US midterm elections are coming: on the 6th of November all 435 seats in the house of representatives and 35 of the 100 seats in the senate will be up for grab. After riding the bull markets to new highs following the surprise election of Donald trump two years ago, investors are now looking for clues about the upcoming midterm elections, which could have a massive impact on equity and debt markets.

Currently, Republicans control both houses of Congress: stakes are high that if Democrats take control of either chamber as political experts, pollsters and investment bankers mostly agree on, legislative gridlock is likely to result.

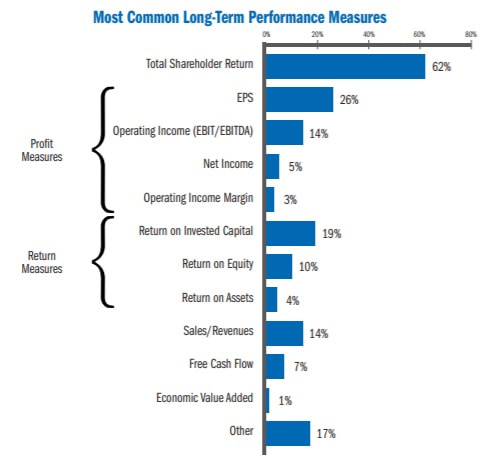

To understand how political outcomes could potentially shape markets, we need to consider that the US economy is currently buoyed by an enormous fiscal stimulus, including a $1.5tn cut in corporate and income tax set to last for 2018 and 2019, as well as increased spending passed by congress in February for $300bn, with a clear impact on public deficit. Together these measures have contributed to US GDP growth of nearly 3% yoy and S&P 500 earnings per share growth of more than 20% in current estimates. Such fiscal stimulus is set to expire unless renewed in 2020, year of the next presidential election, as such is widely expected that the current administration will try to push it further, in an attempt to extend the current growth cycle in US economy. The ability to do so depends on whether the Republican Party maintains sufficient authority to pass such legislation, highly unlikely in a scenario where the democrats take back one house. In such a setting, a highly unpredictable role would be played by president Trump’s response in terms of trade policy, matter over which the executive power holds a great deal of autonomy. If it followed with even more aggressive sanctions US companies (although less reliant on revenues from export than other countries) would suffer, and, in a setting where no further fiscal stimulus can be implemented, this would severely impact US economic outlook.

Currently, Republicans control both houses of Congress: stakes are high that if Democrats take control of either chamber as political experts, pollsters and investment bankers mostly agree on, legislative gridlock is likely to result.

To understand how political outcomes could potentially shape markets, we need to consider that the US economy is currently buoyed by an enormous fiscal stimulus, including a $1.5tn cut in corporate and income tax set to last for 2018 and 2019, as well as increased spending passed by congress in February for $300bn, with a clear impact on public deficit. Together these measures have contributed to US GDP growth of nearly 3% yoy and S&P 500 earnings per share growth of more than 20% in current estimates. Such fiscal stimulus is set to expire unless renewed in 2020, year of the next presidential election, as such is widely expected that the current administration will try to push it further, in an attempt to extend the current growth cycle in US economy. The ability to do so depends on whether the Republican Party maintains sufficient authority to pass such legislation, highly unlikely in a scenario where the democrats take back one house. In such a setting, a highly unpredictable role would be played by president Trump’s response in terms of trade policy, matter over which the executive power holds a great deal of autonomy. If it followed with even more aggressive sanctions US companies (although less reliant on revenues from export than other countries) would suffer, and, in a setting where no further fiscal stimulus can be implemented, this would severely impact US economic outlook.

Source: (Left) IMF, Thomson Reuters Datastream, J.P. Morgan Asset Management.

(Right) BEA, China National Bureau of Statistics, Office of the US Trade Representative, Thomson Reuters Datastream, US Commerce Department, US Federal Register, J.P. Morgan Asset Management.

(Right) BEA, China National Bureau of Statistics, Office of the US Trade Representative, Thomson Reuters Datastream, US Commerce Department, US Federal Register, J.P. Morgan Asset Management.

"Divided government is increasingly the most likely case, with limited ramifications for markets" Morgan Stanley strategists Michael Zezas and Meredith Pickett wrote to clients last week. Barclays agrees, highlighting how a government gridlock would translate in a lowest chance of market-moving legislation to pass through Congress.

Legislative paralysis implies few if any changes to current tax law and spending programs. Legislation passed by a Democratic-controlled House could simply be ignored by a Republican-dominated Senate where the proposed legislation would likely die. The Democrats do, however, have a proposal for a $1.0tn expansion of federal infrastructure spending that could gain some Republican support, even though it must be taken into account that in the current period of fiscal stimulus it might prove hard to find additional resources to be devoted to spending without further enlarging what already looks like a ballooning public deficit.

Turning to the likely impacts on the markets, what most analysts agree on is that we will observe in our base scenario of split Congress and high partisan conflict is a higher volatility. In such a scenario, potential budget impasse, fights over debt ceiling and even government shutdowns such as those seen at the end of the second Obama administration (when he had lost both chambers to the Republicans) could all be potential catalyst for heightened stock volatility.

Legislative paralysis implies few if any changes to current tax law and spending programs. Legislation passed by a Democratic-controlled House could simply be ignored by a Republican-dominated Senate where the proposed legislation would likely die. The Democrats do, however, have a proposal for a $1.0tn expansion of federal infrastructure spending that could gain some Republican support, even though it must be taken into account that in the current period of fiscal stimulus it might prove hard to find additional resources to be devoted to spending without further enlarging what already looks like a ballooning public deficit.

Turning to the likely impacts on the markets, what most analysts agree on is that we will observe in our base scenario of split Congress and high partisan conflict is a higher volatility. In such a scenario, potential budget impasse, fights over debt ceiling and even government shutdowns such as those seen at the end of the second Obama administration (when he had lost both chambers to the Republicans) could all be potential catalyst for heightened stock volatility.

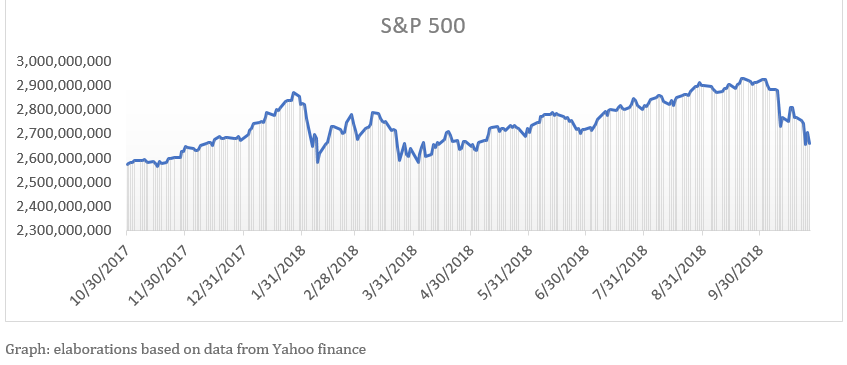

Analysing equity performance, Keith Parker, Chief Equity Strategist at UBS, found that on average since the end of WWII stocks gained 14.5% from the end of August to the end of March in the year after midterm elections (regardless of the outcome in terms of split or united Congress), with no period showing negative returns, that compares with average gains of 6.1% over the same period in non-midterm years. The theorized reason stocks perform well is that valuations before midterms often reflect an overconcern about the risk of political change.

Could it be the case that the pronounced corrections we have seen in the last weeks, with the S&P 500 now trading more that 8% lower than at the end of August, signal an overconcern?

Davide Scordamaglia

Could it be the case that the pronounced corrections we have seen in the last weeks, with the S&P 500 now trading more that 8% lower than at the end of August, signal an overconcern?

Davide Scordamaglia