Video streaming industry overview

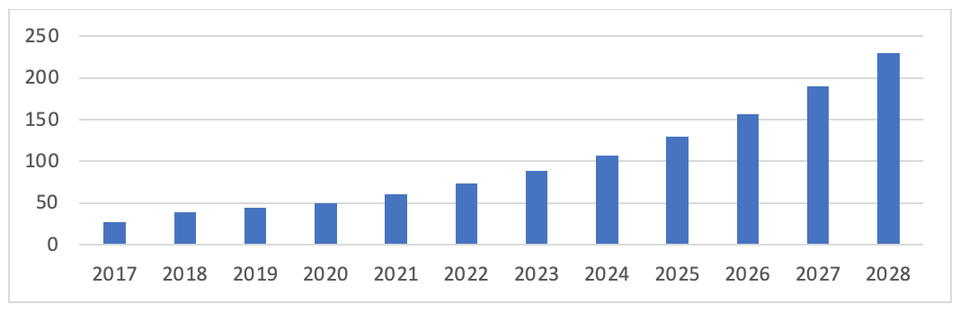

The global video streaming market size was valued at $50.11B in 2020 and it’s expected to grow at a compound annual rate of 21.0% from 2021 to 2028, especially through the implementation of blockchain and AI’s technologies, which will improve video quality, performance, and security.

Networks and studios are engaged in a streaming war, where every major player is launching its own streaming service. Thus, it’s getting more and more difficult to create a broad library of content, with the ability to attract and retain consumers. According to Kevin Westcott, vice chairman and US telecommunications, media, & entertainment leader at Deloitte Consulting LLP, this conflict creates the opportunity for M&E firms (Media and Entertainment) to reassemble their offerings, which include a mixture of video, music, and gaming services.

Telecommunication providers can help the development of such platforms by defining the new infrastructure of 5G, which would allow meeting the higher consumers' expectations, by increasing both download speed and data capacity.

The video streaming industry is exploding and as explained in Deloitte's Digital Media Trends Survey, video streaming subscriptions are surpassing traditional pay-TVs. While almost every big studio is presenting its platform, it is becoming impossible for third-party services to reunite all the major producers in a unique library. The result is a general frustration among consumers that are obliged to continuously subscribe to additional services to have access to their favorite content. The current market situation is going against the core values that led to the creation of such platforms: accessibility and affordability.

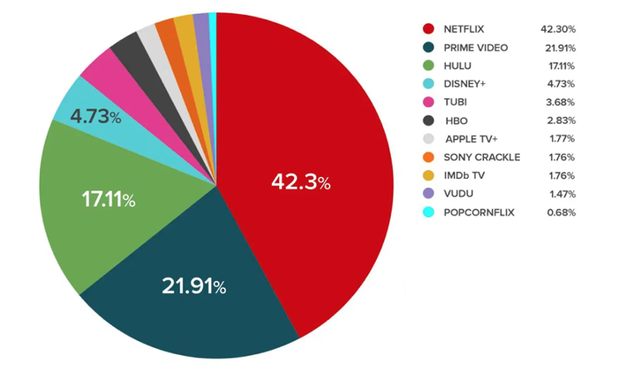

For these reasons, the companies that can "reaggregate" their offerings are the most likely to succeed. An example might be Amazon's prime package, made of music, shows and home delivery. Another significant driver of consumer's decisions is the availability of ad-free content, which Netflix has exploited to dominate the North American market.

The global video streaming market size was valued at $50.11B in 2020 and it’s expected to grow at a compound annual rate of 21.0% from 2021 to 2028, especially through the implementation of blockchain and AI’s technologies, which will improve video quality, performance, and security.

Networks and studios are engaged in a streaming war, where every major player is launching its own streaming service. Thus, it’s getting more and more difficult to create a broad library of content, with the ability to attract and retain consumers. According to Kevin Westcott, vice chairman and US telecommunications, media, & entertainment leader at Deloitte Consulting LLP, this conflict creates the opportunity for M&E firms (Media and Entertainment) to reassemble their offerings, which include a mixture of video, music, and gaming services.

Telecommunication providers can help the development of such platforms by defining the new infrastructure of 5G, which would allow meeting the higher consumers' expectations, by increasing both download speed and data capacity.

The video streaming industry is exploding and as explained in Deloitte's Digital Media Trends Survey, video streaming subscriptions are surpassing traditional pay-TVs. While almost every big studio is presenting its platform, it is becoming impossible for third-party services to reunite all the major producers in a unique library. The result is a general frustration among consumers that are obliged to continuously subscribe to additional services to have access to their favorite content. The current market situation is going against the core values that led to the creation of such platforms: accessibility and affordability.

For these reasons, the companies that can "reaggregate" their offerings are the most likely to succeed. An example might be Amazon's prime package, made of music, shows and home delivery. Another significant driver of consumer's decisions is the availability of ad-free content, which Netflix has exploited to dominate the North American market.

Netflix overview and earnings

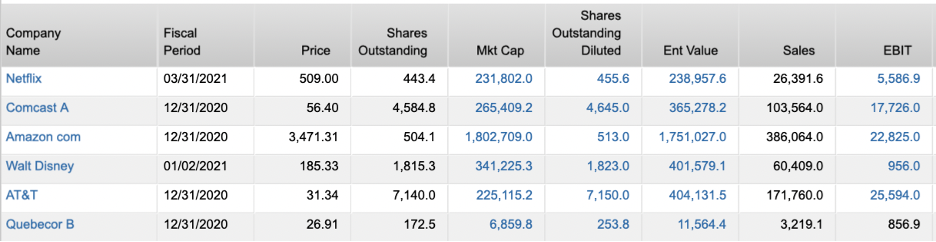

Netflix, Inc. is the leading streaming entertainment service company, with a market cap of $224.59B. It was founded by Marc Randolph and Wilmot Reed Hastings Jr. on August 29, 1997, and is headquartered in Los Gatos, CA. The company was born as a rent-by-mail DVD service and has grown to be the place of reference where people go for TV streaming.

Over the years, Netflix’s streaming service has substituted its original core business, which has suffered a sharp decline in the last decade. With 207.64 million paying subscribers, the company is the undiscussed biggest player in the industry. However, the increasing competition, due to the introduction of new streaming services by established companies, such as Disney, Apple, and Amazon just to name a few, has been reducing Netflix’s market share.

Netflix, Inc. is the leading streaming entertainment service company, with a market cap of $224.59B. It was founded by Marc Randolph and Wilmot Reed Hastings Jr. on August 29, 1997, and is headquartered in Los Gatos, CA. The company was born as a rent-by-mail DVD service and has grown to be the place of reference where people go for TV streaming.

Over the years, Netflix’s streaming service has substituted its original core business, which has suffered a sharp decline in the last decade. With 207.64 million paying subscribers, the company is the undiscussed biggest player in the industry. However, the increasing competition, due to the introduction of new streaming services by established companies, such as Disney, Apple, and Amazon just to name a few, has been reducing Netflix’s market share.

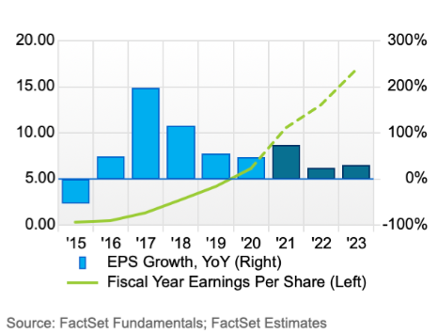

In the first quarter of 2021, the company is absorbing more than 50% of global demand for original content, which is 4% lower than last year and 15% lower than 2019. On the 20th of April, Netflix released its Q1 earnings, reporting revenue growth of 24% year-over-year, with operating profit and margins at an all-time-highs. In addition, the streaming giant announced that it will be no longer borrowing money for the creation of original content, which is an extremely relevant achievement in an industry that constantly requires enormous sums from investors.

Nevertheless, the stock has fallen on the release date as shareholders are worried by the number of new subscriptions, which grew by 14% YoY but was significantly below the expectations: 3.98 million vs 6 million expected. Management justified the performance by blaming Covid-19: the pandemic has been slowing down the creation of new content, resulting in a lighter offer slate for the first quarter of 2021. At the same time, worldwide quarantines led to a record-breaking 40 million net surge in the number of paid memberships during last year; an accomplishment that is unlikely to be repeated in the next years.

While the future is uncertain in the short-term, analysts expect a strong second half, thanks to the return of new seasons of some of Netflix's biggest successes. In the long-term, the conviction that streaming will replace linear TV in the entertainment industry is stronger than ever.

Nevertheless, the stock has fallen on the release date as shareholders are worried by the number of new subscriptions, which grew by 14% YoY but was significantly below the expectations: 3.98 million vs 6 million expected. Management justified the performance by blaming Covid-19: the pandemic has been slowing down the creation of new content, resulting in a lighter offer slate for the first quarter of 2021. At the same time, worldwide quarantines led to a record-breaking 40 million net surge in the number of paid memberships during last year; an accomplishment that is unlikely to be repeated in the next years.

While the future is uncertain in the short-term, analysts expect a strong second half, thanks to the return of new seasons of some of Netflix's biggest successes. In the long-term, the conviction that streaming will replace linear TV in the entertainment industry is stronger than ever.

Tommaso Tenti

BSCM would like to thank FactSet for giving us access to their platform and providing charts and data.