In modern history, Japan's economic development has frequently been described as remarkable and consistently captivating. For this G10 country, to achieve the position it boasts today as an industrial powerhouse and global corporate leader, fiscal and monetary progress and stability were imperative. To this extent, the Bank of Japan has played a crucial role, and, while its policies are heavily scrutinized today, the impact it had from the year it was established (1882) is undeniable. To better understand the status quo, and perfect our guesstimates on where the economy is heading, it would be useful to look at the history that brought us to the point we are at.

Brief economic and monetary policy history of Japan – pioneer, leader, or just the odd one out.

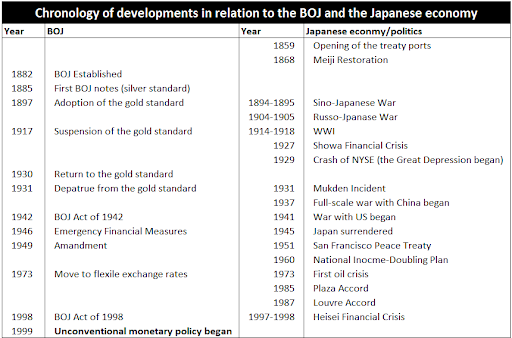

The 19th century marked the feudal to modern society transition, and as such the now open market saw large inflows and outflows of capital. This prompted the need to establish the BOJ in order to mobilize resources, especially financial resources, towards the goal of a “wealthy nation, strong military”.

The 19th century marked the feudal to modern society transition, and as such the now open market saw large inflows and outflows of capital. This prompted the need to establish the BOJ in order to mobilize resources, especially financial resources, towards the goal of a “wealthy nation, strong military”.

Source: https://www.waseda.jp/fpse/winpec/assets/uploads/2014/05/No.E1803.pdf

The main policy tool used by the Central Bank in the 1820s-1920 and 1950s-1920s was the discount window - borrowing to private banks. The bank was also engaged with the war efforts in that time, extending credit in conflicts such as the Russo-Japanese War. It was during these distressed times in which the bank resorted to another “conventional” monetary policy coined “open market operations”. The overwhelming burden of the 1930s and 40s was supported by underwriting government bonds and selling them to the private sector. This caused one of the worst waves of inflation that was succeeded by a rampant growth period of the ‘50s throughout ‘70s. The mandate of the BOJ was imposed with a policy mix, in which the ODR (official discount rate) was the main instrument used, accompanied by reserve ratios.

In order to fast-forward to the modern policies of today, we have to tie the growth, and stability of the mid-1900s to the subsequent stagnation and sticky deflationary environment with zero lower bounds. This can be mainly explained by the worst boom and bust cycle of the post-war period that occurred in the Heisei economy of the 1990s. After reaching an all-time high of 38,915 in December 1989, the Nikkei crashed and thus the asset price bubble burst sending the economy in a downward spiral.

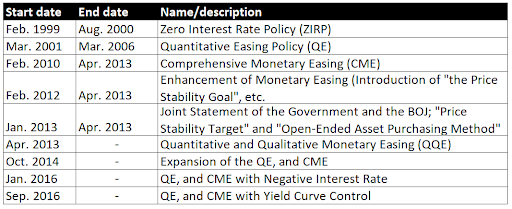

The new environment led to the invention of “unconventional monetary policies” and ultimately changed the central banking paradigm throughout the entire world. You can find more on how current policies like the YCC work on our past article discussing the topic in depth.

The main policy tool used by the Central Bank in the 1820s-1920 and 1950s-1920s was the discount window - borrowing to private banks. The bank was also engaged with the war efforts in that time, extending credit in conflicts such as the Russo-Japanese War. It was during these distressed times in which the bank resorted to another “conventional” monetary policy coined “open market operations”. The overwhelming burden of the 1930s and 40s was supported by underwriting government bonds and selling them to the private sector. This caused one of the worst waves of inflation that was succeeded by a rampant growth period of the ‘50s throughout ‘70s. The mandate of the BOJ was imposed with a policy mix, in which the ODR (official discount rate) was the main instrument used, accompanied by reserve ratios.

In order to fast-forward to the modern policies of today, we have to tie the growth, and stability of the mid-1900s to the subsequent stagnation and sticky deflationary environment with zero lower bounds. This can be mainly explained by the worst boom and bust cycle of the post-war period that occurred in the Heisei economy of the 1990s. After reaching an all-time high of 38,915 in December 1989, the Nikkei crashed and thus the asset price bubble burst sending the economy in a downward spiral.

The new environment led to the invention of “unconventional monetary policies” and ultimately changed the central banking paradigm throughout the entire world. You can find more on how current policies like the YCC work on our past article discussing the topic in depth.

Currently, the Central Bank is under the rule of the academic Kazuo Ueda, its 32nd Governor. As the governor that preceded him, Haruhiko Kuroda, departed from the BOJ, Ueda signaled the end of the decade of dovish, unconventional monetary policy. After being the only economy with a negative policy rate for more than a year and a half, Japan is facing ever-worsening conditions. Dollar pressure, inflation, and many other factors seem to indicate the need to normalize the policies and bring them in line with the other nations. Despite the adversity, some markets (equities) seem to be in the green, yet outlooks are uncertain if further tightening is to be pursued, as it may seem to be the case given the current landscape.

The current market landscape

The Japanese economy witnessed a significant downturn in the July-September period, registering a 2.1% decline in GDP compared to the previous year, marking the sharpest contraction in two years. Factors contributing to this contraction include escalating domestic inflation and a decline in consumer demand, and investment, raising challenges for Prime Minister Fumio Kishida and Bank of Japan Governor Kazuo Ueda. The fragility of the economy is further underscored by decreased stock building and lower-than-expected domestic capital expenditure.

To address these challenges, the Japanese government has introduced a substantial economic package of 13.2 trillion yen ($87 billion) aimed at mitigating rising living costs reflecting a strategic response to the economic vulnerabilities highlighted by the recent contraction.

On the monetary policy front, the Bank of Japan is expected to conclude its negative interest rate policy in early 2024. However, although a shift to a zero-interest rate policy is likely, the BOJ still remains cautious, emphasizing the need for evidence of a wage-price cycle before making significant adjustments to its monetary policy.

Amid these economic challenges, Japan's equity markets have shown resilience and dynamism. Equity offerings in the country have surged, quadrupling in value this year. The Nikkei stock index's rise to a 33-year high and indications of enhanced capital efficiency by Japanese firms have fueled investor confidence. Current monetary policy in Japan, Warren Buffett's increased stakes in Japanese firms, and a redirection of funds away from China amid geopolitical tensions have further contributed to this positive trend.

Data from the London Stock Exchange Group (LSEG) reveals a 343% increase in proceeds from initial public offerings (IPOs) and secondary share and convertible bond issues, reaching $23.7 billion in the first nine months of the year. In contrast, China experienced a 29% decline in proceeds, amounting to $104.3 billion, signaling a relative strength in Japan's equity markets.

Japan's IPO market has been particularly vibrant, with 73 IPOs during the nine months raising a combined $3.3 billion, a fourfold increase from the previous year. Notable offerings, such as Rakuten Bank's $625 million and Kokusai Electric's $724 million IPO, exemplify the market's dynamism.

This positive momentum in equity markets has prompted a wave of share buybacks and dividend hikes, aligning with the Tokyo Stock Exchange's call for companies to disclose plans to enhance capital efficiency, especially when shares are trading below book value. The buoyancy in equity markets has boosted the Nikkei to approximately 25% growth year-to-date, outpacing the S&P 500's 11% increase.

Institutional investors, ranging from hedge funds to long-only funds, have been re-establishing their positions in Japan since April. While international investors are still underweight compared to benchmarks, there is a discernible uptick in their exposure, indicating increasing confidence in the future of Japanese equity markets.

A recent success story of the TSE’s push for capital efficiency is Dai Nippon Printing (DNP), one of Japan’s largest printing companies. DNP has historically struggled with underperformance in valuation despite its strong competitiveness in sectors like lithium-ion battery packaging. In response to the TSE’s initiative in January, DNP surprised the market in February with a new management plan, setting an ROE target of 10% and aiming to raise its P/B above 1. This marked a significant improvement from its previous ROE target of 5%, which investors had criticized as too low. In addition to this, DNP included a goal in its plan to reduce strategic shareholding to less than 10% of net assets. Despite ambitious targets, DNP's stock price has surged 50% year-to-date, far outperforming the TOPIX, and its P/B is approaching 1, showcasing a positive market response to the TSE's initiative and investor engagement, which seems to have been quite effective in producing decisive action by the company's management.

Why is it the perfect scenario for investments?

There are several reasons that currently make Japan an attractive location for investors. First of all, the rising tensions between China and the US are feared by many, which led investors to diversify away from China and to look elsewhere for their investments in the APAC region. Among the other countries, Japan stood out thanks to the low interest rate environment and multiple shareholder-friendly policies the country has been adopting, such as share buybacks plans and measures to improve companies’ governance. These last months have indeed witnessed an important recovery of the Japanese capital markets, with the Topix stock index trading at a 33-year high (¥2,378 as of November 22nd) and the country surpassing China as a driver for Investment Banking revenues for the first time in 25 years (it is now accounting for around 30% of the whole APAC revenues in 2023).

This favorable environment has also seen the realization of the country’s biggest public offering in the last 5 years: Kokusai Electric, a Japanese chip equipment maker, went public on the Tokyo stock exchange on October 25th. A majority stake of 73.2% of the firm had been bought by private equity giant KKR in 2017, when the firm had been valued at about ¥257bn (corresponding to around $1.7bn). Last month KKR decided to reduce their stake in the company, going public at a price of ¥1,840 ($12.3) per share and raising ¥108bn ($720m) during the first day of trading. At the end of the same day, Kokusai Electric’s share price had seen a significant 28% increase in its IPO valuation, closing at ¥2,350. As of today, around one month after its debut, Kokusai’s shares trade at ¥3,260 (77% premium!).

What could be the reasons behind the success? The company holds a significant market share in machines that can deposit thin films on silicon wafers, then used to form electronic circuits, that definitely makes it promising for investors. The restricted access to Chinese semiconductors, pioneered by the US, is also making investors look at other geographies, especially with the strong demand that is expected to arise with large-scale national chip projects in the US and Europe (with countries looking to build their own semiconductors supply chains).

While these certainly make Kokusai Electric’s shares appealing for investors, an important role has also been played by the overall attractiveness Japan is currently facing.

However, this process is a virtuous circle! The IPO success has served in restoring confidence in the equity market even more, and we expect several new public offerings in the months to come.

Where is the Japanese economy headed next?

While most developed countries’ future trajectories have started to take an actual shape with the latest macroeconomic data, the outlook for the Land of the Rising Sun remains unclear.

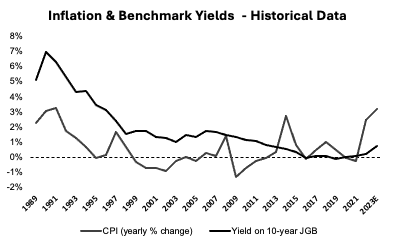

Japan was unable to find a solution to the decades-long declining prices and was figuratively rescued by the multiple supply-side shocks such as the pandemic, wars and increasingly frequent geopolitical conflicts, which put an end to the persistent deflationary pressures the country was struggling to cope with. Other advanced economies’ misfortunes were indeed a blessing for Japan which managed to exit a period of low growth, deflation and historically-low interest rates. After the big sigh of relief which came with GDP and stock market results during H1 2023, investors are now starting to worry about the weak currency and unusually-high inflation rate in the country, which currently stands above 3%.

How is this going to play out in the short and medium-run? What’s worrying investors the most is not only the rapidly increasing inflation, which has been growing uninterruptedly since the post-pandemic period, but rather the nature of Japan’s inflation which seems much stickier than expected, as highlighted by the October CPI data released on November 24th that showed worse-than-expected inflation rate in Japan up 3.3% in October 2023 from 3.0% in the prior month. In this context, the labor market is playing a key role in shaping investors’ expectations of future macroeconomic developments. In September, real wages in the country fell by roughly 2.4% year-on-year for the 18th consecutive month, reflecting the radical shift the country is undergoing from the previous deflationary environment to the current one characterized by rallying prices. It is clear that firms will have to raise nominal wages at some point, which will further boost inflation.

The current market landscape

The Japanese economy witnessed a significant downturn in the July-September period, registering a 2.1% decline in GDP compared to the previous year, marking the sharpest contraction in two years. Factors contributing to this contraction include escalating domestic inflation and a decline in consumer demand, and investment, raising challenges for Prime Minister Fumio Kishida and Bank of Japan Governor Kazuo Ueda. The fragility of the economy is further underscored by decreased stock building and lower-than-expected domestic capital expenditure.

To address these challenges, the Japanese government has introduced a substantial economic package of 13.2 trillion yen ($87 billion) aimed at mitigating rising living costs reflecting a strategic response to the economic vulnerabilities highlighted by the recent contraction.

On the monetary policy front, the Bank of Japan is expected to conclude its negative interest rate policy in early 2024. However, although a shift to a zero-interest rate policy is likely, the BOJ still remains cautious, emphasizing the need for evidence of a wage-price cycle before making significant adjustments to its monetary policy.

Amid these economic challenges, Japan's equity markets have shown resilience and dynamism. Equity offerings in the country have surged, quadrupling in value this year. The Nikkei stock index's rise to a 33-year high and indications of enhanced capital efficiency by Japanese firms have fueled investor confidence. Current monetary policy in Japan, Warren Buffett's increased stakes in Japanese firms, and a redirection of funds away from China amid geopolitical tensions have further contributed to this positive trend.

Data from the London Stock Exchange Group (LSEG) reveals a 343% increase in proceeds from initial public offerings (IPOs) and secondary share and convertible bond issues, reaching $23.7 billion in the first nine months of the year. In contrast, China experienced a 29% decline in proceeds, amounting to $104.3 billion, signaling a relative strength in Japan's equity markets.

Japan's IPO market has been particularly vibrant, with 73 IPOs during the nine months raising a combined $3.3 billion, a fourfold increase from the previous year. Notable offerings, such as Rakuten Bank's $625 million and Kokusai Electric's $724 million IPO, exemplify the market's dynamism.

This positive momentum in equity markets has prompted a wave of share buybacks and dividend hikes, aligning with the Tokyo Stock Exchange's call for companies to disclose plans to enhance capital efficiency, especially when shares are trading below book value. The buoyancy in equity markets has boosted the Nikkei to approximately 25% growth year-to-date, outpacing the S&P 500's 11% increase.

Institutional investors, ranging from hedge funds to long-only funds, have been re-establishing their positions in Japan since April. While international investors are still underweight compared to benchmarks, there is a discernible uptick in their exposure, indicating increasing confidence in the future of Japanese equity markets.

A recent success story of the TSE’s push for capital efficiency is Dai Nippon Printing (DNP), one of Japan’s largest printing companies. DNP has historically struggled with underperformance in valuation despite its strong competitiveness in sectors like lithium-ion battery packaging. In response to the TSE’s initiative in January, DNP surprised the market in February with a new management plan, setting an ROE target of 10% and aiming to raise its P/B above 1. This marked a significant improvement from its previous ROE target of 5%, which investors had criticized as too low. In addition to this, DNP included a goal in its plan to reduce strategic shareholding to less than 10% of net assets. Despite ambitious targets, DNP's stock price has surged 50% year-to-date, far outperforming the TOPIX, and its P/B is approaching 1, showcasing a positive market response to the TSE's initiative and investor engagement, which seems to have been quite effective in producing decisive action by the company's management.

Why is it the perfect scenario for investments?

There are several reasons that currently make Japan an attractive location for investors. First of all, the rising tensions between China and the US are feared by many, which led investors to diversify away from China and to look elsewhere for their investments in the APAC region. Among the other countries, Japan stood out thanks to the low interest rate environment and multiple shareholder-friendly policies the country has been adopting, such as share buybacks plans and measures to improve companies’ governance. These last months have indeed witnessed an important recovery of the Japanese capital markets, with the Topix stock index trading at a 33-year high (¥2,378 as of November 22nd) and the country surpassing China as a driver for Investment Banking revenues for the first time in 25 years (it is now accounting for around 30% of the whole APAC revenues in 2023).

This favorable environment has also seen the realization of the country’s biggest public offering in the last 5 years: Kokusai Electric, a Japanese chip equipment maker, went public on the Tokyo stock exchange on October 25th. A majority stake of 73.2% of the firm had been bought by private equity giant KKR in 2017, when the firm had been valued at about ¥257bn (corresponding to around $1.7bn). Last month KKR decided to reduce their stake in the company, going public at a price of ¥1,840 ($12.3) per share and raising ¥108bn ($720m) during the first day of trading. At the end of the same day, Kokusai Electric’s share price had seen a significant 28% increase in its IPO valuation, closing at ¥2,350. As of today, around one month after its debut, Kokusai’s shares trade at ¥3,260 (77% premium!).

What could be the reasons behind the success? The company holds a significant market share in machines that can deposit thin films on silicon wafers, then used to form electronic circuits, that definitely makes it promising for investors. The restricted access to Chinese semiconductors, pioneered by the US, is also making investors look at other geographies, especially with the strong demand that is expected to arise with large-scale national chip projects in the US and Europe (with countries looking to build their own semiconductors supply chains).

While these certainly make Kokusai Electric’s shares appealing for investors, an important role has also been played by the overall attractiveness Japan is currently facing.

However, this process is a virtuous circle! The IPO success has served in restoring confidence in the equity market even more, and we expect several new public offerings in the months to come.

Where is the Japanese economy headed next?

While most developed countries’ future trajectories have started to take an actual shape with the latest macroeconomic data, the outlook for the Land of the Rising Sun remains unclear.

Japan was unable to find a solution to the decades-long declining prices and was figuratively rescued by the multiple supply-side shocks such as the pandemic, wars and increasingly frequent geopolitical conflicts, which put an end to the persistent deflationary pressures the country was struggling to cope with. Other advanced economies’ misfortunes were indeed a blessing for Japan which managed to exit a period of low growth, deflation and historically-low interest rates. After the big sigh of relief which came with GDP and stock market results during H1 2023, investors are now starting to worry about the weak currency and unusually-high inflation rate in the country, which currently stands above 3%.

How is this going to play out in the short and medium-run? What’s worrying investors the most is not only the rapidly increasing inflation, which has been growing uninterruptedly since the post-pandemic period, but rather the nature of Japan’s inflation which seems much stickier than expected, as highlighted by the October CPI data released on November 24th that showed worse-than-expected inflation rate in Japan up 3.3% in October 2023 from 3.0% in the prior month. In this context, the labor market is playing a key role in shaping investors’ expectations of future macroeconomic developments. In September, real wages in the country fell by roughly 2.4% year-on-year for the 18th consecutive month, reflecting the radical shift the country is undergoing from the previous deflationary environment to the current one characterized by rallying prices. It is clear that firms will have to raise nominal wages at some point, which will further boost inflation.

How is Japan’s pessimistic outlook on inflation going to affect other macroeconomic variables? Needless to say, this comes with bearish expectations of monetary policy in the upcoming months, though the Bank of Japan is already taking steps in this direction. The first move came on October 31st as the BoJ altered its yield curve control policy by abolishing the 1% cap on 10-year government bond yields (which had been raised from the 0.5% level just a few months earlier), allowing greater flexibility for upward yields movements. Around the announcement of this policy change, the yen dropped to a 30-year low against the USD as traders reacted by heavily shorting the currency to test BoJ’s willingness to intervene to defend it. It eventually did and the yen slightly rebounded, though many argue that this BoJ’s measure was merely a foot-in-the-door move to engineer an exit from YCC without explicitly telling the market. In 2023, the growing divergence between borrowing costs in Japan relative to other advanced economies has forced the BoJ to repeatedly make large Japanese Government Bonds (JGB) purchases to keep yields below the set 1% ceiling. Clearly, longer-than-expected inflation would have to be tackled with rising rates, which would negatively impact fixed interest-paying bonds.

Macroeconomic news and the general sentiment prevailing in the market suggest that investors expect tighter monetary policy by the BoJ, which should theoretically be fully priced into fixed income instruments. However, uncertainty surrounding both the measures and timing of this potential intervention are holding markets back from incorporating these future changes into securities’ prices. As of today, 3-year and 5-year JGB yields are 0.09% and 0.31% respectively, which considering the inflation target of 2% makes the implied real return on these securities far from appealing. Clearly, large investors are not missing out on the opportunity. Fixed income leading asset manager PIMCO has been building a large position on the JPY betting on longer-than-expected inflation and further monetary tightening, as the Japanese currency fell by more than 12% YTD against the dollar. The $2-trillion AuM investment manager was not the only institutional investor trading BoJ’s policy expectations. Just a few days ago, Buffett's Berkshire Hathaway raised approximately $800m by selling Japanese, yen-denominated bonds, as expectations of future interest rate hikes by the BoJ are now beginning to materialize. As market movers explicitly bet on one side of the coin, the question arises as to if and when other investors will follow.

How is this outlook going to affect capital markets in Japan? Low interest rates and historically-low currency have been key drivers of capital inflows in the country over the past few years, which resulted in record-high exports in 2023 and a rallying stock market, with the Nikkei 225 index up 30% YTD. Lower discount rates also boosted equity valuations, leading to a spike in dealmaking activity. According to LSEG, domestic M&A value grew 14% year-on-year to over $100bn in the three quarters of 2023, with some landmark deals such as the Toshiba and JSR buyouts. Clearly, persistently-low interest rates increased the attractiveness of Japanese companies as potential candidates for leveraged buyouts, which caused a spike in fund-raising by large institutional investors.

Equity capital markets had a similar year, with plenty of major stock market listings including Rakuten Bank’s $676m offering (up 36% since it began trading in April) and the above-mentioned Kokusai Electric IPO. What’s unique about Japan’s recent public offerings is the post-IPO performance of firms, the majority of which delivered double-digit returns following their listings, very different compared to most US IPOs of 2023. The current macroeconomic situation could potentially impact Japan’s ECM through two channels. First, the outlook for IPOs and SEOs should remain strong as long as the ultra-loose monetary policy remains in place, as firms take advantage of the low discount rates boosting their valuations to raise more capital in the stock market, which also offers a potentially highly-rewarding exit strategy for private equity investors. Second, Japanese publicly-traded companies have recently emerged as attractive targets for delisting. This is related to the low-discount rates argument, as low costs of financing and equity valuations make buyouts of public firms more feasible, even at high premiums. Interestingly, roughly half of Japan’s listed companies are currently trading below book value (that is, have price-to-book ratios lower than 1x). This underscores how potentially-undervalued Japanese equities are, which again makes them appealing take-private candidates.

Clearly, a bearish outlook featuring persistent inflation and monetary tightening in the upcoming months would lead to a relative appreciation of the yen, higher costs of borrowing and lower company valuations, making Japan less attractive to foreign investors as well as potentially triggering a decline in both dealmaking and equity offerings.

The BoJ will soon find itself at a crossroads having to provide guidance on its future policy measures. Meanwhile, in the short-term it is fair to assume an acceleration in dealmaking as long as Japan’s loose monetary policy is still in place and low-cost financing remains available. Whether or not this will persist depends on the timing and direction of the BoJ’s response which, as of today, is far from being certain.

Written by Sara D’Apice, Jacopo Landi, Alexander Lockhart, Matei Sandru

Macroeconomic news and the general sentiment prevailing in the market suggest that investors expect tighter monetary policy by the BoJ, which should theoretically be fully priced into fixed income instruments. However, uncertainty surrounding both the measures and timing of this potential intervention are holding markets back from incorporating these future changes into securities’ prices. As of today, 3-year and 5-year JGB yields are 0.09% and 0.31% respectively, which considering the inflation target of 2% makes the implied real return on these securities far from appealing. Clearly, large investors are not missing out on the opportunity. Fixed income leading asset manager PIMCO has been building a large position on the JPY betting on longer-than-expected inflation and further monetary tightening, as the Japanese currency fell by more than 12% YTD against the dollar. The $2-trillion AuM investment manager was not the only institutional investor trading BoJ’s policy expectations. Just a few days ago, Buffett's Berkshire Hathaway raised approximately $800m by selling Japanese, yen-denominated bonds, as expectations of future interest rate hikes by the BoJ are now beginning to materialize. As market movers explicitly bet on one side of the coin, the question arises as to if and when other investors will follow.

How is this outlook going to affect capital markets in Japan? Low interest rates and historically-low currency have been key drivers of capital inflows in the country over the past few years, which resulted in record-high exports in 2023 and a rallying stock market, with the Nikkei 225 index up 30% YTD. Lower discount rates also boosted equity valuations, leading to a spike in dealmaking activity. According to LSEG, domestic M&A value grew 14% year-on-year to over $100bn in the three quarters of 2023, with some landmark deals such as the Toshiba and JSR buyouts. Clearly, persistently-low interest rates increased the attractiveness of Japanese companies as potential candidates for leveraged buyouts, which caused a spike in fund-raising by large institutional investors.

Equity capital markets had a similar year, with plenty of major stock market listings including Rakuten Bank’s $676m offering (up 36% since it began trading in April) and the above-mentioned Kokusai Electric IPO. What’s unique about Japan’s recent public offerings is the post-IPO performance of firms, the majority of which delivered double-digit returns following their listings, very different compared to most US IPOs of 2023. The current macroeconomic situation could potentially impact Japan’s ECM through two channels. First, the outlook for IPOs and SEOs should remain strong as long as the ultra-loose monetary policy remains in place, as firms take advantage of the low discount rates boosting their valuations to raise more capital in the stock market, which also offers a potentially highly-rewarding exit strategy for private equity investors. Second, Japanese publicly-traded companies have recently emerged as attractive targets for delisting. This is related to the low-discount rates argument, as low costs of financing and equity valuations make buyouts of public firms more feasible, even at high premiums. Interestingly, roughly half of Japan’s listed companies are currently trading below book value (that is, have price-to-book ratios lower than 1x). This underscores how potentially-undervalued Japanese equities are, which again makes them appealing take-private candidates.

Clearly, a bearish outlook featuring persistent inflation and monetary tightening in the upcoming months would lead to a relative appreciation of the yen, higher costs of borrowing and lower company valuations, making Japan less attractive to foreign investors as well as potentially triggering a decline in both dealmaking and equity offerings.

The BoJ will soon find itself at a crossroads having to provide guidance on its future policy measures. Meanwhile, in the short-term it is fair to assume an acceleration in dealmaking as long as Japan’s loose monetary policy is still in place and low-cost financing remains available. Whether or not this will persist depends on the timing and direction of the BoJ’s response which, as of today, is far from being certain.

Written by Sara D’Apice, Jacopo Landi, Alexander Lockhart, Matei Sandru

Sources

- Edward J., “The Heisei Economy: Puzzles, Problems, Prospects.” The Journal of Japanese Studies, vol. 37, no. 2, 2011

- Hayashi F., "Understanding Saving: Evidence from the United States and Japan", Waseda University, Faculty of Political Science and Economics, 2018

- Bank for International Settlements

- CNBC

- FT

- Bloomberg & Reuters

- FactSet

- TradingEconomics