On November 1st 2019, Christine Lagarde took over Mario Draghi as the head of the European Central Bank. While Mario Draghi leaves after having reached a relatively high level stability in euro currency and safety in European markets, the ECB still faces some important challenges.

Lagarde’s job will bring with it the power of setting euro supply, moving accordingly EU interest rates and monitoring the economic situation of the biggest European banks. Furthermore, it must not be forgotten that every single word spoken by the new president has an important effect on financial markets, affecting investors’ expectations.

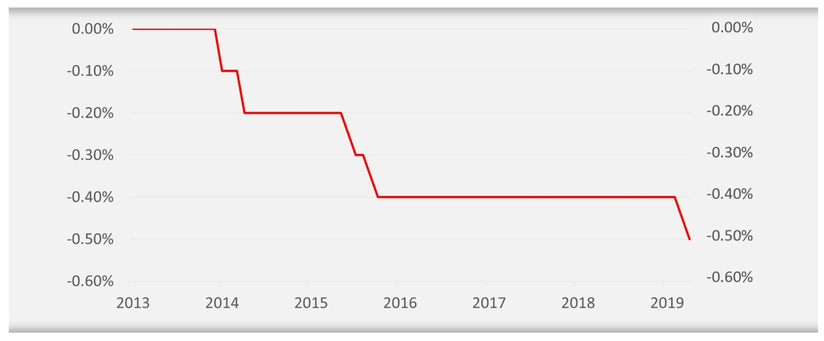

Global growth is decreasing and economists believe that the power of central banks is becoming increasingly lower. In normal times, whenever there is need for stimulus, the central bank can adopt a standard expansionary monetary policy. By buying bonds held by banks it can indeed increase monetary supply and decrease interest rate (and in turn affect positively investments, consumption and, therefore, economy GDP). However, under Draghi, the ECB moved in the territory of negative interest rates, which is now forcing households, businesses and banks to pay an interest rate to lend money [Exhibit 1]. Consequently, some banks (e.g. UniCredit) recently decided to offer negative yields on large deposits. The negative interest rate environment has limited the possibility of ECB monetary policies.

Although Draghi declared at the end of its mandate that there is still room for monetary stimulus, Lagarde, during an interview with CBS, clearly underlined that “There is a limit to how far and how deep you go into negative territory”. Furthermore, it is important to consider that both the US Federal Reserve and the Bank of England decided to avoid negative interest rates in order to have a higher stimulus possibility to respond to any potential crisis.

Exhibit 1 – Trend of ECB interest rate (2013 – 2019)

Lagarde’s job will bring with it the power of setting euro supply, moving accordingly EU interest rates and monitoring the economic situation of the biggest European banks. Furthermore, it must not be forgotten that every single word spoken by the new president has an important effect on financial markets, affecting investors’ expectations.

Global growth is decreasing and economists believe that the power of central banks is becoming increasingly lower. In normal times, whenever there is need for stimulus, the central bank can adopt a standard expansionary monetary policy. By buying bonds held by banks it can indeed increase monetary supply and decrease interest rate (and in turn affect positively investments, consumption and, therefore, economy GDP). However, under Draghi, the ECB moved in the territory of negative interest rates, which is now forcing households, businesses and banks to pay an interest rate to lend money [Exhibit 1]. Consequently, some banks (e.g. UniCredit) recently decided to offer negative yields on large deposits. The negative interest rate environment has limited the possibility of ECB monetary policies.

Although Draghi declared at the end of its mandate that there is still room for monetary stimulus, Lagarde, during an interview with CBS, clearly underlined that “There is a limit to how far and how deep you go into negative territory”. Furthermore, it is important to consider that both the US Federal Reserve and the Bank of England decided to avoid negative interest rates in order to have a higher stimulus possibility to respond to any potential crisis.

Exhibit 1 – Trend of ECB interest rate (2013 – 2019)

Source: REFINITIV

Climate change will be another huge challenge that the European Union will have to face. During a confirmation hearing in September, Lagarde announced that tackling climate change will represent one of the priorities of the new presidency. In that sense, the European Central bank will mainly act by directing asset purchases towards green bonds. This, in turn, could represent an important incentive to governments to increase public investments aimed at reaching the targets set for reducing carbon dioxide emissions.

However, as discussed by different economists, the biggest European target remains increasing cooperation between European monetary actions and single-State fiscal policies. A potential solution to some of the problems would consist in stimulating the economy by encouraging a fiscal expansion of Northern States with strongest budgetary positions. Indeed, according to Mario Draghi, one of the main reasons of USA’s recent growth has been represented by the lower level of taxes which, through a boost in consumption, has led to an increase of US GDP. “The biggest challenge facing Christine Lagarde will be to get Berlin to do a major fiscal stimulus,” declared Melvin Krauss, a senior fellow at Standard University’s Hoover Institution. “Germany’s continued refusal was the main reason Draghi couldn’t solve Europe’s too low inflation problem and why Ms. Lagarde could face a similar fate.”

Investors, as showed by the positive effect in stock markets, seemed to have forecasted a continuity between Mr. Draghi’s work in monetary policy and the arrival of Ms. Lagarde. However, she is also expected to act in a different way in some European areas, involving especially northern countries. “The incoming ECB president is a warmer, more outgoing personality than Mr. Draghi. She has been known to lock the doors of a meeting room until those inside — often mostly men — reach a decision. When appearing on a US television chat show in 2009 she proceeded to whip out a French beret and started cracking jokes.” reported the Financial Times.

Ms. Lagarde was in that room in 2012 when Mr. Draghi promised to do “whatever it takes” to save the Euro currency and those European countries abruptly affected by huge public debts and constantly growing interest rates. When Members of European Parliament asked if she shared Draghi’s determination to do “whatever it takes” to preserve the European states and Euro currency, her reply was direct: “I hope I never have to say something like that because if I do it will mean that other economic policymakers have not done what they have to”.

Riccardo Tirelli

Climate change will be another huge challenge that the European Union will have to face. During a confirmation hearing in September, Lagarde announced that tackling climate change will represent one of the priorities of the new presidency. In that sense, the European Central bank will mainly act by directing asset purchases towards green bonds. This, in turn, could represent an important incentive to governments to increase public investments aimed at reaching the targets set for reducing carbon dioxide emissions.

However, as discussed by different economists, the biggest European target remains increasing cooperation between European monetary actions and single-State fiscal policies. A potential solution to some of the problems would consist in stimulating the economy by encouraging a fiscal expansion of Northern States with strongest budgetary positions. Indeed, according to Mario Draghi, one of the main reasons of USA’s recent growth has been represented by the lower level of taxes which, through a boost in consumption, has led to an increase of US GDP. “The biggest challenge facing Christine Lagarde will be to get Berlin to do a major fiscal stimulus,” declared Melvin Krauss, a senior fellow at Standard University’s Hoover Institution. “Germany’s continued refusal was the main reason Draghi couldn’t solve Europe’s too low inflation problem and why Ms. Lagarde could face a similar fate.”

Investors, as showed by the positive effect in stock markets, seemed to have forecasted a continuity between Mr. Draghi’s work in monetary policy and the arrival of Ms. Lagarde. However, she is also expected to act in a different way in some European areas, involving especially northern countries. “The incoming ECB president is a warmer, more outgoing personality than Mr. Draghi. She has been known to lock the doors of a meeting room until those inside — often mostly men — reach a decision. When appearing on a US television chat show in 2009 she proceeded to whip out a French beret and started cracking jokes.” reported the Financial Times.

Ms. Lagarde was in that room in 2012 when Mr. Draghi promised to do “whatever it takes” to save the Euro currency and those European countries abruptly affected by huge public debts and constantly growing interest rates. When Members of European Parliament asked if she shared Draghi’s determination to do “whatever it takes” to preserve the European states and Euro currency, her reply was direct: “I hope I never have to say something like that because if I do it will mean that other economic policymakers have not done what they have to”.

Riccardo Tirelli