In October 2016, Citigroup upgraded both Dow Chemical (DOW) and DuPont (DD) from Neutral to Buy and defined DowDuPont as “the stock to own in 2017.” This company will be the result of the $130bn merger of equals that the two US chemical giants announced last December.

Such operation, yet to be finalized, could be defined as the catalyst of the wave of consolidation that has recently affected the chemical industry. It precedes ChemChina’s acquisition of Syngenta ($43bn), Agrium and Potash Corp’s merger ($36bn), and Bayer’s takeover of Monsanto ($66bn).

These players are joining forces because of the lower margins they can cash-in from selling agricultural-related products such as fertilizers and pesticides. In fact, crop prices are falling, which impairs farmers’ ability to keep buying the products they need.

In such shrinking industry, players can react in two ways.

On one hand, they can innovate. By developing new technology, companies could reduce costs and revamp margin even when facing low prices. Such option requires, however, both significant investments and time and does not deliver immediate improvements. To understand why corporations might not want to follow this path, think about how this would impact investors’ returns and managers’ bonuses in the short term.

On the other hand, companies can opt for joining forces with other industry players so to reduce competition and cut cost through synergies. This second option could immediately boost margin and might also translate into higher EPS –rewarding both investors and management. However, it comes at a price.

First, companies will need to achieve synergies. An example to do so is to significantly cut the workforce in excess, which, reasonably, does not happen overnight.

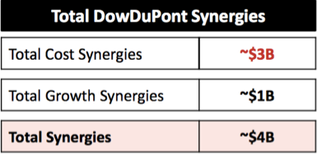

Here an example of projected synergies:

Such operation, yet to be finalized, could be defined as the catalyst of the wave of consolidation that has recently affected the chemical industry. It precedes ChemChina’s acquisition of Syngenta ($43bn), Agrium and Potash Corp’s merger ($36bn), and Bayer’s takeover of Monsanto ($66bn).

These players are joining forces because of the lower margins they can cash-in from selling agricultural-related products such as fertilizers and pesticides. In fact, crop prices are falling, which impairs farmers’ ability to keep buying the products they need.

In such shrinking industry, players can react in two ways.

On one hand, they can innovate. By developing new technology, companies could reduce costs and revamp margin even when facing low prices. Such option requires, however, both significant investments and time and does not deliver immediate improvements. To understand why corporations might not want to follow this path, think about how this would impact investors’ returns and managers’ bonuses in the short term.

On the other hand, companies can opt for joining forces with other industry players so to reduce competition and cut cost through synergies. This second option could immediately boost margin and might also translate into higher EPS –rewarding both investors and management. However, it comes at a price.

First, companies will need to achieve synergies. An example to do so is to significantly cut the workforce in excess, which, reasonably, does not happen overnight.

Here an example of projected synergies:

Source: DowDuPont Merger of Equals Presentation

Second, they will have to face antitrust regulators, which has proven to be particularly hard recently. In fact, new policies and taxation rules have led to the blockage of deals such as Pfizer’s takeover of Allergan and AT&T’s acquisition of T-Mobile. Moreover, let’s not forget that companies of Dow and DuPont’s size operate in multiple markets and need to comply with the regulation of all the relative countries. Receiving approval might have the same chances as winning a coin toss.

In fact, just recently the European Commission has resumed investigations on the merger proposed by the two America-headquartered giants. Approval from this body is not expected until February 6th, 2017. Denial would stop the transaction.

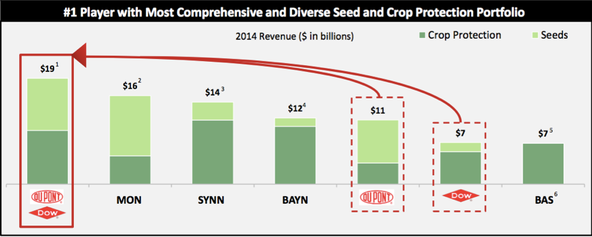

No wonder, then, that DowDuPont is still yet to be finalized after almost one year since the merger announcement. After all, the deal will create a corporation with an overall market cap of roughly $130bn and an undiscussed supremacy in the agrichemical market. Cost-cutting operations and regulators will take their time.

Second, they will have to face antitrust regulators, which has proven to be particularly hard recently. In fact, new policies and taxation rules have led to the blockage of deals such as Pfizer’s takeover of Allergan and AT&T’s acquisition of T-Mobile. Moreover, let’s not forget that companies of Dow and DuPont’s size operate in multiple markets and need to comply with the regulation of all the relative countries. Receiving approval might have the same chances as winning a coin toss.

In fact, just recently the European Commission has resumed investigations on the merger proposed by the two America-headquartered giants. Approval from this body is not expected until February 6th, 2017. Denial would stop the transaction.

No wonder, then, that DowDuPont is still yet to be finalized after almost one year since the merger announcement. After all, the deal will create a corporation with an overall market cap of roughly $130bn and an undiscussed supremacy in the agrichemical market. Cost-cutting operations and regulators will take their time.

Source: DowDuPont Merger of Equals Presentation

Nonetheless, investors will be keen on seeing such giants holding hands; not so supportive will be the antitrust bodies.

Gabriele Zaffarano

Nonetheless, investors will be keen on seeing such giants holding hands; not so supportive will be the antitrust bodies.

Gabriele Zaffarano