At the end of November the new economic data was released in Japan. After the recession in the Japan’s economy in the middle of the year the figures suggest that the market is starting to recover. There are five key indicators to discuss.

Consumer-Price Index

Consumer-Price Index

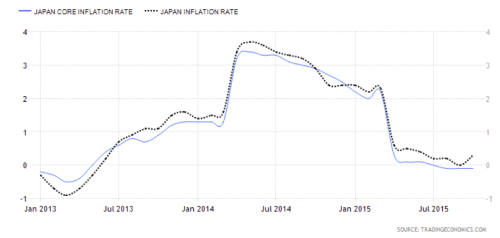

- CPI rose by 0.3 percent

- Core CPI excluding fresh food declined by 0.1 percent

- Core CPI excluding energy and all food went up by 0.7 percent

In January 2013 the Bank of Japan (BOJ) set the “price stability target” at 2 percent increase of the year-to-year change in the consumer-price index. To achieve the target the BOJ introduced the Quantitative and Qualitative Monetary Easing program (QQE), which implied the doubling of the monetary base, the amounts outstanding of Japanese government bonds (JGB) and exchange-traded funds (ETF) in two years. In 2014 the BOJ decided to further extend the QQE by increasing the annual pace of money market operations and asset purchases. Finally, in November 2015 the Bank decided to continue the program and to expand the monetary base by approximately 80 trillion yen. In the Monthly Report of the Recent Economic and Financial Developments published on November 20, 2015 the BOJ expects the economy to recover moderately and while it acknowledges the weak development of inflation indicators, it said that long-term inflation expectations are rising.

In general, the expected yearly change in CPI is around 0 percent and this is mainly explained by the declining trend in energy prices. In fact, the growth of the CPI excluding energy and food prices supports the idea that the inflation trend in Japan is improving. Still some analysts believe that the latest figures might lead to another expansion of the QQE program.

Unemployment Rate

In general, the expected yearly change in CPI is around 0 percent and this is mainly explained by the declining trend in energy prices. In fact, the growth of the CPI excluding energy and food prices supports the idea that the inflation trend in Japan is improving. Still some analysts believe that the latest figures might lead to another expansion of the QQE program.

Unemployment Rate

- The unemployment rate reached its minimum since 1995 and amounted 3.1 percent

- The labor force declined by 230 thousand people

- Participation rate went down by 0.3 percent to 59.9 percent compared to September

The unemployment rate fell unexpectedly in the previous month, while the market predicted it to stay at the level of 3.4 percent in September. This was a result of the declined number of unemployed and the growth of employment rate. In addition, there was a positive development in the new job openings and the active job openings-to-applicants was at its highest level since 1992. Also, according to the Health, Labor and Welfare Ministry salaries went up by 0.7 percent in October compared to the previous year. This developments on the labor market are considered in line with the economic recovery by BOJ.

Business Indicators

Business Indicators

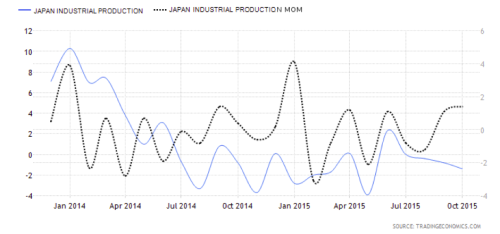

- Japan’s industrial production grew by 1.4 percent compared to September

- Compared to the previous year, industrial production output declined by 1.4 percent

- Capital spending rose by 11.2 percent in the third quarter ended in September

- Japan’s corporate bankruptcies fell by 11 percent on the year-on-year basis

Industrial production remained more or less flat and no major changes are expected. However, the month-to-month growth in output may be seen as a signal that Japan’s economy is finally recovering after the disappointing movements in the middle of the year. The main improvement are expected in transport, electronic parts and devices and machinery industries.

Furthermore, the stable growth of investments in the past 10 quarters despite the overall decline in the economy also fuels up the expectations. According to some analysts the increase in capital spending might lead to a revision of the GDP data.

Finally, the corporate bankruptcies are at 25-year low, which again is interpreted as the positive sign for the Japan’s economy.

To sum up, it looks like Japan’s economy is starting its recovery, although the inflation rate still has not reached the BOJ target of two percent and both exports and production have been affected by the slowdown in the emerging markets. In fact, BOJ Deputy Gov. Kikuo Iwata said that the slowdown in China and other emerging countries is the “most significant risk” for the economy of Japan. He also indicated that “the Bank will make adjustments without hesitation” if the trend in inflation does not change. That gives rise to expectation of extra monetary stimulus in 2016.

Ekaterina Kotova

Furthermore, the stable growth of investments in the past 10 quarters despite the overall decline in the economy also fuels up the expectations. According to some analysts the increase in capital spending might lead to a revision of the GDP data.

Finally, the corporate bankruptcies are at 25-year low, which again is interpreted as the positive sign for the Japan’s economy.

To sum up, it looks like Japan’s economy is starting its recovery, although the inflation rate still has not reached the BOJ target of two percent and both exports and production have been affected by the slowdown in the emerging markets. In fact, BOJ Deputy Gov. Kikuo Iwata said that the slowdown in China and other emerging countries is the “most significant risk” for the economy of Japan. He also indicated that “the Bank will make adjustments without hesitation” if the trend in inflation does not change. That gives rise to expectation of extra monetary stimulus in 2016.

Ekaterina Kotova