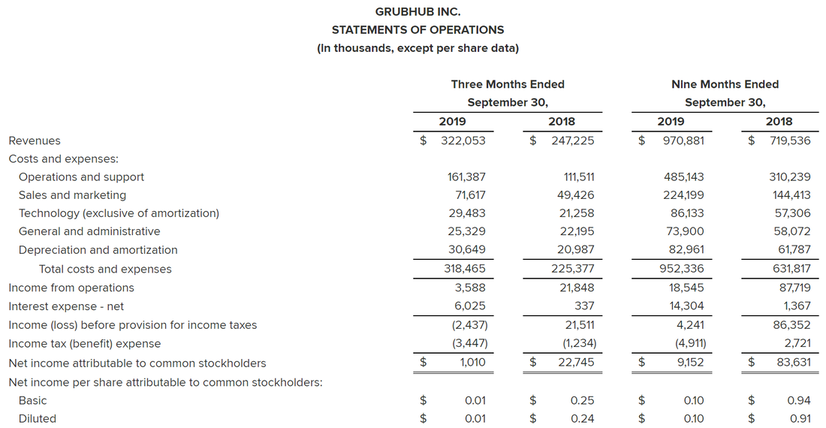

In August 2018, Grubhub Inc.’s (NYSE:GRUB) share price had reached a peak of $149. Since then, shares in the American food-ordering and delivery company have witnessed a significant downfall and are now trading at $49.0 (as of 30/12/19). This downfall in the stock price reflects growing skepticism regarding the company’s business plan, which investors believe will be unable to defend the company’s market share vis-à-vis competitors such as Postmates, Doordash and Uber Eats. In particular, shares of Grubhub plunged significantly a couple of weeks ago, when on the 29th October Grubhub shares fell by 43% following disappointing 3rd quarter results. Indeed, revenues were much weaker than expected and profits collapsed to $1m, compared to the $22.7 million in the third quarter of 2018, with EPS decreasing from $0.24 (3rd quarter 2018) to $0.01 (3rd quarter 2019). Furthermore, the company declared that adjusted earnings for the current quarter could be as little as $15m, representing a value which is around 80% lower than the market consensus.

Source: Google

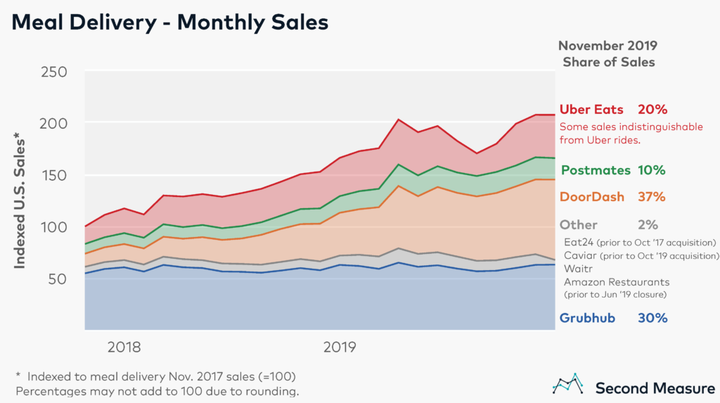

The company issued a 5,000-word letter to shareholders to explain the nature of these poor financial results, outlining the difficulties that the companies has faced in raising its profitability. Amongst the most important reasons were changes in the way customers use food-ordering platforms. According to Grubhub, customers are becoming more “promiscuous”, in the sense that they are not loyal to any food-ordering platform when placing their orders. When customers want to order a certain dish, they simply chose the platform which offers the most convenient price for it and make the order. Being customers more sensitive than before to price-fluctuations, competition amongst the top players in the industry has increased, with giants such as Uber Eats, Doordash and Postmates cutting prices and offering free delivery services to attract customer orders. Whilst this has severely hurt their profitability, it has hurt Grubhub’s income generation as well. Indeed, to protect its 30% market share, Grubhub have also started offering free delivery services. While this was supposed to be a short-term strategy, the letter to shareholders explains how the company will continue offering these free delivery services in the future. Despite these incentives are offered to a small number of fast food chains such as KFC, McDonald’s, Panera Bread and Taco Bell, they still lead to significant expenditures by Grubhub and are one of the main causes of the firm’s drop in net income.

Source: Grubhub press release

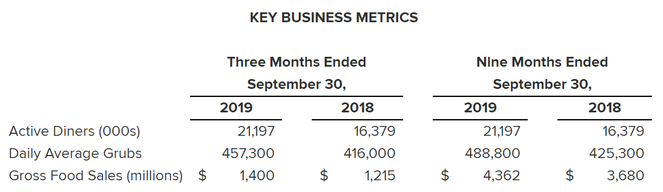

While net income has dropped significantly, Grubhub’s revenues have increased in the meantime. Revenues for the third quarter of 2019 have been equal to $322.1 million, representing a 30% year-over-year increase from $247.2 million in the third quarter of 2018. This growth in revenues is reflected in two key business metrics utilized by Grubhub to measure its performance: “Daily Average Grubs (DAGs)” and “Gross Food Sales”. “DAGs” represent the average daily number of orders placed on the Grubhub platform during the period of reference, whereas “Gross Food Sales” measures the total volume of food sales transacted through the platform. In comparison to the third quarter of 2018, DAGs have grown by 10% to $457,300 and Gross Food Sales have grown by 15% to $1.4 billion. Another business metric utilized by Grubhub is the “Active Diners” metric, which measures the number of unique diner accounts from which an order has been placed in the past twelve months through the Grubhub platform. In the third quarter of 2019, Active Diners have increased to 21.2 million, representing a 29% year-over-year increase compared to the third quarter of 2018.

Source: Grubhub press release

Although all of these business metrics appear positive at first glance, it is by analyzing them more deeply that we can explain the fall in net income from $22.7 million to $1million witnessed in the third quarter of 2019. Although “Active Diners” have grown by 29% year-on-year, we have to consider that this business metric might not fully reflect the number of orders that each diner place on the platform. For example, if a person places just one order per year through the Grubhub platform, he wouldn’t significantly increase Grubhub’s revenues but would still count as an “Active Diner”. Whilst a few years ago this business metric was key in evaluating Grubhub’s performances, it is now less determinant in forecasting the company’s fate due to the problem of falling customer loyalty described before. In April 2019, Grubhub CEO Matt Maloney spoke this way out about Grubhub customers: “Once they start ordering, we know that they’re lifers”. Nowadays, certain customers might have instead used the Grubhub platform just for a few occasional purchases and then place most of their orders using other competing platform. This might explain why “Active Diners” have risen by 29% but “Daily Average Grubs” have risen only by 10%. This lower customer loyalty and lower retention rates are a serious problem for Grubhub vis-à-vis investors. Indeed, as also evidenced by Maloney’s phrase, the company has always attributed a great importance to customer loyalty in making its revenue projections and justifying its valuation. Therefore, even if revenues are rising, they are doing so at a pace below company's expectations and at a rate which is insufficient to compensate the high expenditures made to offer the free delivery services described before.

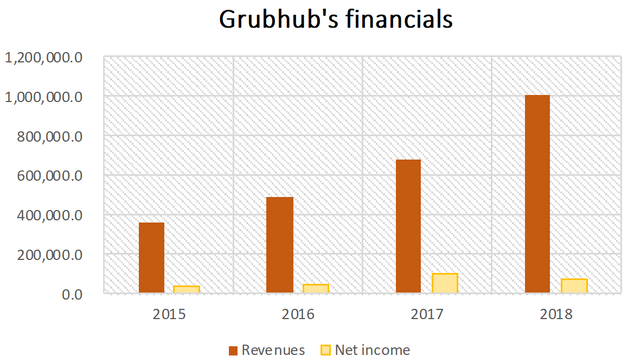

Grubhub’s financial performances 2015-2018

These free delivery services are a consequence of partnerships that Grubhub has secured with some of the largest enterprise brands in the world, such as: Applebee’s, Dunkin’, IHOP, KFC, McDonald’s, Panera Bread, Shake Shack, Subway, Taco Bell and Wendy’s. Although free delivery is hampering profitability from these partnerships at the moment, there are no guarantees that once these incentives are over there will be huge profits for Grubhub coming from these operations. In order to understand this, we have to better understand the way in which Grubhub and other food delivery companies make their profits. Contrarily to common sense, the margins coming from the logistics component of the business, namely the commissions earned just from the delivery of the dish to the consumer, are quite low. Delivering a dish involves significant costs to the firm, in particular to pay the riders providing the service. As these costs are mostly variable, they are also hard to leverage with technology and scale. Therefore, companies such as Grubhub make most of their profits from the other side of the business, which is scalable and concerns the relationship that Grubhub has with the variety of restaurants it partners with. Indeed, in delivering dishes to customers, the Grubhub platform also offers visibility to the numerous restaurants on the platform and to the dishes they have to offer. The Grubhub platform represents a sort of “advertising replacement” for restaurants and it is therefore paid accordingly, with restaurants paying a commission to Grubhub for each order based on how important it is for them to market their dishes on the platform. Smaller restaurants pay higher commissions because they don’t have the scale, financial resources and technical expertise to generate online demand as efficiently as Grubhub. On the other hand, bigger brands are not as interested in Grubhub’s platform and digital marketing services since they already spend millions in promoting their own brands. For this reason, bigger brands often tend to recognize Grubhub lower commissions for each order placed on the platform. Therefore, for each dollar of revenues coming from the partnerships recently secured by Grubhub with the big enterprises listed above, only a small portion of it is actually going to increase Grubhub’s net income.

Grubhub is aware of this, which is why 80% of the company’s business is still generated by orders linked to small-medium size businesses that offer higher commissions. However, although about $200 billion of the takeout market still remains offline and therefore stands as an opportunity for further market penetration, new restaurant supply remains stagnant and the strong competition makes it difficult for Grubhub to fully exploit this market opportunity and establish new partnerships. At the moment, Grubhub’s worry is to keep earning income from its existing partnerships by retaining market share and visibility on its platform. If it fails to do so, companies will start paying lower commissions to have their dishes marketed on Grubhub’s platform. However, to retain its market share, the company has to continue pouring money into less profitable operations, such as free delivery, partnerships with big brands or the listing of non-partnered companies on the Grubhub platform. These strategies increase revenues and orders but have little positive impact on the company’s margin. On the long-term, this strong competition between food delivery companies to secure orders seems unsustainable and many players will either have to consolidate (M&A) or exit the industry. In June, Amazon shuts down its four-year old “Amazon Restaurants” division. Grubhub has active partnerships with over 95,000 restaurants and is the only company in the United States to have generated profits at scale in the online food industry. However, with bigger and deeper-pocketed rivals, such as Uber, pouring into the industry and engaging in price wars to attract customers, Grubhub’s ability to generate profits in the long-run is at stake.

Grubhub is aware of this, which is why 80% of the company’s business is still generated by orders linked to small-medium size businesses that offer higher commissions. However, although about $200 billion of the takeout market still remains offline and therefore stands as an opportunity for further market penetration, new restaurant supply remains stagnant and the strong competition makes it difficult for Grubhub to fully exploit this market opportunity and establish new partnerships. At the moment, Grubhub’s worry is to keep earning income from its existing partnerships by retaining market share and visibility on its platform. If it fails to do so, companies will start paying lower commissions to have their dishes marketed on Grubhub’s platform. However, to retain its market share, the company has to continue pouring money into less profitable operations, such as free delivery, partnerships with big brands or the listing of non-partnered companies on the Grubhub platform. These strategies increase revenues and orders but have little positive impact on the company’s margin. On the long-term, this strong competition between food delivery companies to secure orders seems unsustainable and many players will either have to consolidate (M&A) or exit the industry. In June, Amazon shuts down its four-year old “Amazon Restaurants” division. Grubhub has active partnerships with over 95,000 restaurants and is the only company in the United States to have generated profits at scale in the online food industry. However, with bigger and deeper-pocketed rivals, such as Uber, pouring into the industry and engaging in price wars to attract customers, Grubhub’s ability to generate profits in the long-run is at stake.

Francesco Marino - 30/12/2019