A no-deal Brexit is a key concern of Mark Carney, the Bank of England governor, who defined this situation as “an acid test” which could show whether the world is heading towards an era of protectionism causing uncertainty about future market access. Not only Mr. Carney is worried but Macquarie Group as well, who warned about the licence backlog with the European regulators required for banks to carry out their activities.

The Australian investment bank stated that a fallout of the deal process forces them to implement contingency plans to cope with it and that is going to affect a significant part of its clients. Moreover, the bank might not be able to receive the licences from the Irish and Luxembourger regulators until the first mid-year, beyond March the 29th , the date of a possible crash of the UK from the EU without a transition agreement.

So now, why do we need to worry about Macquarie’s warning and its compelling need for licences? Who is Macquarie?

Macquarie is one of Australia’s biggest investors in the UK. It is a diversified financial group providing clients with asset management and finance, banking, advisory and risk and capital solutions across debt, equity and commodities. Its business is divided into six units: Macquarie Asset Management (MAM), Corporate and Asset Finance Group (CAF), Banking and Financial Services Group (BFS), Commodities and Global Markets (CGM) and Macquarie Capital (MC). Each of these units have built an overseas network of strong partnerships and clients’ fidelity.

In detail, it is the CAF unit with its activity of Asset Finance in the energy sector that has the most relevant impact in the UK territory: not only considered the largest independent owner of gas and electricity meters and a L-sized portfolio of 9 million of traditional and smart meters in the United Kingdom, but also offers an energy efficiency financial solutions across a wide range of technologies such as LED lighting, battery storage and so on.

Over the last three years the firm has invested in 26 energy and infrastructure projects in EMEA with a total project value in excess of €10bn, of which €1.4bn was committed by Macquarie positioning itself as pioneer and market leader in the energy and infrastructure sectors over the last two decades.

The Australian investment bank stated that a fallout of the deal process forces them to implement contingency plans to cope with it and that is going to affect a significant part of its clients. Moreover, the bank might not be able to receive the licences from the Irish and Luxembourger regulators until the first mid-year, beyond March the 29th , the date of a possible crash of the UK from the EU without a transition agreement.

So now, why do we need to worry about Macquarie’s warning and its compelling need for licences? Who is Macquarie?

Macquarie is one of Australia’s biggest investors in the UK. It is a diversified financial group providing clients with asset management and finance, banking, advisory and risk and capital solutions across debt, equity and commodities. Its business is divided into six units: Macquarie Asset Management (MAM), Corporate and Asset Finance Group (CAF), Banking and Financial Services Group (BFS), Commodities and Global Markets (CGM) and Macquarie Capital (MC). Each of these units have built an overseas network of strong partnerships and clients’ fidelity.

In detail, it is the CAF unit with its activity of Asset Finance in the energy sector that has the most relevant impact in the UK territory: not only considered the largest independent owner of gas and electricity meters and a L-sized portfolio of 9 million of traditional and smart meters in the United Kingdom, but also offers an energy efficiency financial solutions across a wide range of technologies such as LED lighting, battery storage and so on.

Over the last three years the firm has invested in 26 energy and infrastructure projects in EMEA with a total project value in excess of €10bn, of which €1.4bn was committed by Macquarie positioning itself as pioneer and market leader in the energy and infrastructure sectors over the last two decades.

|

<<Corporate and Asset Finance's(CAF)

Asset and Principal Finance portfolio of $A34.1 billion at 30 June 2018, was broadly in line with 31 March 2018. Asset Finance originations were in line with expectations. During the quarter, notable Principal Finance transactions included funding the first installation in the 30MWp onsite PPA solar PV roll out for the UK's largest licensed water and sewerage undertaker, and providing financing to the UK's largest provider of construction waste management services.>> (Marketscreener, 15th February) |

|

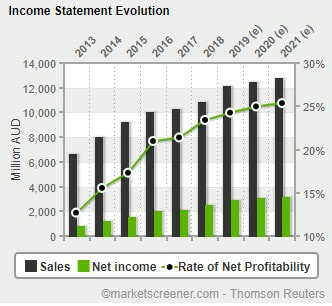

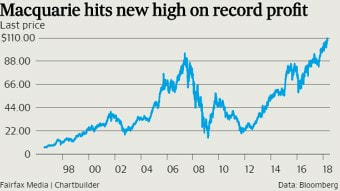

Translated in numbers the group counts:

- ≈ 14,000 employees across 27 countries; - ≈ €310 billion in total AUM at 31st March 2017; - ≈ €1.9 billion of Net profit for FY2018; - 49 years of unbroken profitability. More specifically in the EMEA area, the Macquarie group has advised across all major sectors of PPP in the UK since 1997 with a total capital value exceeding €11 billion. |

Despite a small part of the firm’s business would be affected by a delay in the issuing of licences, the bank started working to re-route clients business in order to not risk being paralysed or even to sink in the event of a no-deal Brexit until new licensing arrangements would have been in place. But according to the chief executive Ms. Wikramanayake “Processing is taking longer than expected. They have many, many people going through the re-licensing process in these different jurisdictions” (Financial Times, 12th February). Indeed, due to being headquartered in London, the bank is setting up operations in other European countries and applying for licences from regulators. In addition, the company is concerned about being unable to continue trading in the UK market and so it has to reorganise its structure, both functional and administrative, and shift its operations to new European-based brokerages.

Numbers had already given the answer to the question why the financial capital of Europe has to worry about Maquarie’s warning but the domino of a no-deal Brexit definitively scares every single financial institution.

Giulia Di Marco