While the Western world is committing to the green transition, natural resources become crucial to achieve this target. Nickel, above all, is raising more and more attention from investors due to its employment in the Electric Vehicles market. The Indonesian corporation Harita Nickel is an example of this trend, whose successful recent IPO tells a lot about how this market is evolving. In this article, we will go more in depth on what are the economical and geopolitical implications both for exporting countries and more broadly for South East Asia.

The IPO

Indonesia recently caught the spotlight thanks to two important Initial Public Offerings (IPOs), both related to the field of natural resources. In February, Pertamina Geothermal Energy’s shares started trading on the Jakarta Stock Exchange, raising $597mm and leading Indonesia’s path towards less energy imports and reduced carbon emissions. Even though this had been the biggest listing in Indonesia in almost a year, it didn’t take long for the record to be broken: in March, indeed, Harita Nickel IPO for institutional investors raised the company, known as Trimegah Bangun Persada in the region, $660mm.

Harita Nickel is part of the Harita Group conglomerate, owned and controlled by the Lim family and whose core businesses are natural resources. The Lims control 82% of the shares of Harita Nickel through two holding companies, Harita Jayarraya and Citra Duta Jaya Maker. What Harita Nickel does more specifically is operating the first high-pressure acid leaching smelter on Obi island, in North Maluku, and this process turns the local low-grade ore into mixed hydroxide precipitate, a form of nickel that can be further processed to make batteries. Currently, Harita Nickel operates one facility with production capacity of 55,000 tons per year, but next year a planned new plant would more than double this output, bringing it to 120,000 tons.

Harita Nickel chose two slots for its Initial Public Offering: one, in March, for institutional investors only, and a second retail one, through which the company’s shares are set to go public on the Indonesian Stock Exchange and that should happen on April 12th. Why does the company want to go public now, in a period of extreme uncertainty in the market and high volatility in nickel prices? The idea, pushed by the Indonesian government, is for the country to develop an end-to-end electric vehicle supply chain, and this IPO aimed to test international investors’ confidence. The proceeds will serve not only to increase the company’s processing capacity, but also to pay existing debt, increase working capital and carry out capital expenditures. This will to accelerate the mining downstream industry in the South-East Asian country could also be hiding a political motive: China, indeed, has always had discrete dominance on the Indonesian nickel supply chain, and the IPO can be seen as a first step to full independence.

Harita Nickel’s advisors for this Initial Public Offering were Credit Suisse Group AG, BNP Paribas SA, Citigroup Inc. and PT Mandiri Sekuritas, an Indonesian investment advisory firm. The investment banks’ top-end valuation priced Harita Nickel’s shares at 1,250Rp, which is equal to a price of 0.084USD per share and a total value of the company of $5.15BN. Even if the economic environment is, in general, not the most optimistic, the issue was oversubscribed. Among the investors who put their money and trust in Harita Nickel we find Glencore, a Swiss commodities trader, many international funds such as Fidelity, and many regional sovereign funds, probably pushed by the fact that this initiative was approved by the Indonesian government. There were also some, even if few, hedge funds that decided to invest in the company.

Harita Nickel’s shares are set to become publicly tradable on April 12th, when 12.1BN shares will be available for sale - around 18% of its total. According to the company’s prospectus, it will raise between $960mm and $983mm.

Nickel: why should we care?

Nickel is a base metal that finds an extensive application in the production of stainless steel and metal alloys. Which is even more important, nickel has become crucial in the production of batteries. In fact, demand for nickel in the decades to come is expected to grow further due to a strong demand from stainless steel and electric vehicle (EV) battery markets. As of 2022, the biggest nickel producer worldwide is Indonesia with roughly 1,600,000 metric tons of nickel production. That accounts for nearly a half of global nickel output. The other major nickel producers are the Philippines, with roughly 330,000 metric tons, and Russia, with 220,000 metric tons.

Estimated global nickel mine production in 2022 grew by about 20%, an increase that was to a large extent provided by Indonesia’s output. In the third quarter of 2022 exports of nickel from Indonesia increased five-fold YoY, underpinned by aforementioned high demand for electric vehicle batteries. The largest share of the increase was facilitated by the ongoing commissioning of integrated nickel pig iron and stainless-steel projects. In addition, several companies continued to develop technologies to produce intermediate matte or mixed nickel-cobalt hydroxide that were intended to be used as feedstock to produce battery-grade nickel sulfate.

Major trends and issues in nickel production sector

In 2022 nickel prices witnessed an increased volatility. In the beginning of March 2022, the London Metal Exchange three-month (LME 3M) jumped 250.5% over the growing concerns about Russian nickel exports. As a result, a so-called “nickel short squeeze” led to the LME's decision to suspend trading on the exchange for six working days. The price surges in March disrupted nickel trading on the LME for approximately two weeks. After peaking in March, monthly average prices began to decline through July, and stabilized for the remainder of the year. Overall, in 2022 the annual average LME nickel cash price was estimated to have increased by 35% compared with that in 2021 which was attributed to increasing use of nickel in electric vehicle batteries and continued strong demand for stainless steel.

After an unstable year of 2022, the volatility in the nickel industry carried on into the beginning of 2023. This time the price softening was mainly influenced by the news of the latest production strategy shift by Chinese stainless steel and nickel producer Tsingshan Holding Group Co. Ltd. The reason behind an unfavorable price dynamic lies in the fact that one of the main Chinese producers, Tsingshan, released its intent of adding Class 1 primary nickel to its diverse production mix. Thus, in March 2023 price plummeted to a 3-month low since the end-November levels.

Considering the existing trends in the industry, S&P Global Commodity Insights, in its monthly Nickel Commodity Briefing Service, released in January 2023, forecasted the LME 3M nickel price to average $27,518/t in 2023, below current price levels, on expectations for a wider global primary nickel market surplus.

It is safe to conclude that among natural resources nickel is undoubtedly one we are going to hear more and more about, especially with an eye to the medium-long term outlook of the electric vehicles market.

How Nickel affects the Indonesian Economy

The Indonesian government values the domestic mining downstream industry a lot, and this is why it is pushing for it to continue developing. In 2014 the export of nickel ore had been initially banned because of this reason, policy eased between January 2017 and December 2019 by allowing the export of nickel with below 1.7% nickel content. Its export had been banned again in January 2020.

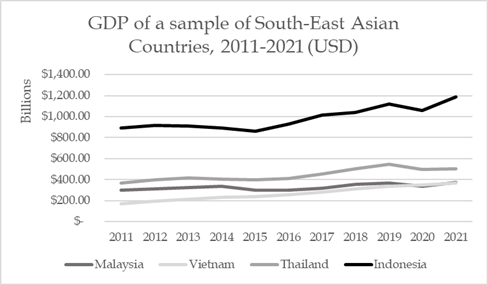

The mining sector represents one of the pillars of the Indonesian economy, and nickel production has been one of the country's main sources of income.The Indonesian economy has experienced stronger, though less steady, growth in GDP over the last decade, if compared to other South-East Asian countries. However, it is not exempt from the period of uncertainty in the global economy, with inflation still not under control despite rate hikes.

An increase in production of nickel is generally considered beneficial due to higher state revenues in the form of taxes and royalties and higher employment demand in various stages of the nickel production process, such as extraction, transportation, and processing. However, it could also have negative effects on the environment and local communities. Nickel production requires large amounts of water and energy and could cause greater deforestation and environmental degradation. It is essential that the industry and governments commit to reducing the negative impacts of nickel production through the adoption of more sustainable practices and the improvement of environmental policies.

Environmental concerns

The nickel industry in Indonesia has a significant impact on the environment and human health. Nickel extraction and processing intensively exploit natural resources, and the industry is highly dependent on coal. This makes the nickel production process particularly carbon-intensive, with high greenhouse gas emissions such as carbon dioxide, carbon monoxide, and nitrogen oxide, contributing to climate change.

Moreover, the nickel industry releases a range of toxic substances into the air and water, including mercury, arsenic, and lead, which can cause serious health problems among the local population. This is particularly problematic for Indonesia, where many communities depend on river water for irrigation and drinking water.

Furthermore, the nickel industry in Indonesia involves deforestation, which is often necessary to make space for nickel mines: this worsens even more the already concerning environmental impact of the industry. In recent years, the nickel industry in Indonesia has become a point of concern for environmental groups. In particular, Tesla has been urged to halt its investment plans in the Indonesian nickel industry, citing concerns about deforestation, pollution of water bodies, and disruption of indigenous populations' livelihoods following nickel extraction. Many activists emphasize the need for greater attention to environmental and social sustainability in nickel production in Indonesia and worldwide.

To address these challenges, it is necessary for the nickel industry in Indonesia to commit further to the transition to renewable and less polluting energy sources. Additionally, rigorous regulations are needed to protect the environment and human health, such as responsible waste management, control of polluting emissions, and the implementation of high safety standards. This is the only way this market can survive under increasingly more environmentally concerned investors.

Market dynamics

Despite these challenges, the Indonesian government and investors entering the nickel sector seem willing to overlook these environmental and social concerns. President Joko Widodo has expressed his intention to develop a domestic EV industry based on nickel, including processing and refining as well as battery component production. In 2020, Indonesia banned the export of raw nickel to develop a downstream industry, thereby disrupting the large flow of raw nickel to China.

Following the export ban, Indonesia has seen increased downstream investment focused on nickel refining and processing, especially from China. Chinese refineries, including GEM Co, have committed about $30 billion to move their operations to Indonesia. In mid-April 2022, Chinese battery giant CATL launched a joint investment in Indonesia for nickel extraction and EV battery production. Even downstream EV industry players such as Volkswagen and Tesla have sought to secure minerals from the Southeast Asian nation.

Additionally, it would be challenging for EV manufacturers to exclude Indonesian nickel from their supply chain. Russia supplies about 20% of Class 1 nickel, but the repercussions of the invasion of Ukraine and potential sanctions may reduce its supply and limit the willingness or ability of European and American actors to source nickel from Russia. Given Indonesia's investment in refining and processing capacity and the extent of its nickel reserves, it is likely that Indonesia will become an even more important source of refined nickel for EV batteries in the next decade.

However, it is crucial that investors and industry players prioritize sustainability and responsible investment in the Indonesian nickel sector. This means taking into account not only environmental impacts but also social and economic factors such as local community engagement and labor standards. By adopting a sustainable approach, investors can help ensure the long-term viability and success of the Indonesian nickel industry while minimizing its negative impacts on the environment and society.

The Positive Impacts of the Nickel Industry

The development plan for nickel processing and refining in Southeast Sulawesi Province has had several positive impacts on the region. Firstly, it has contributed to the growth of the regional economy by increasing the Gross Regional Domestic Product, with a 400% increase in the added value of nickel products. Secondly, it has created new employment opportunities and is estimated to absorb 4,000 new workers. Thirdly, it has led to an increase in income per capita/head of family, savings, investment, and welfare. A study found that mining activities increased the income of the surrounding community by an average of Rp. 3,166,667.00 (212$) per month, compared to an average of Rp. 1,961,111.00 (132$) per month before the development plan.

Furthermore, the development plan has facilitated the growth of micro-enterprises in the community, such as small-scale kiosks, food stalls, credit counters, small industries, services, and craftsmen. These businesses are profitable for both the community and the mining employees, creating a win-win situation.

China’s influence on ASEAN

In the 21st century China has seen exponential growth and affirmed itself as one of the most influential economic powers worldwide: the increasing power of China is the most influential driver of geopolitical change today.

China’s emergence of economic, military and cultural presence is extremely apparent in the countries of Southeast Asia. The health of China’s economy is, especially because of geographical proximity and associated trade networks, an important driver of economic growth in the ASEAN region, which is the primary focus of China’s neighborhood diplomacy. With the Framework Agreement on Comprehensive Economic Cooperation Between ASEAN and the People’s Republic of China in 2002, and the ASEAN-China Free Trade Area in 2010, China started negotiating with foreign countries and, under these initiatives, bilateral trade has expanded rapidly as investment markets liberalized between the two parties.

During the pandemic, ASEAN became China’s largest trading partner, accounting for 14.7% of the mainland’s total trade in 2020, replacing the United States and the European Union. At the same time, China has become a major investor in the ASEAN area: in 2020 China’s foreign direct investment (FDI) flow to the region amounted to $7.62 billion, accounting for 6.7% of the total FDI absorbed by ASEAN. Despite the economic agreements, political tensions have developed due to trade in the South China Sea: the countries are claiming portions of territories such as the Spratly Islands and the Paracel Islands, deemed rich in gas and oil. The negotiations have continued since 2002, with limited progress due to the incompatibility of positions between China and ASEAN states.

Indonesia and the relationship with China

In recent years, multinational corporations have been increasingly looking to ASEAN as an alternative production hub, being one of the fastest-growing regions of the world with an estimated total GDP of $3.9 billion and a growth of 5.5%, reflecting booming population expansion and increasingly liberal trade policies.

Indonesia has taken over the chairmanship of the ASEAN for 2023 and it is the region's sole G20 member. It is the ASEAN’s first economy, and it is considered a newly industrialised country, with an estimated GDP of $1.38T and an economic expansion of 5.31% in 2022; S&P Global analysts suggest that the global economic downturn will have less impact on Indonesian domestic demand-led economy. Investment grew by 3.87%, due to the abundance of natural resources and a large domestic market of $260 million that attracts long-term investments.

Indonesia's mineral resources, including nickel, tin, bauxite, gold and copper, contribute significantly to the country’s economy. The country is expected to continue to attract investments, according to Investment Minister Bahlil Lahadalia. China more than doubled its investment in Indonesia in the first half of 2022 and the FDI outflow from China to Indonesia reached about $8.2 billion in the same year.

China has been Indonesia’s biggest trading partner since 2005, when the Indonesia-China Strategic Partnership was signed to expand the scope of their partnership to other sectors, such as the military one.That's not always been the case: Indonesian relations with China have fluctuated strongly over the past 70 years. They first established diplomatic relations in 1950, with Sino-Indonesian relations. In 1967, the Indonesian government decided unilaterally to suspend relations with China, with reference to national security, portraying China as the prime source of external threat. In 1990 the relationship was restored and with Wahid’s administration (1999–2001) the collaboration between the two associates increased: China provided financial aid to critical Indonesian sectors and the Indonesian government revoked discriminatory laws against Chinese minorities, representing more than 3% of the Indonesian population. Since Indonesia has declared neutrality on the unresolved disputes in the South China Sea mentioned above, the political side of the Chinese–Indonesian relationship is not expected to change drastically anytime soon, therefore China and Indonesia are expected to be strong economic parties in the foreseeable future.

Conclusion

The nickel industry is undoubtedly expanding and exporting countries can benefit from this trend. Indonesia’s government and investors seem to go in this direction. However, it is clear that sustainability and responsible investment will be critical factors in the future of the nickel industry in the country. Government action will play a vital role in promoting sustainable practices and reducing the carbon emissions associated with nickel mining and processing. If the industry continues to ignore the climate threats posed by coal-powered industrial parks used to produce nickel and natural resources in general, Indonesia endangers its position as one of the key players in the EV supply chain. This also raises concerns on an already fragile geopolitical panorama, with international relations to be played wisely. In such an articulated panorama, there is no such thing as a certain outlook, but this market will continue raising attention.

By Sara D’Apice, Polina Mednikova, Federico Tita, Sofia Rubino

SOURCES

- Financial Times

- Bloomberg

- U.S. Geological Survey, Mineral Commodity Summaries

- World Bank, Indonesia Economic Prospects

- London Metal Exchange

- S&P Global