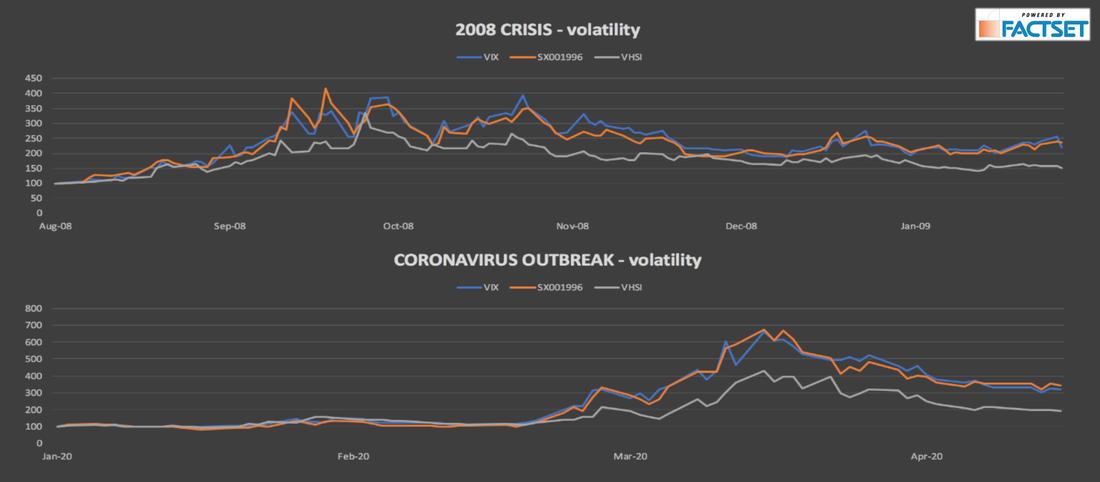

Asset-backed securities (ABS) are investment products derived from pooling together several receivable assets and selling their cash flows to investors. The receivables must be standardized and have a predictable stream of revenues. Thanks to securitization, the receivable seller frees up cash and reduces its exposure to credit risk. On the other hand, investors receive higher returns compared to the ones in the traditional fixed income market. Additionally, ABS exploit geographical diversification and tranching. However, many of these products tend to deliver poor performances when unexpected shocks cause disruption in the economy. That is what happened in 2008. Coronavirus has shaken credit markets all around the globe, how would this virus impact ABS? South Korea was one of the first countries affected by this epidemic and studying what happened there may tell us what is going to happen in Europe in the near future.

Credit card ABS

Cash flows from credit card interests and fees are often securitized into financial products. It is possible to divide the process for a credit card securitization into three steps.

1. The card issuer builds its portfolio

First, the bank must have a large pool of credit card receivables. In other words, the bank must sell its credit card services to a high number of customers to create the minimum volume for the deal. This is the reason why the access to the securitization market is reserved only to the top players in the industry: they are the only ones able to collect the sufficient amount of underlying receivables (the average book value of a deal is $800 million). A bankcard issuer would not securitize all its account immediately because she may be subsequently required to replace some nonperforming accounts already in the securitization.

2. A trust is created

Once the credit card receivables have been collected, a trust is created. The bank (which is often the Originator of the credit card loans, the Sponsor of the deal and the receivable Seller) passes the credit card receivables to a Transferor through a Receivables Purchase Agreement. Then, the Transferor transfers those receivables to a trust, a SPV called Issuing Entity, through a Transfer Agreement. A prospectus is written.

3. The trust starts operating

Ratings are assigned to the new securities issued. These ratings are based on the quality of the underlying assets and the deal terms. Then, sophisticated investors (no retail) will buy the notes issued by the fund. As cash flows from credit cards are turned to the trust, the fund pays investors following the payments waterfall.

Credit card ABS

Cash flows from credit card interests and fees are often securitized into financial products. It is possible to divide the process for a credit card securitization into three steps.

1. The card issuer builds its portfolio

First, the bank must have a large pool of credit card receivables. In other words, the bank must sell its credit card services to a high number of customers to create the minimum volume for the deal. This is the reason why the access to the securitization market is reserved only to the top players in the industry: they are the only ones able to collect the sufficient amount of underlying receivables (the average book value of a deal is $800 million). A bankcard issuer would not securitize all its account immediately because she may be subsequently required to replace some nonperforming accounts already in the securitization.

2. A trust is created

Once the credit card receivables have been collected, a trust is created. The bank (which is often the Originator of the credit card loans, the Sponsor of the deal and the receivable Seller) passes the credit card receivables to a Transferor through a Receivables Purchase Agreement. Then, the Transferor transfers those receivables to a trust, a SPV called Issuing Entity, through a Transfer Agreement. A prospectus is written.

3. The trust starts operating

Ratings are assigned to the new securities issued. These ratings are based on the quality of the underlying assets and the deal terms. Then, sophisticated investors (no retail) will buy the notes issued by the fund. As cash flows from credit cards are turned to the trust, the fund pays investors following the payments waterfall.

The typical structure of a securitization

Coronavirus and credit card ABS in South Korea

Moody’s has recently published a report about the effects of coronavirus on credit card ABS in Korea. That may be interesting given that South Korea seems to have already gone through the most dramatic phase of the health crisis and it may provide some insights on our future. Let’s go through the main points of the report.

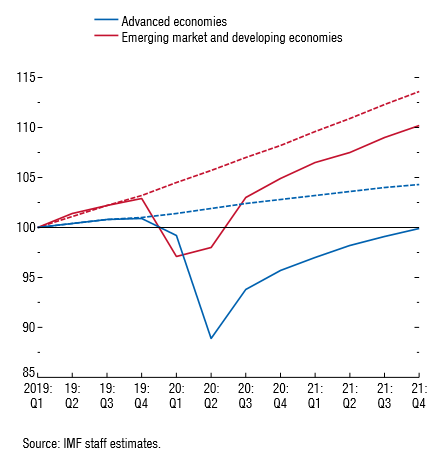

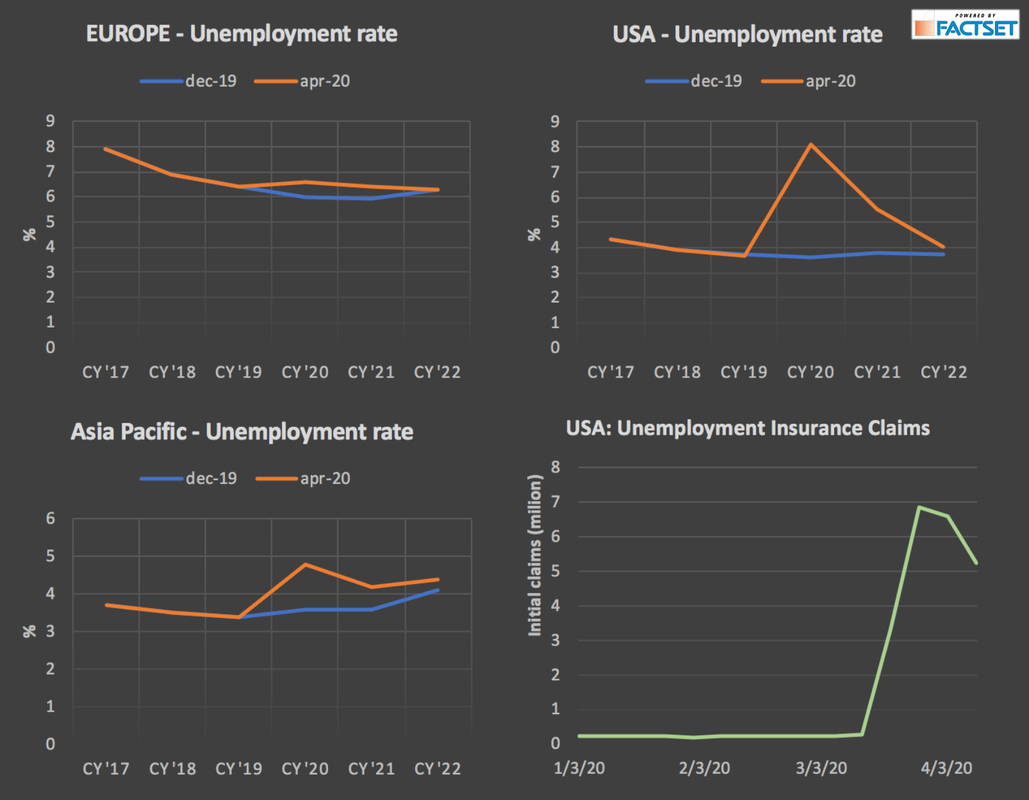

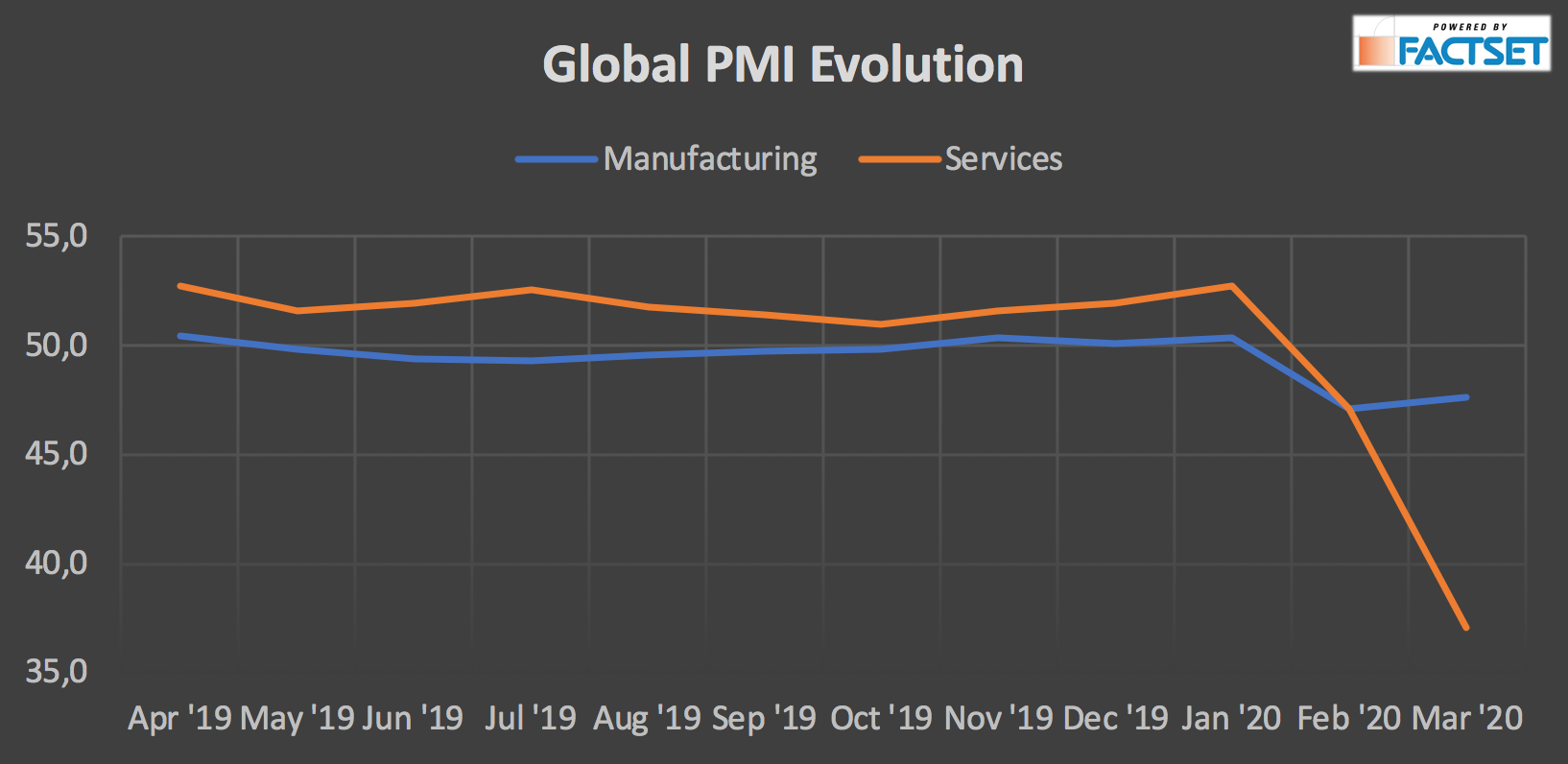

As expected, coronavirus will negatively impact credit card ABS performance. Indeed, the disruption in the job market caused by the virus will negatively affect individual incomes and the ability to pay back debts. The spread of coronavirus has severely hurt South Korea’s economy: in February global exports declined by 6.6% with respect to the previous year, with exports to China plunging by 21.1%; real GDP growth is expected to be 1.4% in 2020, while it was 2.0% in 2019; finally, unemployment is expected to rise from 3.8% to 4.2%. Nevertheless, the current situation is very fluid, and these forecasts are highly dependent on the future developments of the global epidemic.

Given the current state of affairs, two credit negative events will take place: credit card delinquencies will rise and payment rates will decrease. In fact, as the economy worsens, more people struggle to pay back their outstanding balances and delinquency rates increase. If the economic shock is prolonged enough, then ABS investors might suffer severe losses, especially if invested in junior tranches. Moody’s has prepared two scenarios: in the base scenario the spread of the virus is weakened by the warmer weather in the summer and the turmoil in the ABS market is contained; in the more pessimistic scenario, disruption will last more and the performance of credit card ABS securities will be also hit by rising default rates.

Moody’s has recently published a report about the effects of coronavirus on credit card ABS in Korea. That may be interesting given that South Korea seems to have already gone through the most dramatic phase of the health crisis and it may provide some insights on our future. Let’s go through the main points of the report.

As expected, coronavirus will negatively impact credit card ABS performance. Indeed, the disruption in the job market caused by the virus will negatively affect individual incomes and the ability to pay back debts. The spread of coronavirus has severely hurt South Korea’s economy: in February global exports declined by 6.6% with respect to the previous year, with exports to China plunging by 21.1%; real GDP growth is expected to be 1.4% in 2020, while it was 2.0% in 2019; finally, unemployment is expected to rise from 3.8% to 4.2%. Nevertheless, the current situation is very fluid, and these forecasts are highly dependent on the future developments of the global epidemic.

Given the current state of affairs, two credit negative events will take place: credit card delinquencies will rise and payment rates will decrease. In fact, as the economy worsens, more people struggle to pay back their outstanding balances and delinquency rates increase. If the economic shock is prolonged enough, then ABS investors might suffer severe losses, especially if invested in junior tranches. Moody’s has prepared two scenarios: in the base scenario the spread of the virus is weakened by the warmer weather in the summer and the turmoil in the ABS market is contained; in the more pessimistic scenario, disruption will last more and the performance of credit card ABS securities will be also hit by rising default rates.

A source of strength for credit card ABS is that underlying assets are geographically diversified. For instance, the combined exposure to Daegu and North Gyeongsang, the two most affected regions by the virus, is only 8%. On the other hand, this shock is likely to have a negative impact on the entire country. Korean credit card ABS exposure is relatively concentrated in two regions, Kyunggi and Seoul, which together account for more than 45% of credit card receivables. Deterioration of the quality of receivables in these areas would have severe effects on the ABS yield.

Credit card delinquencies are more likely to materialize for cash advance receivables rather than for credit card purchase receivable. This is because people who use credit cards to withdraw cash tend to have weaker credit quality. This type of receivables represents 9% of the assets in credit card ABS rated by Moody’s. Over the past decade, some Korean credit card companies experienced a default rate which peaked in the 10%-15% range for this type of receivable. These numbers would imply a default on 0.9%-1.35% of the assets underlying the ABS.

Credit card delinquencies are more likely to materialize for cash advance receivables rather than for credit card purchase receivable. This is because people who use credit cards to withdraw cash tend to have weaker credit quality. This type of receivables represents 9% of the assets in credit card ABS rated by Moody’s. Over the past decade, some Korean credit card companies experienced a default rate which peaked in the 10%-15% range for this type of receivable. These numbers would imply a default on 0.9%-1.35% of the assets underlying the ABS.

Interestingly, the percentage of Cash Advances with respect to total ABS assets almost halved since June 2020, passing from around 16% to 9%. Revolving Purchased and Revolving Cash Advances show a downward trend too. On the other hand, Lump Sum Purchases rose from 20% to 30% and Instalment Purchased from 40% to 45%.

The trajectory of payment rates may create some concern among investors. As payment rates decline, exposure to credit risk increases. For this reason, Revolving Purchases (accounting for 16% of the assets underlying the ABS rated by Moody’s) are a key indicator for the ABS performance. Revolving purchases allow customers to borrow up to a certain amount depending on their outstanding balance. Traditionally, most Koreans repay their outstanding quickly to avoid paying interests on the borrowed amount. However, coronavirus might cause liquidity issues, and some individuals might struggle to repay the amount borrowed.

To sum up, both an increase in credit card delinquencies and a decrease in payment rates are credit negative events that will negatively impact the ABS performance in Korea. Nevertheless, if the performance of ABS deteriorates, sponsors may step in to improve the yield. Usually, this is done by securitizing new accounts and receivables. Whether sponsors intervene or not depends on their credit quality. So far, most of the Korean sponsors are affiliated to the major banks in the country, financial institutions that enjoy high credit ratings. However, the epidemic crisis might have negatively impacted banks’ assets, increasing asset risks and reducing their credit quality.

Marco Calamandrei.

Want to keep up with our most recent articles? Subscribe to our weekly newsletter here.

To sum up, both an increase in credit card delinquencies and a decrease in payment rates are credit negative events that will negatively impact the ABS performance in Korea. Nevertheless, if the performance of ABS deteriorates, sponsors may step in to improve the yield. Usually, this is done by securitizing new accounts and receivables. Whether sponsors intervene or not depends on their credit quality. So far, most of the Korean sponsors are affiliated to the major banks in the country, financial institutions that enjoy high credit ratings. However, the epidemic crisis might have negatively impacted banks’ assets, increasing asset risks and reducing their credit quality.

Marco Calamandrei.

Want to keep up with our most recent articles? Subscribe to our weekly newsletter here.