The International Monetary Fund announced on the November 30th that the Yuan is joining the basket of elite reserve currencies which are used as its unit of account by the international organization. The decision will be effective from the 1st of October, 2016.

This inclusion by the IMF Board states that that the currency has finally met both requirements needed to be part of the Standard Drawing Rights which are:

Nevertheless, it is clearly evident that the Chinese government has been making efforts to integrate globally the country’s financial markets which are bound to push the international reach of the Yuan.

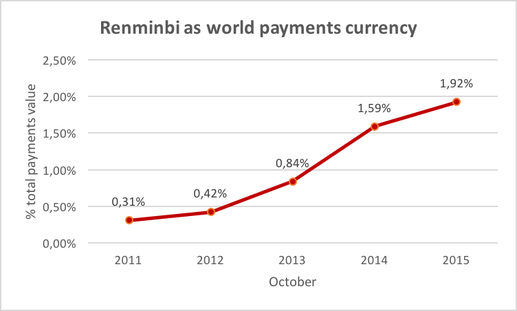

With reference to the last RMB Tracker Report of the Society for Worldwide Interbank Financial Telecommunication (SWIFT), the data of November shows the Renminbi ranking in the 5th position with a 1.92% share of the global payments. In just one year’s time it upgraded 2 positions overcoming the Canadian and Australian Dollar. Now Renminbi is just behind its peers of the SDR basket and there are optimistic outlooks that it will catch up the Yen.

Zooming to the Asian geographic zone, the Yuan is far more used, especially in foreign exchange transactions between mainland and Honk Kong, Japan, Taiwan and South Korea.

This inclusion by the IMF Board states that that the currency has finally met both requirements needed to be part of the Standard Drawing Rights which are:

- The country has to be relevant in the international trade;

- The currency is freely usable, which means it has to be largely used in global transactions;

Nevertheless, it is clearly evident that the Chinese government has been making efforts to integrate globally the country’s financial markets which are bound to push the international reach of the Yuan.

With reference to the last RMB Tracker Report of the Society for Worldwide Interbank Financial Telecommunication (SWIFT), the data of November shows the Renminbi ranking in the 5th position with a 1.92% share of the global payments. In just one year’s time it upgraded 2 positions overcoming the Canadian and Australian Dollar. Now Renminbi is just behind its peers of the SDR basket and there are optimistic outlooks that it will catch up the Yen.

Zooming to the Asian geographic zone, the Yuan is far more used, especially in foreign exchange transactions between mainland and Honk Kong, Japan, Taiwan and South Korea.

In the financial sector it is gaining a growing role as an investment-currency recently due to the liberalization reforms of China’s capital markets.

Great steps have been taken in the debt market. In fact, considering the panda bond market (Renminbi-denominated bonds issued by a non-Chinese institution and sold in the onshore market) the last transaction in a row has been carried out by South Korea. The country has decided to sell panda bonds for a total amount worth Rmb3bn ($468m).

Previously similar transactions have been done. Last year the UK became the first foreign country to raise Rmb3bn in sovereign debt. Further more, other issuers joined the club, such as the German automaker Daimler, which was the first non-financial company, and in September HSBC became the first foreign bank to do so.

Russia has planned to raise $1bn in renminbi-denominated sovereign bonds in Moscow in 2016. In the long run this will take China to loosen even more the control over the currency’s value, slowly depegging it from the dollar and let the market forces determine it. A more flexible exchange rate is oncoming.

Vittoria Roà

Great steps have been taken in the debt market. In fact, considering the panda bond market (Renminbi-denominated bonds issued by a non-Chinese institution and sold in the onshore market) the last transaction in a row has been carried out by South Korea. The country has decided to sell panda bonds for a total amount worth Rmb3bn ($468m).

Previously similar transactions have been done. Last year the UK became the first foreign country to raise Rmb3bn in sovereign debt. Further more, other issuers joined the club, such as the German automaker Daimler, which was the first non-financial company, and in September HSBC became the first foreign bank to do so.

Russia has planned to raise $1bn in renminbi-denominated sovereign bonds in Moscow in 2016. In the long run this will take China to loosen even more the control over the currency’s value, slowly depegging it from the dollar and let the market forces determine it. A more flexible exchange rate is oncoming.

Vittoria Roà