Ferrari is the world's most powerful car brand according to Brand Finance. Founded by Enzo Ferrari in 1939, the company built its first car one year later while the company's inception took place in 1947, when the first Ferrari-badged car was completed. Since 2015, when the firm went public through an IPO, investors have appreciated a lot Ferrari shares, believing in improvement in operating margins and increasing earnings, which have been constantly rising for 2 years. Ferrari shares have beaten, in terms of surge, all car manufacturers shares. Yet unfortunately the incredible rise has been overshadowed by Tesla’s gain in market value. While Tesla Inc. grabbed headlines by becoming America’s most valuable carmaker, it’s Ferrari NV that’s been rewarding shareholders the most lately, with a 74 percent surge in the Italian company’s stock price over the past year.

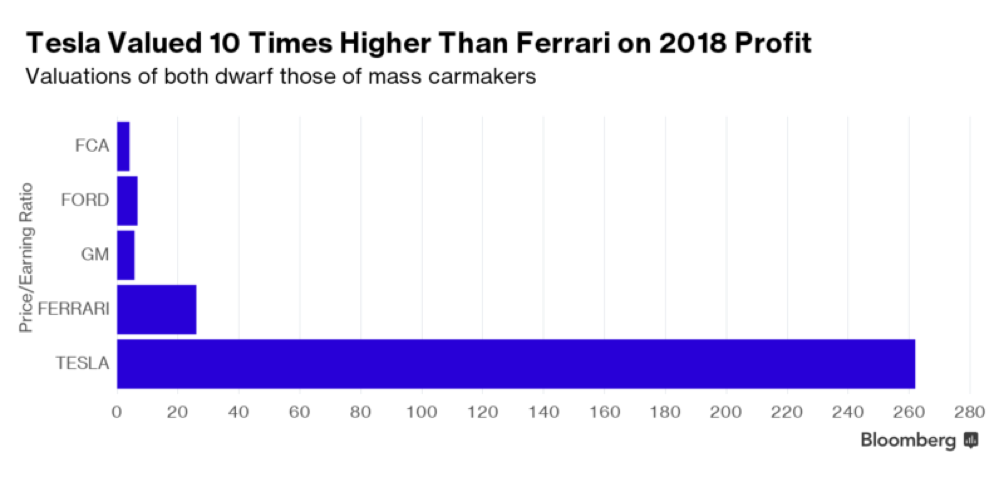

Ferrari’s profit has been driven by income that exceeded expectations as Marchionne increased production of higher-margin, special-edition supercars, like the $2.1 million LaFerrari Aperta. That compares with a 25 percent increase for Tesla which has capitalized on market enthusiasm for Elon Musk’s belief of a future dominated by electric vehicles. These firms have at least 2 things in common: Their valuations are much higher than peers, and both are embarking on crucial expansions of their business models. Tesla is going into the mass-market segment while Ferrari is moving beyond its traditional supercars to attract new customers. Relative to P/E, Tesla’s valuation is about 10 times Ferrari’s. The Italian carmaker trades at 26 times next year’s estimated profit, versus Tesla’s multiple of 257. Large-capitalization car companies on average have a P/E multiple of 7.8.

Ferrari’s profit has been driven by income that exceeded expectations as Marchionne increased production of higher-margin, special-edition supercars, like the $2.1 million LaFerrari Aperta. That compares with a 25 percent increase for Tesla which has capitalized on market enthusiasm for Elon Musk’s belief of a future dominated by electric vehicles. These firms have at least 2 things in common: Their valuations are much higher than peers, and both are embarking on crucial expansions of their business models. Tesla is going into the mass-market segment while Ferrari is moving beyond its traditional supercars to attract new customers. Relative to P/E, Tesla’s valuation is about 10 times Ferrari’s. The Italian carmaker trades at 26 times next year’s estimated profit, versus Tesla’s multiple of 257. Large-capitalization car companies on average have a P/E multiple of 7.8.

Tesla briefly became the largest U.S. automaker by market value, with a capitalization of $50.3 billion, overtaking both General Motors Co. And Ford Motor Co. Ferrari, which was spun off from Fiat Chrysler Automobiles NV, has a $13.6 billion market value. Ferrari has been trading on luxury segment because of its business of producing supercars for high-net-worth individuals. The company limited its production to 7,000 vehicles annually to protect its image as a luxury brand. Marchionne has planned to increase the number of cars per year in order to reach a target of 9000 in 2019. Ferrari sold 8,014 in 2016 and expects to sell about 8,400 this year. Tesla delivered fewer than 80,000 vehicles globally last year. CEO Musk’s ambitions are to turn Tesla from niche carmaker into a mass-market manufacturer.

Armando Volpicelli