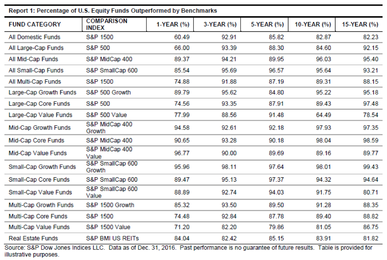

These are bad times for active portfolio managers: almost 90% underperformed the S&P 500 in the past 15 years, and, only in 2016, two thirds of them failed to overtake the index.

But, what does active management exactly mean?

It is a fund management strategy in which individuals - typically a group of experts - rely on analytical research, forecasts, and on their own judgment and experience in making investment decisions on what securities to buy, hold and sell (1). The opposite procedure is called passive management, better known as ‘indexing’, which lacks of the human element to overcome the benchmark title. Active managers hope for a revival, but hope is not a strategy.

Huge losses showed difficulties in beating the S&P 500, according to the S&P Dow Jones Indices.

Particularly striking were the figures of 89.4% of mid-cap funds - a type of stocks that invests in mid-sized companies, generally ranging from $2 to $10 billion market capitalization - falling short of expectations, as well as small-cap missing the target in the 85.5% of the operations recorded.

Nevertheless, historically mid-cap stocks have offered more stability than small ones, which are still the most profitable.

Recent failures stimulated a debate over the benefits of active against passive management, but annual predictions have been always in favour of ‘stock-picking’, namely, a selection of equities based on price expectations in the short term.

“The S&P figures have become a massive boon for the ETF industry, which has been able to use them to show the benefit of passive investing” Stewart Aldcroft, senior adviser on the Asian fund industry at Cititrust - the fund services business of Citigroup – said.

Due to such a consistent ineffectiveness investors are becoming more confident towards passive strategies, so that exchange-traded funds have recorded high cash flows in the first quarter of 2017, both in stock and bond side. Last year indexing attracted a net $508.4 billion of assets while active-managed investments a more subdued $340.1 billion volume, according to Morningstar. Equity or stock-based Exchange-traded funds (ETFs) made the greatest share, reaching $96.6 billion, since the S&P 500 does not employ professional managers to pick individual stocks.

"Its been a dismal backdrop in a dismal environment for active. The numbers prove that" said Nick Colas, chief market strategist at Convergex, an agency focused on global brokerage and trading. "Does that mean that environment will last forever? Markets always go in cycles".

However, the latest report on active management performance, within U.S. reference market, paints a desolate picture over the long term. “SPIVA U.S. Balance Scorecard”, a well-known strategic planning system, confirmed that managed portfolios have never outperformed the market, and there is no evidence they will run faster in the near future, even if JPMorgan analysts displayed a significant increase in recent years.

Bob Doll, senior portfolio manager at Nuveen Asset Management, said market conditions are conducive this year for his side of Wall Street:

"Among these factors are the tailwinds that enable active managers, given their portfolio construction, to win, and we are heading into that environment," he said in a video presentation for clients. "So this should be a good year. Among desirable qualities are lower fees and managers who own the investments they are endorsing for clients” he added.

"Once you incorporate reasonable screens that any reasonable advisor and certainly most practitioners employ, you can drastically improve your success rate”.

Steve Deschenes, product management and analytics director at Capital Group Companies, the world’s oldest and largest financial services organizations said:

"It doesn't really matter if 20 percent of managers beat the index. What matters is, can you identify the 20 percent and take advantage of that identification in your portfolio?"

But, what does active management exactly mean?

It is a fund management strategy in which individuals - typically a group of experts - rely on analytical research, forecasts, and on their own judgment and experience in making investment decisions on what securities to buy, hold and sell (1). The opposite procedure is called passive management, better known as ‘indexing’, which lacks of the human element to overcome the benchmark title. Active managers hope for a revival, but hope is not a strategy.

Huge losses showed difficulties in beating the S&P 500, according to the S&P Dow Jones Indices.

Particularly striking were the figures of 89.4% of mid-cap funds - a type of stocks that invests in mid-sized companies, generally ranging from $2 to $10 billion market capitalization - falling short of expectations, as well as small-cap missing the target in the 85.5% of the operations recorded.

Nevertheless, historically mid-cap stocks have offered more stability than small ones, which are still the most profitable.

Recent failures stimulated a debate over the benefits of active against passive management, but annual predictions have been always in favour of ‘stock-picking’, namely, a selection of equities based on price expectations in the short term.

“The S&P figures have become a massive boon for the ETF industry, which has been able to use them to show the benefit of passive investing” Stewart Aldcroft, senior adviser on the Asian fund industry at Cititrust - the fund services business of Citigroup – said.

Due to such a consistent ineffectiveness investors are becoming more confident towards passive strategies, so that exchange-traded funds have recorded high cash flows in the first quarter of 2017, both in stock and bond side. Last year indexing attracted a net $508.4 billion of assets while active-managed investments a more subdued $340.1 billion volume, according to Morningstar. Equity or stock-based Exchange-traded funds (ETFs) made the greatest share, reaching $96.6 billion, since the S&P 500 does not employ professional managers to pick individual stocks.

"Its been a dismal backdrop in a dismal environment for active. The numbers prove that" said Nick Colas, chief market strategist at Convergex, an agency focused on global brokerage and trading. "Does that mean that environment will last forever? Markets always go in cycles".

However, the latest report on active management performance, within U.S. reference market, paints a desolate picture over the long term. “SPIVA U.S. Balance Scorecard”, a well-known strategic planning system, confirmed that managed portfolios have never outperformed the market, and there is no evidence they will run faster in the near future, even if JPMorgan analysts displayed a significant increase in recent years.

Bob Doll, senior portfolio manager at Nuveen Asset Management, said market conditions are conducive this year for his side of Wall Street:

"Among these factors are the tailwinds that enable active managers, given their portfolio construction, to win, and we are heading into that environment," he said in a video presentation for clients. "So this should be a good year. Among desirable qualities are lower fees and managers who own the investments they are endorsing for clients” he added.

"Once you incorporate reasonable screens that any reasonable advisor and certainly most practitioners employ, you can drastically improve your success rate”.

Steve Deschenes, product management and analytics director at Capital Group Companies, the world’s oldest and largest financial services organizations said:

"It doesn't really matter if 20 percent of managers beat the index. What matters is, can you identify the 20 percent and take advantage of that identification in your portfolio?"

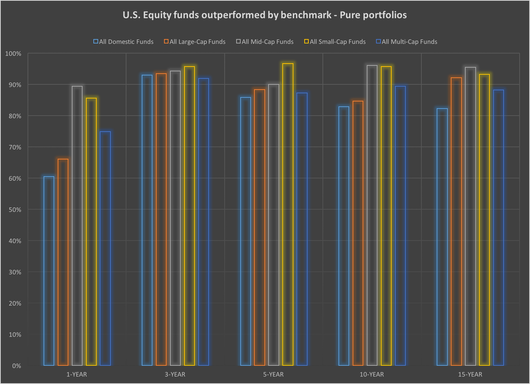

Source: CNBC; S&P Dow Jones Indices LLC, Data as of December 31, 2016. Data autonomously elaborated by the author.

As showed above, the majority of capitalized funds did not succeed in 80% of operations, regardless of the company size. According to the Crisil’s ratings and research, the general ineffectiveness showed small-cap liquidity climb over the past years (in 95% of cases these investments are inconvenient), while mid-cap and multi-cap maintained a steady position mostly over 90%. Active managers obsession towards pure portfolios and low diversification displayed their Achille’s heel, the great weakness in spite of the potential strength.

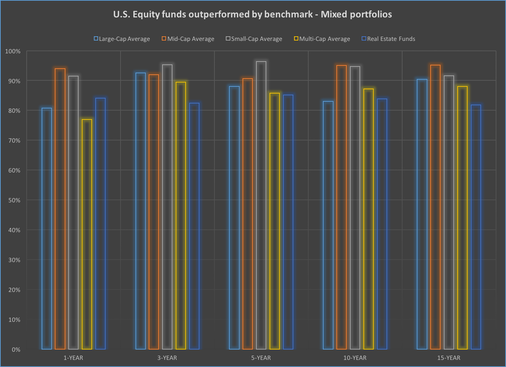

Source: CNBC; S&P Dow Jones Indices LLC, Data as of December 31, 2016. Data autonomously elaborated by the author.

In fact, mixed portfolios outperformed the index at least 10% more than “pure” ones, especially as maturity increases. The opposite scenario occurs when it comes to the short term. In this case, the ability to mix equities among different companies, from the smallest to the largest ones, has to cope with volatility and market instability. Firms are more sensitive to political economy and expected dividends are not guaranteed in 1-year time.

Indeed, performance among different strategies has differed considerably, though all have still underperformed market benchmarks. Neither diverse hedging strategies, such as short selling and derivatives, have been exploited enough to protect portfolios, nor have current managers decided to broaden their horizons with new assets to trade.

For all these reasons, active investments would move closer to the index returns but would never surpass them, just like in Zeno’s paradox.

Whenever Achilles reaches somewhere the tortoise has been, he is still farther to go.

In the most optimistic hypothesis, excellent active operations stimulates, in the aggregate, growth in stocks and bond market, so as to increase the benchmark itself.

There will always be an infinitesimal gap that cannot be filled if market conditions do not change drastically.

Alessandro Di Cerbo

Indeed, performance among different strategies has differed considerably, though all have still underperformed market benchmarks. Neither diverse hedging strategies, such as short selling and derivatives, have been exploited enough to protect portfolios, nor have current managers decided to broaden their horizons with new assets to trade.

For all these reasons, active investments would move closer to the index returns but would never surpass them, just like in Zeno’s paradox.

Whenever Achilles reaches somewhere the tortoise has been, he is still farther to go.

In the most optimistic hypothesis, excellent active operations stimulates, in the aggregate, growth in stocks and bond market, so as to increase the benchmark itself.

There will always be an infinitesimal gap that cannot be filled if market conditions do not change drastically.

Alessandro Di Cerbo

1 http://www.investopedia.com/terms/a/activemanagement.asp#ixzz4eJEQ9Xat