In 2017 China bought almost 3,6 million tons of liquefied natural gas (LNG) from USA, which strongly helped USA to become the second biggest supplier of gas for the country. According to IHS Markit, in the first 8 months of 2018, the import of LNG halved with respect to the same period of last year. The reason of this drop in sales comes from the ongoing trade war between China and USA as ,since the end of August 2018, each country has introduced tariffs on goods traded with the other. US President Donald Trump had promised in his campaign to fix China's " long time abuse of the broken international system and unfair practices". Another reason for the drop might be the price of the product, which became more expensive.

According the analytics of FGE, an oil consulting company, China is making up for its need of LNG by buying it from Qatar, United Arab Emirates, Saudi Arabia and Kuwait. LNG import is not the only product that was affected by the trade war, also oil supplies from USA are not imported in China anymore. However, this did not affect USA’s primacy in the sector, unlike LNG. In fact, USA is massively investing in the gas infrastructure and many american companies are ready to build new terminals in Mexico.

According the analytics of FGE, an oil consulting company, China is making up for its need of LNG by buying it from Qatar, United Arab Emirates, Saudi Arabia and Kuwait. LNG import is not the only product that was affected by the trade war, also oil supplies from USA are not imported in China anymore. However, this did not affect USA’s primacy in the sector, unlike LNG. In fact, USA is massively investing in the gas infrastructure and many american companies are ready to build new terminals in Mexico.

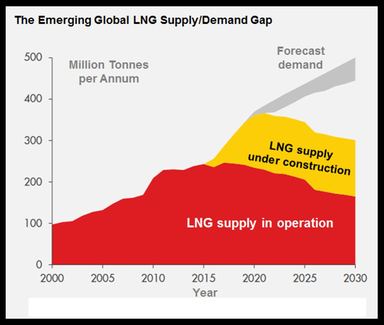

We can see from the graph how analysts predicted a demand greater that the actual LNG possibly supplied and for the construction of a dozen of terminals, American companies will need about 130 billion dollars. But 2018 is a critical year for finding investors. Meanwhile, with the financing of these projects, serious difficulties will arise, and this may put an end to Washington’s hopes of making America, if not the first, then at least the second exporter of liquefied gas on the planet. The United States hopes to exceed 1 trillion ft³ (28.3 billion m³) in LNG exports this year. For comparison: 1 billion feet ³ of gas is enough to heat about 5 million American homes per day. The longer the trade war lasts, the less likely USA are to find financing for the construction of gas terminals.

According to analysts, the hardest hit will be on American companies such as Cheniere Energy, Sempra and Kinder Morgan, which are going to build new terminals or expand existing ones.

The situation may turn out in a complete disaster for Washington and putting pressure on its European partners to build new LNG terminals for receiving American gas will be meaningless, since the United States simply will not be able to deliver the required amount of LNG to Europe. However, China may also suffer, as gas prices will go up, and the country will have to buy part of the required volumes elsewhere at higher prices. Analysts do not even rule out that Europeans will resell American gas to China. But it seems that Beijing will not step back anymore - a war is a war.

We have to remind that when two dogs strive for a bone, usually the third runs away with it and this might be the case of Russia.

“Stopping China's purchases of American LNG will play into the hands of countries competing with the United States, also targeting the Chinese market. First of all, Russian pipeline projects,” said Gilles Farrer, research director at consulting company WoodMakcenzie.

According to analysts, the hardest hit will be on American companies such as Cheniere Energy, Sempra and Kinder Morgan, which are going to build new terminals or expand existing ones.

The situation may turn out in a complete disaster for Washington and putting pressure on its European partners to build new LNG terminals for receiving American gas will be meaningless, since the United States simply will not be able to deliver the required amount of LNG to Europe. However, China may also suffer, as gas prices will go up, and the country will have to buy part of the required volumes elsewhere at higher prices. Analysts do not even rule out that Europeans will resell American gas to China. But it seems that Beijing will not step back anymore - a war is a war.

We have to remind that when two dogs strive for a bone, usually the third runs away with it and this might be the case of Russia.

“Stopping China's purchases of American LNG will play into the hands of countries competing with the United States, also targeting the Chinese market. First of all, Russian pipeline projects,” said Gilles Farrer, research director at consulting company WoodMakcenzie.

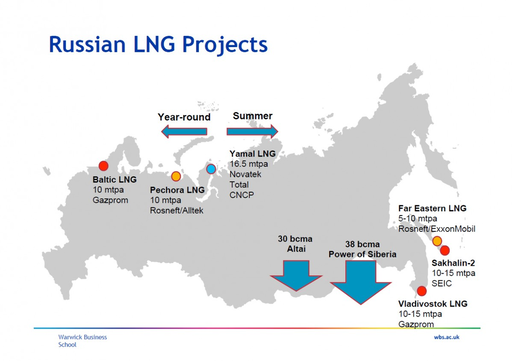

With the launch of “the Power of Siberia” gas pipeline, the situation will change, since Russian gas is much more attractive in terms of price. Saudi state-owned Aramco, whose contract prices serve as a reference for Asia, are now selling liquefied gas at $ 655 per ton, equivalent to $ 470 per thousand cubic meters. Russian pipeline gas costs one and a half to two times cheaper.

In spring, Gazprom’s Chairman of the Board, Alexander Medvedev, noted that the economic efficiency of Russian gas supplies to China “will be comparable to Europe’s.” This year, Gazprom’s average export price is $ 230 per thousand cubic meters. The cost of Russian gas for China is likely to be close to this value. Note that “the Power of Siberia” , which will be commissioned on December 20, 2019, is designed to transport 38 billion cubic meters of Russian gas to China annually. This is about a quarter more than the current volume of LNG supplies to the Middle Kingdom (a little more than 21 million tons per year, which is equivalent to 30 million cubic meters).

However, one should not expect that Russian gas will completely displace the entire LNG from the Chinese market.

First, Beijing strictly adheres to the principle of diversifying supplies, so it will keep buying gas from other countries for purely political reasons. Secondly, the need in blue fuel will grow faster than the capacity of the gas transportation infrastructure.

According to experts, by 2030 gas consumption in China will double and reach 480 billion cubic meters per year. It is no coincidence that in September, during a meeting with Russian President Vladimir Putin at the Eastern Economic Forum, Chinese leader Xi Jinping instructed his subordinates to agree on all the formalities for commencing construction of the Power of Siberia-2 gas pipeline with a capacity of about 30 billion cubic meters of gas per year.

However, this may not be enough: according to Gazprom estimates, by 2035 the need for Russian pipeline gas supplies to China will be from 80 to 110 billion cubic meters. So, probably, it will be necessary to lay another pipe.

Sofiya Sergeeva

In spring, Gazprom’s Chairman of the Board, Alexander Medvedev, noted that the economic efficiency of Russian gas supplies to China “will be comparable to Europe’s.” This year, Gazprom’s average export price is $ 230 per thousand cubic meters. The cost of Russian gas for China is likely to be close to this value. Note that “the Power of Siberia” , which will be commissioned on December 20, 2019, is designed to transport 38 billion cubic meters of Russian gas to China annually. This is about a quarter more than the current volume of LNG supplies to the Middle Kingdom (a little more than 21 million tons per year, which is equivalent to 30 million cubic meters).

However, one should not expect that Russian gas will completely displace the entire LNG from the Chinese market.

First, Beijing strictly adheres to the principle of diversifying supplies, so it will keep buying gas from other countries for purely political reasons. Secondly, the need in blue fuel will grow faster than the capacity of the gas transportation infrastructure.

According to experts, by 2030 gas consumption in China will double and reach 480 billion cubic meters per year. It is no coincidence that in September, during a meeting with Russian President Vladimir Putin at the Eastern Economic Forum, Chinese leader Xi Jinping instructed his subordinates to agree on all the formalities for commencing construction of the Power of Siberia-2 gas pipeline with a capacity of about 30 billion cubic meters of gas per year.

However, this may not be enough: according to Gazprom estimates, by 2035 the need for Russian pipeline gas supplies to China will be from 80 to 110 billion cubic meters. So, probably, it will be necessary to lay another pipe.

Sofiya Sergeeva