there were 30 companies with banking licenses in the country, the same number as Poland, a country with twice the population and more than twice the GDP. Alpha Bank’s merger with UniCredit shows large banks stand to gain from entering the market (according to Andrea Orcel, UniCredit’s CEO), seconded also by Intesa’s acquisition of First Bank. In addition, Romanian banks are also interest in profiting from current developments: Banca Transilvania is close to acquiring the Romanian branch of Hungary’s largest bank OTP Bank as they are going head-to-head with Austria’s Raiffeisen.

So, while commercial banks have felt the need to expand, when will we see financial advisors present in the country? They have assisted more and more transactions here, with Rothschild and Citi winning mandates for Hidroelectrica’s IPO (the largest in Europe’s energy sector this year) and the previously mentioned Italian-Greek merger. Consequently, it cannot be long until investment banks start setting their eye on the Eastern European and especially Romanian advisory market.

By Polina Mednikova, Georgia-Alesia Mirica, Dinu Cionga and Emanuele Tartaglini

Sources

- Financial Times, Reuters, Bloomberg and FactSet

- The World Bank. GDP growth (annual %) - Central Europe and the Baltics

- The Unicredit Economics Chartbook - 27 Sep 23

- CEE Banking M&A Study 2022 Deloitte

- CMS Emerging Europe M&A Report 2022/2023

- Veton Zeqiraj, Shawkat Hammoudeh, Omer Iskenderoglu & Aviral Kumar Tiwari (2020) Banking sector performance and economic growth: evidence from Southeast European countries