What happens when the first two economies of our era are entangled in a very dangerous spiral? In order to properly analyze the relationship between U.S. and China, it is worth going a lot back in time, precisely to twenty-five years ago, when China had not yet started the transition from developing to consumer economy and the fulcrum of its economy was represented by exports to the rest of the world, rather than by imports of goods and services from foreign countries. In ten years, the Asian giant has managed to turned into a market itself, with a strong demand for all sorts of goods and services.

What is the link with the US? The answer becomes quite evident if one observes the external balances of the United States and China. From one side, the United States are the best example of developed economy, that produces a current account deficit and needs to finance it externally in order to keep its economy afloat. From the other side, China used to represent the perfect example of developing country, with a current account surplus and an evident unbalance towards exports, which translated into a need to reinvest the net inflow of money. China showed a clear preference for financial assets, specifically for U.S. securities, due to the dollar-denomination of the predominant share of its surplus. It is evident how China and U.S. were a perfect match in terms of demand and supply. As a result, China became the major buyer of U.S. corporate bonds and equities, but also the major supporter of U.S. sovereign debt for 10 years, for an amount equal to $1.13tn as of January 2019. Nowadays, the circumstances have changed considerably. China has undergone the transition to a consumer economy: the current account surplus has been exponentially shrinking, from 10% of GDP in 2007 to 0.4% in 2018, and so has the amount of U.S. securities bought. The scenario looks even gloomier if one considers that, the more Chinese financial markets become open to foreign investors, the more the current account deteriorates: foreign investors, indeed, strictly prefer Chinese high-yielding securities, which results in a net outflow of investment income.

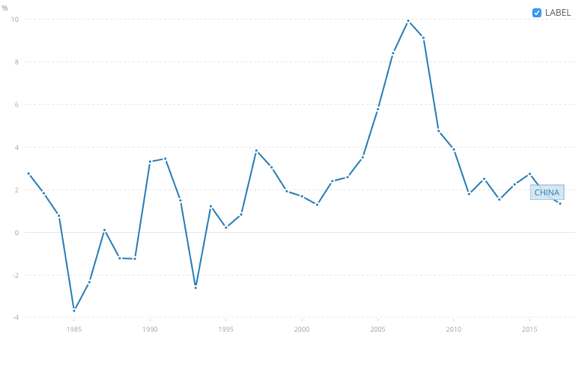

What is the link with the US? The answer becomes quite evident if one observes the external balances of the United States and China. From one side, the United States are the best example of developed economy, that produces a current account deficit and needs to finance it externally in order to keep its economy afloat. From the other side, China used to represent the perfect example of developing country, with a current account surplus and an evident unbalance towards exports, which translated into a need to reinvest the net inflow of money. China showed a clear preference for financial assets, specifically for U.S. securities, due to the dollar-denomination of the predominant share of its surplus. It is evident how China and U.S. were a perfect match in terms of demand and supply. As a result, China became the major buyer of U.S. corporate bonds and equities, but also the major supporter of U.S. sovereign debt for 10 years, for an amount equal to $1.13tn as of January 2019. Nowadays, the circumstances have changed considerably. China has undergone the transition to a consumer economy: the current account surplus has been exponentially shrinking, from 10% of GDP in 2007 to 0.4% in 2018, and so has the amount of U.S. securities bought. The scenario looks even gloomier if one considers that, the more Chinese financial markets become open to foreign investors, the more the current account deteriorates: foreign investors, indeed, strictly prefer Chinese high-yielding securities, which results in a net outflow of investment income.

Chinese Current account 1982-2017

Source: The World Bank

Source: The World Bank

It won’t be long before U.S. companies will need to refinance their debt, for an estimated amount of $700bn for 2019, and Treasuries issues are already scheduled for an amount between $1.3bn and $1.7bn. A week ago, the issue was worsened by the FED restrictive monetary stance, which entailed to keep shrinking the central bank balance sheet. Right now, this scenario is quite unlikely and the FED will probably cut rates in order to support the economy renewed need of funding. Nonetheless, this support will definitely not be enough.

So the question now is: will China play its part? The answer seems more evident than ever. The expectations are for a small and positive, if not even negative, Chinese current account, which would translate into the incapability to support U.S. economy. One solution would be to stop the shrinkage of the so-called “external savings”, by means of reducing imports. However, this scenario is highly unlikely, given that China itself is putting on the plate of the U.S.-China trade negotiations the increase of imports of U.S. goods and services. In conclusion, it is about time for the U.S. to start looking for another foreign buyer or, at least, to start considering the odds that China, next time, will not bid for American debt.

Adriana Messina

So the question now is: will China play its part? The answer seems more evident than ever. The expectations are for a small and positive, if not even negative, Chinese current account, which would translate into the incapability to support U.S. economy. One solution would be to stop the shrinkage of the so-called “external savings”, by means of reducing imports. However, this scenario is highly unlikely, given that China itself is putting on the plate of the U.S.-China trade negotiations the increase of imports of U.S. goods and services. In conclusion, it is about time for the U.S. to start looking for another foreign buyer or, at least, to start considering the odds that China, next time, will not bid for American debt.

Adriana Messina