Xi’s consolidation of power and its effects on the economy

The 20th National congress of the Chinese Communist Party, which took place between the 16th and 22nd October 2022, marked a significant turning point for China’s economic policy. The paramount leader, Xi Jinping, has successfully become the most powerful ruler since Mao Zedong, appointing his closest allies to the most prestigious institutional positions of the party, efficiently eradicating the opposition.

Reports from the congress convey the leader’s view on the future of the country, which is based on a set of national-oriented isolationist policies. Examples of these are: the strive towards technological self-reliance, characterized by massive spending on technological resources, and implemented to “win the battle of key and core technologies”, and the concept of “common prosperity”, which aims at redistributing more of China’s wealth to the poor by steering national investments. In addition to this, the prolonged Zero Covid Policy was renovated, meaning that the Chinese government will not hesitate in shutting down an entire financial hub if the number of Covid-19 cases deem so. Not to mention, a noteworthy outcome of the congress was the inclusion of "resolutely opposing and deterring separatists seeking 'Taiwan independence'" in the amended Chinese Communist Party constitution, hinting at upcoming geopolitical and social turmoil.

In essence, Xi Jinping has made it clear that China will divert its investments towards its own national priorities; a move which is most likely not going to benefit foreign investors. Naturally, the effects of this were mirrored in stock market prices, for all companies listed on the Shanghai Stock Exchange (SSE) and on the Hong Kong Stock Exchange (SEHK) as well as for Chinese companies listed in the U.S.

Reaction of the Market

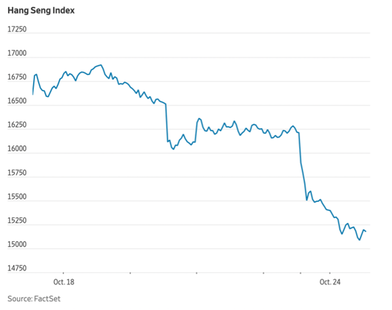

After the conclusion of the National Congress and the announcement of the seven-member Politburo Standing Committee (PSC), investors were quick to react, demonstrating alarmist tendencies and a strong sense of dissatisfaction.

In fact, on Monday, October 24th, a ‘panic selling’ of Chinese stock spread around the globe. According to Bloomberg data, foreigners sold a net value of ¥17.9 billion (or $2.5 billion) of mainland shares via trading links with Hong Kong setting a record from 2016, and consequently driving a 3% loss in the CSI 300 Index, which follows the performance of the top 300 stocks traded on the SSE and on the Shenzhen Stock Exchange (SZSE).

As further confirmation of the souring of investors feeling on Chinese companies, the Hang Seng China Enterprises Index, that serves as a benchmark for the performance of mainland securities listed on the SEHK, decreased by 7.3% in its worst performance since the 2008 financial crisis.

Following this trend, even stocks of Chinese companies listed in the U.S. fell rapidly with the Invesco Golden Dragon China ETF, which tracks the Nasdaq Goldman Dragon China Index, declined by 14.5% reaching its lowest level since 2009. The Goldman Dragon China Index reflects the performance of 65 companies publicly listed in the U.S. that mainly conduct their core operating activities in China.

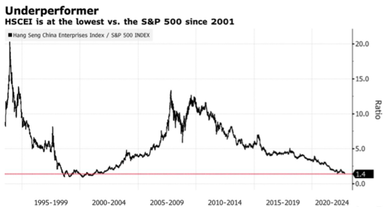

This decrease in Chinese stock prices stands in contrast with the overall trend of markets around the world with global shares that, according to Bloomberg, steadily increased during the week of the Congress. The result is that the Hang Seng China Index is currently valued at its minimum, in relative comparison to the S&P 500, since the beginning of the millennium.

Some experts believe that the decline in Chinese stock prices is disconnected from fundamentals, indicating that the mainland stocks are currently underpriced. The article will further analyze the origin of these lower stock prices, commenting on the related impact of Xi Jinping’s measures and will provide evidence to understand whether the decline can be rationally justified by market data.

The 20th National congress of the Chinese Communist Party, which took place between the 16th and 22nd October 2022, marked a significant turning point for China’s economic policy. The paramount leader, Xi Jinping, has successfully become the most powerful ruler since Mao Zedong, appointing his closest allies to the most prestigious institutional positions of the party, efficiently eradicating the opposition.

Reports from the congress convey the leader’s view on the future of the country, which is based on a set of national-oriented isolationist policies. Examples of these are: the strive towards technological self-reliance, characterized by massive spending on technological resources, and implemented to “win the battle of key and core technologies”, and the concept of “common prosperity”, which aims at redistributing more of China’s wealth to the poor by steering national investments. In addition to this, the prolonged Zero Covid Policy was renovated, meaning that the Chinese government will not hesitate in shutting down an entire financial hub if the number of Covid-19 cases deem so. Not to mention, a noteworthy outcome of the congress was the inclusion of "resolutely opposing and deterring separatists seeking 'Taiwan independence'" in the amended Chinese Communist Party constitution, hinting at upcoming geopolitical and social turmoil.

In essence, Xi Jinping has made it clear that China will divert its investments towards its own national priorities; a move which is most likely not going to benefit foreign investors. Naturally, the effects of this were mirrored in stock market prices, for all companies listed on the Shanghai Stock Exchange (SSE) and on the Hong Kong Stock Exchange (SEHK) as well as for Chinese companies listed in the U.S.

Reaction of the Market

After the conclusion of the National Congress and the announcement of the seven-member Politburo Standing Committee (PSC), investors were quick to react, demonstrating alarmist tendencies and a strong sense of dissatisfaction.

In fact, on Monday, October 24th, a ‘panic selling’ of Chinese stock spread around the globe. According to Bloomberg data, foreigners sold a net value of ¥17.9 billion (or $2.5 billion) of mainland shares via trading links with Hong Kong setting a record from 2016, and consequently driving a 3% loss in the CSI 300 Index, which follows the performance of the top 300 stocks traded on the SSE and on the Shenzhen Stock Exchange (SZSE).

As further confirmation of the souring of investors feeling on Chinese companies, the Hang Seng China Enterprises Index, that serves as a benchmark for the performance of mainland securities listed on the SEHK, decreased by 7.3% in its worst performance since the 2008 financial crisis.

Following this trend, even stocks of Chinese companies listed in the U.S. fell rapidly with the Invesco Golden Dragon China ETF, which tracks the Nasdaq Goldman Dragon China Index, declined by 14.5% reaching its lowest level since 2009. The Goldman Dragon China Index reflects the performance of 65 companies publicly listed in the U.S. that mainly conduct their core operating activities in China.

This decrease in Chinese stock prices stands in contrast with the overall trend of markets around the world with global shares that, according to Bloomberg, steadily increased during the week of the Congress. The result is that the Hang Seng China Index is currently valued at its minimum, in relative comparison to the S&P 500, since the beginning of the millennium.

Some experts believe that the decline in Chinese stock prices is disconnected from fundamentals, indicating that the mainland stocks are currently underpriced. The article will further analyze the origin of these lower stock prices, commenting on the related impact of Xi Jinping’s measures and will provide evidence to understand whether the decline can be rationally justified by market data.

Source: The Wall Street Journal

Source: Bloomberg

Theoretically, the value of a company -and thus the value of its publicly traded equity- can be seen as the sum of all the cash flows that the very company will generate in the foreseeable future discounted back to present terms, where the discount factor heavily depends on the risk associated with investing in the business. Therefore, in a nutshell, stock prices depend on two major elements: future cash flows expected by investors and perceived risk.

To assess current Chinese stock prices, the Price-to-Earnings ratio can be used, a simple yet effective way of determining whether stock prices are undervalued or overvalued. Data shows that the P/E ratio of the SSE Composite, an index which encompasses all of the A and B class shares on the Chinese market, was approximately 12.70 on October 20th, and dropped to a record low of 11.96 on October 30th. The Hang Seng Index P/E ratio also followed a similar trend. On the other hand, the P/E of the S&P 500, the main composite index of the United States, revolves around 20. This signifies that Chinese stocks on average generate greater earnings compared to their lower prices and are potentially undervalued.

An attentive investor may argue that the discrepancy between the level of western and Chinese price-to-earnings may be due to different growth prospects. Therefore, in order to assess whether the Chinese stock market is underpriced, it is fundamental to be aware of the region’s macroeconomic conditions, further focusing on the growth potential of Chinese companies and on the major geopolitical risks.

Macroeconomic Analysis and Growth Prospects

From a macroeconomic perspective, China’s GDP growth estimates were recently revised downwards by The World Bank. Indeed, the Chinese economy is now forecasted to grow 2.8% this year, less than the 8.1% in 2021 and the 4/5% estimated in April. For Beijing, this is a major setback in an improving Asian economy. Excluding China, the region is in fact expected to grow 5.3% this year, up from 2.6% in 2021. This is the first time since the 1990s that Beijing is growing less than the rest of Asia.

On the other hand, an acute reader may argue that the P/E ratio of an index depends on the growth of the underlying publicly listed companies’ earnings, rather than on the growth prospects of the whole economy. But unfortunately, we bring bad news also from this point of view. The major Chinese publicly listed corporations performed even worse than the very Chinese economy. In fact, the profits of China's major industrial companies fell 2.1% year-on-year in the first eight months of 2022.

An emblematic example is Alibaba. The e-commerce giant traded at $310 per share in October 2020. The price reflected extremely optimistic expectations about the company’s future growth. Indeed, the company’s earnings jumped from ¥88 billion in 2019 to ¥151 billion in 2021, showing a compounded annual growth rate of 31% for the two years. Nevertheless, as of today BABA stock is selling for $70 per share, representing a price decrease of 77%. The plunge was partially due to the net decline in the company’s income, which dropped to ¥40 billion in the last twelve trailing months. According to Reuters, the cause underlying the plunge in Chinese companies’ earnings is the slowing economy, which has negatively impacted consumers’ discretionary spending.

Combining both the inferior performance of Chinese corporations and the revised macroeconomic forecasts for the region, the pessimism revolving around Chinese stocks might appear at least partially justified. Nevertheless, current valuations are also attributable to the risk perceived by investors in allocating their capital in a region that is extremely exposed to geopolitical risk and is governed by a party which lacks any kind of opposition.

Risks associated with Xi’s consolidation of power

The main driver of the aforementioned risks are the alarming geopolitical tensions between U.S. and China and the new economic policies implemented by the Xi Jinping government. Xi’s focus on national security and self-sufficiency, coupled with the removal of the opposition from the leadership of the country, takes China further away from the market-oriented reforms that investors had previously hoped for. As clearly shown by the data, several aspects of the new direction that Xi is setting are concerning market participants.

First of all, the clear signs that Xi Jinping prioritizes personal loyalty over technocratic competences of governmental officials are alarming investors. With this new ideology-driven leadership, less experienced economic officials may replace more competent politicians, potentially leading to heavy repercussions in such a delicate period.

Another ongoing concern that is a direct consequence of this new leadership style is the lack of reformists in the high offices of the government that will now unquestionably support Xi in any of his decisions. As reported to CNN by Sonya Opper, a professor at Bocconi University and an expert on the Chinese economy: “In effect, Xi Jinping establishes an echo chamber around his own ideas. The risk is that China’s leadership becomes isolated and loses sight of alternative”.

This implies having no resistance to policy making, that exposes investors to a high risk because of the tremendous effects that regulations can have on the private sector and the economy. A prime example of this is represented by the private tutoring ban implemented by China in July 2021 which was unexpected by the market and disrupted the tutoring industry. It ultimately led to enormous losses for investors, as demonstrated by the plummeting of New Oriental shares, a provider of private educational services, that decreased by 87% from their peak. It follows that no opposition to implementation of regulations, that could unexpectedly hit every industry, poses a strong aggravating factor that must be taken into account in investment decisions.

Furthermore, investors are concerned about the Zero Covid Policy, with most American businesses operating in China that have lost confidence after the spring Covid lockdown in Shanghai. The risk is represented by continuous threats of closure, travel curbs and supply chain interruptions that are the main reasons to divert investments away from China. As confirmation of this trend, the American Chamber of Commerce in Shanghai (AmCham Shangai) conducted a survey which showed that an increasing number of U.S. companies have lost their interest in China this year, steering their capital flows elsewhere.

In addition to this, geopolitical risk presents itself in a number of forms, but Taiwan is at the core of this. Xi has made the return of Taiwan back to China central to his remarks at the Congress. In fact, there is growing confidence that China will intervene within the next 5 years to reclaim the island. The U.S. has insisted it will defend Taiwan and this is creating substantial concern that a military conflict could arise and would have untold consequences for investors and markets. It

seems likely that Xi will continue to plan for this, and the Chinese reaction to Nancy Pelosi’s visit to the island reflects the hostility between the two countries and highlights the risk for a potential conflict.

The aforementioned factors are exacerbating the confidence of investors that are progressively losing their trust towards Chinese securities. This is reflected by the declining return expectations for Chinese assets. Morgan Stanley has predicted the markets would rise by 64% by next June and now have scaled back to only 16% in that time. Other stock market analysts have said that any short-term bounces will probably be used to sell positions given that a higher risk premium has been built in. We would expect to see investors scaling back their allocations to China and this will have consequences for growth and capital markets.

The combination of a consolidation of power on the part of Xi, the adherence to a set of policies that will challenge free markets and the rising geopolitical tensions is resulting in a greater systematic risk in the Chinese market. The latter induces investors, who are less incentivized to own assets in a risky market, to require a higher return, thus increasing the risk premium. This premium is evident in the recent sell off and underperformance of the asset class. Looking forward, investors will keep requesting higher returns in response to higher risk.

Conclusion

In summary, the confluence of political power being firmly consolidated under an authoritarian form of rule, the commitment to a more equitable distribution of wealth, a pro-state-owned company set of policies, zero tolerance for COVID and increasingly strident geopolitical goals, are dampening Chinese growth prospects over the short and intermediate term while also having a direct impact on stock prices.

As it relates to Chinese assets, we have argued that combining both the inferior performance of Chinese corporations and the revised macroeconomic forecasts for the region, the decline of the Chinese stock prices appears rationally justified by market data and in accordance with the fundamentals of the mainland stock market.

As economic growth slows in China alongside heightened policy risks, we continue to believe this will impact valuations and return expectations for Chinese assets over the longer term, explaining the current decrease in prices of Chinese stocks altogether, and forecasting a prolongation of this trend.

Taking into account all of the information presented in this article, we can postulate that the Chinese economy will be entering a period of more sluggish economic growth alongside greater reluctance on the part of foreign investors to own Chinese assets given the rising risk premium and heightened uncertainty generated by central party policies.

Sources:

Written by Lorenzo Morosini, Marco Berardi, Alejandro Lockhart

To assess current Chinese stock prices, the Price-to-Earnings ratio can be used, a simple yet effective way of determining whether stock prices are undervalued or overvalued. Data shows that the P/E ratio of the SSE Composite, an index which encompasses all of the A and B class shares on the Chinese market, was approximately 12.70 on October 20th, and dropped to a record low of 11.96 on October 30th. The Hang Seng Index P/E ratio also followed a similar trend. On the other hand, the P/E of the S&P 500, the main composite index of the United States, revolves around 20. This signifies that Chinese stocks on average generate greater earnings compared to their lower prices and are potentially undervalued.

An attentive investor may argue that the discrepancy between the level of western and Chinese price-to-earnings may be due to different growth prospects. Therefore, in order to assess whether the Chinese stock market is underpriced, it is fundamental to be aware of the region’s macroeconomic conditions, further focusing on the growth potential of Chinese companies and on the major geopolitical risks.

Macroeconomic Analysis and Growth Prospects

From a macroeconomic perspective, China’s GDP growth estimates were recently revised downwards by The World Bank. Indeed, the Chinese economy is now forecasted to grow 2.8% this year, less than the 8.1% in 2021 and the 4/5% estimated in April. For Beijing, this is a major setback in an improving Asian economy. Excluding China, the region is in fact expected to grow 5.3% this year, up from 2.6% in 2021. This is the first time since the 1990s that Beijing is growing less than the rest of Asia.

On the other hand, an acute reader may argue that the P/E ratio of an index depends on the growth of the underlying publicly listed companies’ earnings, rather than on the growth prospects of the whole economy. But unfortunately, we bring bad news also from this point of view. The major Chinese publicly listed corporations performed even worse than the very Chinese economy. In fact, the profits of China's major industrial companies fell 2.1% year-on-year in the first eight months of 2022.

An emblematic example is Alibaba. The e-commerce giant traded at $310 per share in October 2020. The price reflected extremely optimistic expectations about the company’s future growth. Indeed, the company’s earnings jumped from ¥88 billion in 2019 to ¥151 billion in 2021, showing a compounded annual growth rate of 31% for the two years. Nevertheless, as of today BABA stock is selling for $70 per share, representing a price decrease of 77%. The plunge was partially due to the net decline in the company’s income, which dropped to ¥40 billion in the last twelve trailing months. According to Reuters, the cause underlying the plunge in Chinese companies’ earnings is the slowing economy, which has negatively impacted consumers’ discretionary spending.

Combining both the inferior performance of Chinese corporations and the revised macroeconomic forecasts for the region, the pessimism revolving around Chinese stocks might appear at least partially justified. Nevertheless, current valuations are also attributable to the risk perceived by investors in allocating their capital in a region that is extremely exposed to geopolitical risk and is governed by a party which lacks any kind of opposition.

Risks associated with Xi’s consolidation of power

The main driver of the aforementioned risks are the alarming geopolitical tensions between U.S. and China and the new economic policies implemented by the Xi Jinping government. Xi’s focus on national security and self-sufficiency, coupled with the removal of the opposition from the leadership of the country, takes China further away from the market-oriented reforms that investors had previously hoped for. As clearly shown by the data, several aspects of the new direction that Xi is setting are concerning market participants.

First of all, the clear signs that Xi Jinping prioritizes personal loyalty over technocratic competences of governmental officials are alarming investors. With this new ideology-driven leadership, less experienced economic officials may replace more competent politicians, potentially leading to heavy repercussions in such a delicate period.

Another ongoing concern that is a direct consequence of this new leadership style is the lack of reformists in the high offices of the government that will now unquestionably support Xi in any of his decisions. As reported to CNN by Sonya Opper, a professor at Bocconi University and an expert on the Chinese economy: “In effect, Xi Jinping establishes an echo chamber around his own ideas. The risk is that China’s leadership becomes isolated and loses sight of alternative”.

This implies having no resistance to policy making, that exposes investors to a high risk because of the tremendous effects that regulations can have on the private sector and the economy. A prime example of this is represented by the private tutoring ban implemented by China in July 2021 which was unexpected by the market and disrupted the tutoring industry. It ultimately led to enormous losses for investors, as demonstrated by the plummeting of New Oriental shares, a provider of private educational services, that decreased by 87% from their peak. It follows that no opposition to implementation of regulations, that could unexpectedly hit every industry, poses a strong aggravating factor that must be taken into account in investment decisions.

Furthermore, investors are concerned about the Zero Covid Policy, with most American businesses operating in China that have lost confidence after the spring Covid lockdown in Shanghai. The risk is represented by continuous threats of closure, travel curbs and supply chain interruptions that are the main reasons to divert investments away from China. As confirmation of this trend, the American Chamber of Commerce in Shanghai (AmCham Shangai) conducted a survey which showed that an increasing number of U.S. companies have lost their interest in China this year, steering their capital flows elsewhere.

In addition to this, geopolitical risk presents itself in a number of forms, but Taiwan is at the core of this. Xi has made the return of Taiwan back to China central to his remarks at the Congress. In fact, there is growing confidence that China will intervene within the next 5 years to reclaim the island. The U.S. has insisted it will defend Taiwan and this is creating substantial concern that a military conflict could arise and would have untold consequences for investors and markets. It

seems likely that Xi will continue to plan for this, and the Chinese reaction to Nancy Pelosi’s visit to the island reflects the hostility between the two countries and highlights the risk for a potential conflict.

The aforementioned factors are exacerbating the confidence of investors that are progressively losing their trust towards Chinese securities. This is reflected by the declining return expectations for Chinese assets. Morgan Stanley has predicted the markets would rise by 64% by next June and now have scaled back to only 16% in that time. Other stock market analysts have said that any short-term bounces will probably be used to sell positions given that a higher risk premium has been built in. We would expect to see investors scaling back their allocations to China and this will have consequences for growth and capital markets.

The combination of a consolidation of power on the part of Xi, the adherence to a set of policies that will challenge free markets and the rising geopolitical tensions is resulting in a greater systematic risk in the Chinese market. The latter induces investors, who are less incentivized to own assets in a risky market, to require a higher return, thus increasing the risk premium. This premium is evident in the recent sell off and underperformance of the asset class. Looking forward, investors will keep requesting higher returns in response to higher risk.

Conclusion

In summary, the confluence of political power being firmly consolidated under an authoritarian form of rule, the commitment to a more equitable distribution of wealth, a pro-state-owned company set of policies, zero tolerance for COVID and increasingly strident geopolitical goals, are dampening Chinese growth prospects over the short and intermediate term while also having a direct impact on stock prices.

As it relates to Chinese assets, we have argued that combining both the inferior performance of Chinese corporations and the revised macroeconomic forecasts for the region, the decline of the Chinese stock prices appears rationally justified by market data and in accordance with the fundamentals of the mainland stock market.

As economic growth slows in China alongside heightened policy risks, we continue to believe this will impact valuations and return expectations for Chinese assets over the longer term, explaining the current decrease in prices of Chinese stocks altogether, and forecasting a prolongation of this trend.

Taking into account all of the information presented in this article, we can postulate that the Chinese economy will be entering a period of more sluggish economic growth alongside greater reluctance on the part of foreign investors to own Chinese assets given the rising risk premium and heightened uncertainty generated by central party policies.

Sources:

- Bloomberg

- Financial Times

- New York Times

- The Wall Street Journal

- Korea Times

- CSIS

- CNBC

- CNN

Written by Lorenzo Morosini, Marco Berardi, Alejandro Lockhart